How to Calculate Betting ROI

Betting ROI measures how effectively your bets generate profit relative to the money you risk. It's not just about winning more bets - it’s about knowing if your strategy is profitable. Here's the formula:

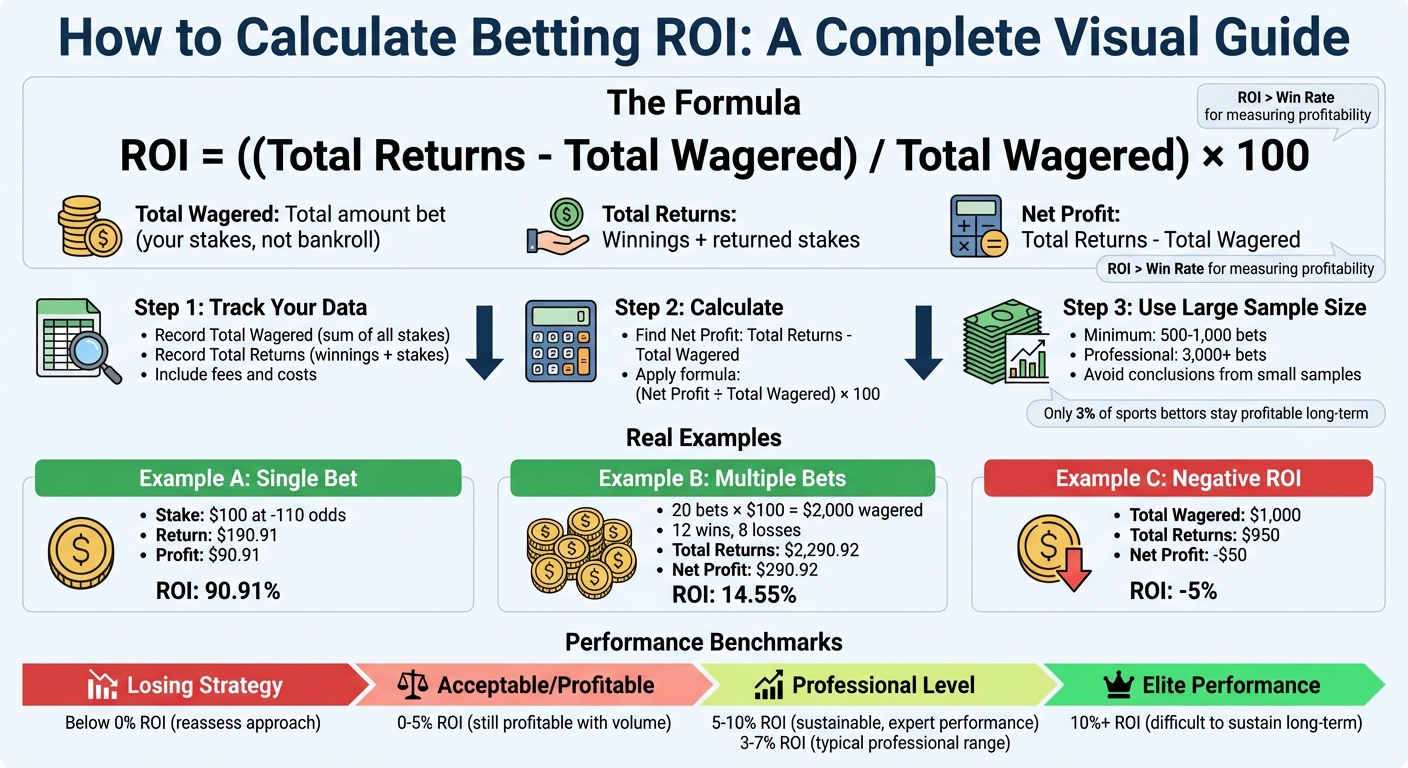

ROI = ((Total Returns - Total Wagered) / Total Wagered) × 100

Key Points:

- Track Total Wagered: The total amount you've bet (not your bankroll).

- Track Total Returns: Includes winnings plus returned stakes.

- Net Profit: Subtract Total Wagered from Total Returns.

For example, if you wager $1,000 and your returns are $1,050, your ROI is 5%. A negative ROI signals losses, while professional bettors aim for 3–7% ROI over thousands of bets.

