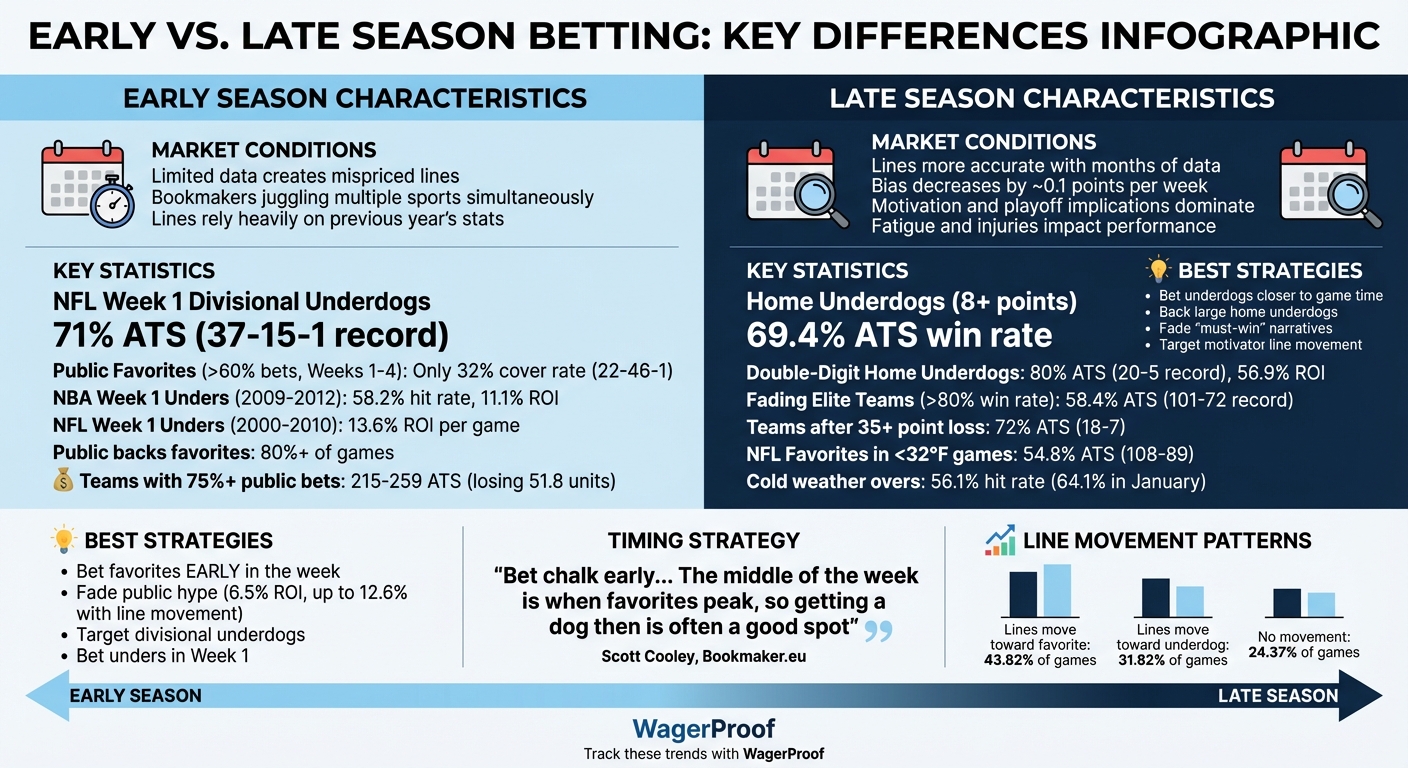

Early vs. Late Season Betting: Key Differences

Betting strategies change dramatically from the start to the end of a season. Early-season lines rely on last year’s data, leading to inefficiencies that savvy bettors can exploit. By the late season, lines are sharper, and motivation factors like playoff stakes take center stage. Here's a quick breakdown:

- Early Season: Limited data creates mispriced lines. Underdogs perform better, especially divisional ones in Week 1 (71% ATS). Public bettors often overreact to small sample sizes, favoring teams with early wins.

- Late Season: Lines are more accurate, but factors like injuries, fatigue, and playoff scenarios impact outcomes. Large home underdogs (8+ points) excel at 69.4% ATS, and fading overhyped "must-win" teams can be profitable.

Key Tip: Bet favorites early in the week and underdogs closer to game time for better value. Tools like WagerProof help track line movements and public vs. sharp money trends, offering insights for smarter bets.

Early vs Late Season Betting Performance Statistics and Strategies

Early Season Betting Characteristics

Limited Data and Market Inefficiencies

At the start of a new season, betting lines often lean heavily on the previous year's stats. But with coaching changes, roster shake-ups, and new rules in play, there's a lot of unpredictability baked in. This uncertainty can lead to pricing mistakes that savvy bettors can take advantage of. Adding to this, when the NBA season begins, bookmakers are juggling lines for multiple sports at once. This divided attention can result in less precise opening lines, creating opportunities for sharp bettors.

Consider this: Between 2009 and 2012, 58.2% of NBA Week 1 games hit the "Under" on the total line, delivering an average return of 11.1% per game. Another strategy - betting the "Under" on a team’s first four home games when the closing line dropped by at least half a point - achieved a 56.72% win rate over 20 years. These numbers highlight how limited early-season data can lead to inefficiencies, which bettors can exploit before the market adjusts. But these early missteps also set the stage for public overreactions in subsequent games.

Public Overreactions to Small Sample Sizes

Early in the season, casual bettors often fall into the trap of overvaluing small sample sizes. This tendency, known as the representativeness heuristic, leads them to believe that a team’s performance in one or two games is a reliable indicator of how the rest of the season will unfold . When a team performs exceptionally well in Week 1, the public tends to overbet on them, creating an imbalance in the market that experienced bettors can capitalize on.

Since 2003, the public has backed the favorite in over 80% of NFL regular-season games. But here’s the kicker: teams with more than 75% of public spread bets have gone 215-259 against the spread, costing public bettors 51.8 units. Betting against these heavily favored teams - especially when the line moves further in their favor - has historically delivered a 6.5% return on investment, which jumps to 12.6% in cases where the line shifts significantly.

Scott Cooley, Odds Consultant at Bookmaker.eu, sheds light on this timing dynamic:

"I do think it is wise to bet chalk early, but it has to be very early or you'll miss a good number. The middle of the week is when the favorites seem to peak so getting a dog then is often a good spot".

This insight underscores how undervalued underdogs often benefit from these early-season market discrepancies.

Underdog Performance Early in the Season

Underdogs tend to perform better than expected early in the season, largely because oddsmakers and the public are still clinging to last year’s narratives. Teams that struggled the previous season often make big changes, while successful teams might lose key players - factors that take time for the market to fully account for.

For example, betting the "Under" on all NFL Week 1 total lines between 2000 and 2010 delivered a statistically significant return of 13.6% per game. This success stems from bookmakers underestimating how frequently offenses underperform in Week 1. These early-season biases create valuable opportunities for sharp bettors. While underdogs thrive amid this early-season uncertainty, the market becomes more efficient as the season progresses, leaving less room for error.

Late Season Betting Characteristics

More Accurate Lines and Fewer Inefficiencies

As the season progresses, sportsbooks refine their lines with months of performance data, making late-season betting lines more precise. By December, early-season biases - like spreads overestimating the margin of victory for favorites by about 1 point - fade, decreasing by roughly 0.1 points each week. This adjustment reflects real-world outcomes, injury reports, and head-to-head matchups. Sharp bettors also spend the season improving their models, which makes spotting glaring pricing errors much harder. Information that might have given bettors an edge in September is often "priced-in" by December as the market adapts. For example, in the NBA, early-season totals that showed clear biases become far more accurate as teams' tendencies are better understood and reflected in the lines.