To improve accuracy, calculate ROI on a large sample size (500+ bets). Use tools like spreadsheets or automated trackers to monitor performance and adjust strategies as needed.

How to Calculate Betting ROI: 3-Step Process with Formula and Examples

The Betting ROI Formula

The Basic Formula

The formula for calculating ROI is:

ROI = ((Total Returns - Total Wagered) / Total Wagered) × 100

Let’s break it down:

- Total Wagered: This is the total amount of money you’ve bet over a specific period. For instance, if you place five bets of $100 each, your Total Wagered is $500. It’s important to note that this figure represents your total stakes, not your initial deposit or bankroll. Sometimes, it’s referred to as "turnover."

- Total Returns: This includes your total winnings plus any returned stakes. For example, if you place a $100 bet at +100 odds and win, your Total Returns would be $200 - $100 in profit plus your original $100 stake.

By multiplying the result by 100, you get a percentage, making it easier to compare performance across different betting strategies or periods.

"ROI is a measure of the efficiency of an investment – or how much money you can expect to make relative to the amount of money you risk" - Patrick Cwiklinski, Evergreen Manager and Sportsbook Expert at Sports Betting Dime

Understanding this formula helps highlight how ROI serves as a key metric alongside others in evaluating betting performance.

ROI vs. Other Betting Metrics

While ROI is a critical metric, it’s not the only one. Other measures can provide additional insights:

- Yield: Often considered alongside ROI, yield is sometimes viewed as the average profit per unit staked. In contrast, ROI focuses on overall profitability over a period.

- Return on Bankroll: This metric evaluates profit relative to your initial bankroll rather than your total wagers. It offers a slightly different perspective on financial performance.

"Whether your bankroll is $10,000 or $1,000,000, your ROI is still the same if you only make four bets of $100. You're thinking interest rate, not return on investment" - PJ from Sports Insights

- Win Rate: This measures how often you win bets but doesn’t consider the odds or stake sizes. ROI, on the other hand, provides a clearer picture of how efficiently your bets generate returns.

Each of these metrics has its place, but ROI stands out for its ability to capture the financial efficiency of your betting strategy.

How to Calculate Betting ROI Step-by-Step

Step 1: Track Your Total Wagered and Returns

The first step in calculating your betting ROI is keeping detailed records. Start by tracking your Total Wagered, which is the total amount you’ve staked on bets. This isn't the same as your initial deposit or your current bankroll - it’s the actual sum of all your stakes.

Next, track your Total Returns, which includes both your original stakes and any winnings from successful bets. For instance, if you place a $100 bet at +100 odds, your total return would be $200 (your $100 stake plus $100 in winnings). Make sure to record each payout accurately.

Don’t forget to include any additional costs, like fees for betting tools or tipster services, in your Total Wagered. Skipping bets or expenses can throw off your calculations, so consistency is key. Once you’ve tracked everything, you’re ready to calculate your net profit.

Step 2: Do the Math

To find your Net Profit, subtract your Total Wagered from your Total Returns. For example, if you wagered $1,000 and your total returns were $1,050, your Net Profit would be $50.

Now, use the ROI formula:

(Net Profit ÷ Total Wagered) × 100

Using the example above: ($50 ÷ $1,000) × 100 = 5%. This means your ROI is 5%, reflecting how efficiently your bets are performing. If your ROI is negative, it indicates losses. For instance, a -5% ROI means you're losing $5 for every $100 wagered.

After calculating, make sure your sample size is large enough to draw meaningful conclusions.

Step 3: Use Enough Bets for Accuracy

Once you’ve calculated your ROI, keep in mind that small sample sizes can be misleading. Evaluating your ROI after only 10 or 20 bets might show inflated or skewed results that don’t reflect long-term performance.

Professional bettors typically analyze their ROI over at least 500 to 1,000 bets, with many tracking 3,000 or more to account for natural variance.

"Amateur gamblers look at how much money they won today. Professional gamblers look at their ROI (Return on Investment) over thousands of bets." - GamblingCalc

For most skilled bettors, a realistic ROI ranges between 3% and 7% when measured across thousands of bets. Be cautious of claims of a 20% or higher ROI, as these often stem from small sample sizes or short-term luck. Allow your strategy enough time to prove its effectiveness before making significant changes.