Scott Cooley, Odds Consultant at Bookmaker.eu, highlights the challenge of timing bets late in the season:

"Late is good but you can't wait until right before kickoff because that half hour window is usually when the value players start to take the dogs. So if you wait too late you'll miss optimal value".

By the end of the season, closing lines are widely regarded as the most accurate prices, factoring in everything from injuries to weather conditions and sharp betting activity. This sets the stage for betting dynamics influenced by playoff stakes and team motivations.

Team Motivation and Playoff Implications

Late-season betting brings a new layer of complexity: playoff scenarios. Teams fighting for postseason spots often see their point spreads inflated due to "must-win" narratives, which can distort the numbers.

Interestingly, elite teams with a win rate above 80% have gone 101-72 ATS (58.4%) when bettors fade them in late-season games. At the same time, large home underdogs thrive in this period, often underestimated by the market. NFL home underdogs getting 8 or more points have a 69.4% ATS win rate late in the season, with double-digit home underdogs achieving a remarkable 20-5 ATS record (80%) and a 56.9% ROI. Teams rebounding from a blowout loss of 35 points or more also perform well, going 18-7 ATS (72.0%) in their next late-season matchup.

In leagues like the NBA and NHL, late-season performance often revolves around player fatigue, rest days, and load management rather than just team quality. Sam Garriock, Trading Manager at PointsBet, addresses misconceptions about tanking in the NBA:

"A common misnomer with tanking in the NBA is that all aspects of the team, including the players, will try to lose on purpose. This is absolutely not the case. It is purely driven by the front office and oftentimes the coach, who are deciding who will be held out or shut down".

Favorite Performance in Late Season

Favorites tend to fare better in late-season games. With more accurate lines, oddsmakers can better distinguish strong teams from those with misleading early-season results.

For example, NFL favorites in games played below 32°F have gone 108-89 ATS (54.8%). While many assume cold weather limits scoring, the "over" has historically hit in 56.1% of these freezing games, increasing to 64.1% in January. Elite quarterbacks like Eli Manning (39-23 ATS, 62.9%) and Philip Rivers (31-19 ATS, 62.0%) have excelled in these conditions, while others, including Tony Romo, Matthew Stafford, and Jay Cutler, have struggled, posting a combined 31-65 ATS record (32.3%).

The challenge lies in identifying which favorites are undervalued and which are overhyped due to public perception or playoff storylines.

Key Differences in Team Performance

Performance Trends Comparison

Team performance evolves significantly from the start of the season to its later stages, creating distinct opportunities for bettors. Early in the season, favorites often struggle to cover spreads due to what analysts refer to as an "information deficit." Oddsmakers rely heavily on data from the previous season and offseason narratives, which can lead to inaccurate lines. For instance, during the first four weeks of the 2024 NFL season, favorites managed to cover in just 27 out of 64 games, translating to a 43.5% cover rate, with the actual margin of victory falling 1.7 points shy of the spread on average.

This trend highlights the efficiency of underdogs early in the season. NFL divisional underdogs in Week 1, for example, boast an impressive 71% cover rate, going 37-15-1 against the spread (ATS). Similarly, teams that received over 60% of public bets during the first four weeks of the last two seasons struggled, posting a poor 22-46-1 ATS record - a mere 32% cover rate. However, by the late season, the dynamics shift. Home underdogs receiving 8 or more points perform exceptionally well, achieving a 69.4% ATS win rate from December through February, while double-digit home underdogs fare even better with a 20-5 ATS record (80%).

| Season Period | Betting Group | ATS Performance |

|---|---|---|

| Early Season (Week 1) | NFL Divisional Underdogs | 71% Win Rate (37-15-1) |

| Early Season (Weeks 1-4) | Public Favorites (>60% bets) | 32% Cover Rate (22-46-1 last 2 seasons) |

| Late Season (Dec-Feb) | NFL Home Underdogs (8+ points) | 69.4% Win Rate |

| Late Season (Dec-Feb) | Double-Digit Home Underdogs | 80% Win Rate (20-5 ATS) |

| Late Season (Dec-Feb) | Fading Elite Teams (>80% Win Rate) | 58.4% ATS Success |

The trends are clear: early-season volatility favors underdogs, while late-season outcomes are shaped by more stable team identities and refined betting lines. As teams settle into their rhythms by mid-season (Weeks 4-10), betting lines become more accurate. These shifts set the stage for how factors like injuries and fatigue affect performance as the season progresses.