Betting ROI Calculation Examples

Example 1: Single Bet

Let’s say you place a $100 bet at -110 odds and win. A winning $100 bet at -110 odds pays back $190.91 - this includes your initial $100 stake and $90.91 in profit. To find the ROI for this single bet, use the formula:

(($90.91 ÷ $100) × 100) = 90.91% ROI.

Keep in mind, this example only shows the return from one bet. While the ROI here is impressive, single bets don’t represent long-term betting performance. Consistency over a series of bets is what really matters.

Example 2: Multiple Bets

Now, consider a scenario involving 20 bets of $100 each, for a total wager of $2,000. Suppose you win 12 of those bets, with each winning bet returning $190.91, while you lose 8 bets. The total return from the 12 wins would be $2,290.92. Subtracting your initial $2,000 wager, the Net Profit is:

$2,290.92 - $2,000 = $290.92.

To calculate ROI:

(($290.92 ÷ $2,000) × 100) = 14.55% ROI.

This example illustrates how a larger sample size offers a clearer picture of performance. It’s a more realistic way to evaluate your betting strategy.

Example 3: Negative ROI

Not every betting period ends in profit. Imagine wagering $1,000 across 50 bets, but your total returns amount to just $950. Here, the Net Profit would be:

$950 - $1,000 = –$50.

Calculating ROI:

((–$50 ÷ $1,000) × 100) = –5% ROI.

This means you’re losing $5 for every $100 wagered. A negative ROI signals that your current betting approach might not be effective. As James Thompson, Sports Writer, points out:

"A negative ROI suggests a rethink might be in order".

Instead of chasing losses, take a step back and review your betting history. Break it down by sport, bet type, or other factors to pinpoint where things are going wrong. Identifying patterns can help you adjust your strategy and make more informed decisions moving forward.

How to Read Your Betting ROI

ROI Performance Benchmarks

Understanding your ROI is key to evaluating your betting performance. Different ROI ranges can tell you whether you're on the right track or need to rethink your strategy.

An ROI of 10% or more is considered elite. This level of performance often stems from niche markets or smaller sample sizes. While impressive, sustaining this long-term is extremely challenging. As GamblingCalc puts it:

"Anyone claiming an ROI of 20%+ long-term is likely lying or has a very small sample size".

An ROI between 5% and 10% is the target for professionals. This range reflects a solid, sustainable betting strategy. In fact, a consistent ROI of 3% to 7% over thousands of bets is often seen as professional-level performance.

An ROI of 0% to 5% is acceptable and still profitable. While your earnings may not be massive, a high betting volume can lead to meaningful income. For example, with a 53% win rate over 3,500 bets in a year, you could see a 62% return on your initial bankroll - far outpacing the stock market's average annual return of 6% to 7%.

If your ROI is below 0%, it signals a losing strategy. A negative ROI over three months is a red flag that it’s time to reassess your approach. Keep in mind, only about 3% of sports bettors manage to stay profitable in the long term. Knowing where you stand on this spectrum is essential for improving your results.

Next, let’s explore why ROI is a better metric than win rate for assessing your betting success.

Why ROI Beats Win Rate

While ROI benchmarks are helpful, relying solely on win rate can be misleading. You can have a high win rate and still lose money - or a low win rate and still turn a profit. The key difference lies in the odds of the bets you’re placing.

Here’s an example: Bettor A wins 60% of their bets at -200 odds but ends up with a -10% ROI, losing money overall. On the other hand, Bettor B wins just 45% of their bets at +150 odds but achieves a +12.5% ROI, making a solid profit. As BettorEdge explains:

"A high win rate with low-odds bets might bring in less profit than a lower win rate with higher-odds bets. That's why combining win rate with ROI and yield gives a clearer picture".

ROI factors in the odds of each bet, offering a more accurate measure of profitability. For example, to break even on standard -110 point spread bets, you need a win rate of 52.38%. However, betting on underdogs with higher odds can allow you to stay profitable even with a significantly lower win rate.

"Bragging about win rates without talking about profit is like a restaurant owner bragging about how many customers they serve while ignoring whether they're actually turning a profit".

Ultimately, ROI reveals the true effectiveness of your betting strategy. It’s not just about how often you win - it’s about whether those wins are translating into actual money in your pocket.