Impact of Injuries and Fatigue

As the season wears on, physical wear and tear begin to play a larger role in shaping team performance. While oddsmakers adjust lines based on statistics, the cumulative toll of fatigue and injuries becomes harder to quantify. Fatigue builds up over time, leading to reduced playing time, lower efficiency, and diminished stats across various sports. Persistent injuries only add to this burden, often impacting a player's mechanics and consistency, even if they’re listed as "probable".

The numbers back this up. In the NBA, shooting percentages tend to dip late in the season as players tire, turning high-scoring games into more defensive affairs. In MLB, pitchers often lose velocity in September - a fastball that hit 97 mph in April might drop to 94 mph, leaving pitchers more vulnerable to contact. Similarly, in the NFL, running backs and wide receivers experience the steepest declines in performance, as the physical toll of repeated hits and heavy workloads takes its toll.

Coaches adapt to these challenges with strategies like load management and planned rest periods, especially once playoff spots are secured. These decisions can significantly reduce a star player’s chances of hitting statistical benchmarks. Interestingly, the advantage of bye weeks has diminished over time. Before 2011, teams gained a 2.2-point edge per game following a bye, but after the 2011 Collective Bargaining Agreement (CBA) mandated four days off during the bye week, that margin dropped to just 0.3 points. One week of rest simply isn’t enough to counteract months of accumulated physical strain.

Late-season performance becomes even more complex when factoring in what experts call "motivation gaps." Teams still in the playoff hunt tend to play with urgency, while those eliminated from contention often lack the same drive. As NXTbets explains:

"The most significant edge comes from identifying a motivation gap. When a team is fighting for a playoff spot... they play with a desperation that a team already eliminated... simply cannot match".

This creates a challenging yet intriguing betting environment where physical condition, motivation, and situational factors all converge.

Sports Handicapping: Betting Early vs Betting Late

Public Money and Line Movement Patterns

When it comes to betting strategies, understanding how public money and line movements evolve throughout the NFL season can provide valuable insights. Early-season trends often contrast sharply with late-season behaviors, revealing opportunities for those who know where to look.

Early Season Public Betting Behavior

At the start of the season, betting tends to be fueled more by emotion than analysis. Since 2003, casual bettors have backed the favorite in over 80% of NFL regular-season games. This trend is especially pronounced in the first few weeks when detailed information about teams is limited. This behavior is often linked to "hindsight bias", where bettors place too much weight on last season’s results and offseason buzz, while overlooking roster changes and coaching shifts.

After Week 1, public overreaction becomes evident. A dominant win is often seen as a reason to bet on that team again, while early losses are quickly dismissed. However, this approach frequently backfires. High-public support for favorites often translates to poor performance against the spread (ATS). For instance, in the 2025-26 season, public bettors stumbled to a shocking 3-13 ATS record in Week 1 alone.

Interestingly, divisional underdogs in Week 1 have consistently outperformed expectations, posting a 37-15-1 ATS record since 2014 - a 71% cover rate. This success stems from sportsbooks inflating lines on popular favorites, creating value for sharp bettors who fade the public. The emotional betting patterns of casual bettors early in the season set the stage for sharp bettors to capitalize later.

Late Season Sharp Money Trends

As the season progresses into Weeks 11-17, the dynamics shift significantly. Sharp bettors take advantage of motivation gaps and public overreactions to narratives like "must-win games". While casual bettors pour money into teams battling for playoff spots, assuming desperation guarantees success, sharp money often flows in the opposite direction. This creates Reverse Line Movement (RLM) - a phenomenon where the line moves against the side receiving the majority of bets.

Sharp bettors focus on discrepancies between bet percentages and money percentages. For example, if a team accounts for only 25% of bets but 50% of the money, it’s a strong signal of sharp action. A discrepancy of 20% or more is particularly telling. Historically, fading teams with over 75% of public support has delivered a 6.5% return on investment (ROI), which increases to 12.6% when the line moves against the public side.

Line Movement Comparison Table

| Season Period | Typical Line Movement | Public Behavior | Sharp Action Signal |

|---|---|---|---|

| Early Season (Weeks 1-3) | Moves toward hyped favorites (e.g., -3 to -3.5) | 80%+ back favorites based on last year's data | Line stays flat despite 75%+ public bets |

| Late Season (Weeks 11-17) | Moves toward "must-win" teams (e.g., -7 to -8) | Overvalues playoff-bound teams | Reverse Line Movement (e.g., -7 to -6.5) |

| Overall (2003-2015) | Toward favorite: 43.82% / Toward underdog: 31.82% | Consistently backs favorites in 80% of games | Money percentage exceeds bet percentage by 20%+ |

The data highlights key trends: lines move toward favorites in 43.82% of games and toward underdogs in 31.82%, with the remaining 24.37% staying unchanged. A sharp bettor’s cue often comes when 70% of bets back the favorite, but the line shifts toward the underdog - a clear sign of sharp money on the other side. Tools like WagerProof can simplify this process by monitoring bet versus money splits in real time. These tools flag mismatches between public betting patterns and prediction market movements, giving bettors access to the same insights professionals rely on to uncover value.

Market Inefficiencies and Profitable Strategies

Exploiting Early-Season Overreactions

The early weeks of a season are a goldmine for sharp bettors. Why? Oddsmakers often lean heavily on last year’s data and offseason buzz, leading to mispriced lines. This creates prime opportunities for those who can spot where the market falls short.

One strategy that consistently delivers results is fading public hype. The public tends to back favorites - over 80% of the time in NFL regular-season games. To balance this, sportsbooks often adjust lines to account for the flood of one-sided bets, creating value for contrarian plays. For instance, fading popular NFL teams that attract more than 75% of spread bets has historically yielded a 6.5% ROI. When the line is inflated due to heavy public action, that ROI nearly doubles to 12.6%.

Public overreactions to last season’s standings or Week 1 performances also open doors. A great example? Betting the "Under" on all NFL Week 1 games between 2000 and 2010 delivered a 13.6% return per game. This leverages the "offensive lag" as teams adjust to new schemes. As the season progresses, these early inefficiencies fade, giving way to new angles for savvy bettors.

Using Late-Season Motivation Factors

Late in the season, motivation becomes a key factor - and the public often misjudges it. Teams in "must-win" scenarios are usually overvalued, while large home underdogs with nothing to lose are underestimated. Consider this: home underdogs of at least 8 points have a 69.4% ATS winning percentage late in the season. For double-digit home underdogs, that figure climbs to an impressive 80% (20-5 ATS).

The trick lies in recognizing when public perception doesn’t align with reality. For example, betting against teams with a winning percentage above 80% late in the season has produced a 58.4% ATS win rate. These elite teams often face inflated lines because casual bettors assume playoff-bound squads will dominate. However, factors like fatigue, injuries, and strategic rest for players can create opportunities on the other side. Scott Cooley, an Odds Consultant at Bookmaker.eu, explains:

"The middle of the week is when the favorites seem to peak, so getting a dog then is often a good spot".

Using WagerProof to Identify Edges

Capitalizing on these inefficiencies is easier with the right tools. Manually tracking betting percentages and money movement across dozens of games is daunting for most bettors. That’s where WagerProof comes in. This platform automates the process, flagging real-time discrepancies between public betting patterns and sharp money movement.

One standout feature of WagerProof is its Edge Finder, which highlights Reverse Line Movement - situations where the line moves in the opposite direction of public bets. This is a telltale sign of professional action influencing the market. WagerProof also tracks Closing Line Value (CLV), a key metric for long-term profitability. By consistently securing better odds than the closing line, bettors can improve their chances of sustained success.