Tools for Tracking and Improving ROI

Manual Tracking with Spreadsheets

Creating a custom tracker in Google Sheets or Excel gives you complete control over the metrics you want to monitor, while also offering insights into your betting patterns. Plus, it's free and accessible from any device. As Graphed explains:

"The process of building it [a spreadsheet] yourself teaches you what metrics actually matter. You're not just plugging numbers into a black box."

To get started, include essential columns like Date, Sport/Event, Bet Type, Stake, Decimal Odds, Status, and Profit/Loss. Use decimal odds (e.g., 1.91) for consistency and set up dropdown menus for status to keep your data organized. You can also add formulas to automatically calculate profit/loss and track cumulative results over time. For quick insights, apply conditional formatting to highlight profits in green and losses in red.

While this approach is great for smaller-scale bettors, managing large volumes of bets manually can quickly become overwhelming.

Automated Tracking with WagerProof

If spreadsheets start to feel like too much work, automated tools like WagerProof can simplify the process as your betting volume grows. WagerProof automatically organizes your ROI by sport, bet type, and scenario, eliminating the need for manual calculations. Its Edge Finder tool is particularly useful - it compares sportsbook odds with prediction markets and statistical models, pinpointing mismatches where you might have an advantage.

WagerProof also calculates ROI based on total turnover, which aligns with industry standards. This helps you pinpoint which markets are driving your profits. And with WagerBot Chat, connected to live professional data, you can ask questions like, "What’s my ROI on NBA moneyline bets?" and get instant, accurate answers - no spreadsheet formulas required.

Whether you prefer the hands-on approach of spreadsheets or the efficiency of automation, both methods give you the tools to track and improve your betting ROI with accuracy.

ROI IN SPORTS BETTING: HOW TO CALCULATE? ALL ABOUT ROI

Conclusion

Understanding betting ROI goes beyond crunching numbers - it’s about uncovering which bets are truly profitable. The formula is straightforward: divide your net profit by the total amount wagered, then multiply by 100. But the real power of this metric lies in tracking it across a large number of bets. This helps reveal patterns and weed out unprofitable strategies.

"Optimizing your betting strategy for ROI is the key to making money betting on sports" - Patrick Cwiklinski, Evergreen Manager and Sportsbook Expert at Sports Betting Dime

ROI isn’t just about how often you win; it’s about the value of your bets. Elite professional bettors aim for a 3% to 7% ROI over thousands of wagers, which is no small feat. To put it into perspective, a modest 53% win rate over 3,500 bets can result in a 62% return - far outpacing the historical stock market average of 6–7%.

Whether you prefer manual tracking or advanced tools like WagerProof, the key is consistency. WagerProof’s Edge Finder takes it a step further by automatically identifying value bets and mismatches using sportsbook odds, prediction markets, and statistical models. And with WagerBot Chat, you can seamlessly analyze your performance by sport or bet type, skipping the hassle of complicated calculations.

FAQs

What is the ideal sample size for accurately calculating betting ROI?

To get a clear picture of betting ROI, you need a large sample size. The more bets you analyze, the more accurate and dependable your profitability estimates will be. A bigger dataset helps smooth out short-term fluctuations and highlights long-term performance trends.

There’s no magic number, but try to analyze at least several hundred bets. This will help you spot meaningful patterns and avoid being misled by results from a small, unreliable sample. In the end, consistent performance over time is what truly reflects betting success.

What’s the difference between ROI, yield, and win rate in betting?

ROI, or Return on Investment, gives you a snapshot of your overall profitability by comparing the total profit you've earned to the total amount you've bet. Yield, however, zeroes in on the average profit per bet, offering a clearer picture of how efficient your wagers are, regardless of how much money you have in your bankroll. Lastly, win rate measures how often your bets hit the mark.

While yield and win rate offer detailed insights into specific parts of your betting performance, ROI serves as a broader, long-term indicator, helping you assess how successful your overall betting strategy has been.

Why is a 3% to 7% ROI considered excellent for professional bettors?

A steady ROI of 3% to 7% is often seen as a hallmark of professional-level success in sports betting. Achieving this range reflects a well-thought-out, profitable approach that can withstand the challenges of betting's risks and unpredictability.

Why does this matter? Even modest percentage gains can lead to impressive profits when spread across a high volume of wagers. Professionals in this field know that reaching and sustaining these returns takes more than luck - it demands discipline, precise analysis, and dependable data to spot value in the market.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free