Unlike pick sites that offer conclusions without much context, WagerProof provides a full suite of data. This includes prediction market spreads, public money trends, and advanced statistical models, giving bettors the tools to make informed, data-driven decisions. It’s not just about the "what" but the "why" behind each bet.

Sport-Specific Early vs. Late Season Edges

Each sport has its own quirks when it comes to betting opportunities, especially when comparing early and late-season trends. These patterns are shaped by factors unique to each sport, offering savvy bettors a chance to capitalize on market inefficiencies.

NFL: Divisional Underdogs and Playoff Contenders

At the start of the NFL season, public bettors often rely too heavily on the previous year’s results when placing wagers on Week 1 and Week 2 matchups. This tendency creates an opportunity to bet against public favorites, which tend to perform poorly against the spread (ATS), despite attracting over 80% of public money.

Later in the season, the dynamics shift. Large home underdogs (8+ points) perform exceptionally well, covering the spread 69.4% of the time from December through February. Double-digit home underdogs are even more impressive, with an 80% ATS record (20-5) and a 56.9% return on investment (ROI). Additionally, betting against teams with a win percentage above 80% late in the season has proven effective, yielding a 92-63 ATS record (59.4%). Scott Cooley, an Odds Consultant at Bookmaker.eu, advises:

"I do think it is wise to bet chalk early, but it has to be very early or you'll miss a good number... The middle of the week is when the favorites seem to peak so getting a dog then is often a good spot".

NBA: Fatigue and Schedule Compression

In the NBA, early-season games are often unpredictable as teams work out rotations and establish their identities. Hot shooting streaks can inflate a team’s perceived value, but these streaks often fade as the season progresses, creating opportunities to bet against overvalued teams.

As the season heads toward its conclusion, fatigue and compressed schedules become key factors. Teams in the 2024-25 season will play an average of 14.9 back-to-back games, and these tight schedules can influence outcomes by 1–3 points. Road teams playing the second game of a back-to-back often struggle against rested opponents. Guards, who typically run over 5 miles per game, show noticeable declines in performance, while centers tend to hold up better. Fatigue also impacts shooting efficiency in close games, with research showing a decline from the first to the fourth quarter (effect size of -1.27).

MLB: Pitching Trends and September Call-Ups

Baseball’s early-season records are notoriously unreliable, explaining only 34% of the variance in final win totals. For instance, a team projected to win 81 games that starts the season 18-8 (.692) in April is more likely to finish with around 90 wins rather than maintain its early pace. Combining April records with preseason forecasts, like Elo ratings, provides a more accurate picture, explaining up to 50% of the variance.

MLB betting inefficiencies also stem from bettors overreacting to last season’s performance. Late-season trends, however, shift focus to September call-ups and team motivation. Teams out of playoff contention often experiment with younger players, while contenders may rest key starters in preparation for the postseason.

Sport-Specific Edges Summary Table

Here’s a quick breakdown of the early and late-season betting edges for each sport:

| Sport | Early Season Edge | Late Season Edge |

|---|---|---|

| NFL | Fade public favorites due to overbetting | Back large home underdogs (8+ pts, 69.4% ATS) |

| NBA | Fade hot shooting streaks (regression to the mean) | Target road teams on back-to-backs (2–3 point decline) |

| MLB | Rely on preseason projections over noisy April records | Watch for September call-ups and team motivation |

WagerProof simplifies tracking these trends in real time. Its tools, like the Edge Finder, flag key betting opportunities - whether it’s NBA back-to-backs or NFL divisional matchups - by identifying reverse line movement and closing line value. This allows bettors to spot when sharp money opposes public perception across these sports.

Conclusion

Betting strategies need to adapt as the season progresses. Early in the season, limited data often leads to market inefficiencies, which can work in favor of underdogs, especially in divisional games. Public bettors tend to overreact to small sample sizes, driving up lines for favored teams and creating opportunities for sharp bettors.

As the season moves forward, the market becomes more refined. Sportsbooks gather more current-year data, sharpening their lines by about 0.1 points each week. By the late season, the focus shifts from statistical analysis to understanding team motivation and playoff stakes. For example, large home underdogs (those getting 8+ points) have covered at an impressive 69.4% rate from December through February. Similarly, betting against teams with a winning percentage above 80% has resulted in a 58.4% ATS success rate.

Seasonal timing plays a key role in betting success. Scott Cooley, Odds Consultant at Bookmaker.eu, explains:

"I do think it is wise to bet chalk early, but it has to be very early or you'll miss a good number... The middle of the week is when the favorites seem to peak so getting a dog then is often a good spot."

Data shows that closing lines shift toward the favorite in 43.82% of games and toward the underdog in 31.82%. This highlights the importance of betting favorites earlier in the week and waiting until closer to kickoff for underdogs to secure better value.

To navigate these seasonal shifts effectively, having the right tools makes all the difference. WagerProof is built to help bettors capitalize on these changing dynamics. The platform tracks real-time line movements, analyzes public and sharp money flows, and identifies reverse line movement trends. Its Edge Finder tool pinpoints opportunities, whether it’s leveraging early-season overreactions or exploiting late-season motivational mismatches. By understanding these seasonal patterns, bettors can gain an edge over casual players who approach every game the same way.

FAQs

What are the key differences between betting early in the season and late in the season?

When it comes to betting, strategies can shift significantly depending on whether you're wagering early or late in the season. Each phase offers unique opportunities based on how sportsbooks set odds, how teams perform, and how public betting trends evolve.

Early in the season, sportsbooks often rely on limited data to set their lines, which can lead to softer odds. This creates a prime opportunity for bettors to spot value before the market stabilizes. At this stage, teams are still defining themselves, and sharp bettors can take advantage of odds that don’t yet fully align with team strengths or weaknesses.

Late in the season, the focus shifts to more immediate factors like team momentum, playoff stakes, and public perception. As teams push for postseason berths - or lose motivation entirely - odds can become skewed by public narratives or emotional betting. Savvy bettors often find success by fading popular teams or backing overlooked underdogs, especially as the stakes heighten and market overreactions become more pronounced.

The key difference? Early-season betting is about identifying inefficiencies in opening lines, while late-season betting thrives on understanding situational dynamics like motivation and playoff pressure to uncover winning opportunities.

What are the best ways to spot and take advantage of market inefficiencies early in the season?

Early in the season, betting markets can be all over the place. This happens because public perception often skews reality, leading to overreactions and misjudgments. Things like team performances, injury updates, and early trends are frequently misunderstood, which can result in betting lines that don’t quite add up. Take leagues like the NBA and NFL, for example - research shows Week 1 lines often underestimate scoring totals while overreacting to what fans are buzzing about.

If you want to take advantage of these early-season quirks, focus on market movements and public betting behaviors. Tools like WagerProof are especially helpful, as they spotlight mismatches in prediction markets, where public money is going, and any statistical oddities. By catching these outliers early, you can find value bets before the odds adjust to reflect more accurate probabilities. The key is to stay disciplined and rely on real-time data to keep your edge sharp.

How do motivation and playoff scenarios impact late-season betting?

Motivation and playoff scenarios play a big role in late-season betting. Teams chasing playoff spots or looking to improve their seeding often bring extra energy to the field, resulting in more intense matchups and, sometimes, surprising results. Meanwhile, teams with no shot at the postseason might lack that drive, leading to underwhelming performances or decisions to rest key players.

These factors also shake up the betting markets. High-stakes situations, like clinching a division title or avoiding elimination, can trigger significant shifts in odds as bettors respond to the evolving stakes. It’s common for public betting to overreact to recent performances, which opens the door for contrarian strategies. By staying tuned into team motivations and the playoff picture, bettors can uncover potential value and better navigate the unpredictable landscape of late-season games.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free