Error Margins in Sports Betting Explained

Error margins in sports betting are the uncertainties in win probability estimates. These margins can turn a seemingly profitable bet into a loss if not accounted for. Here's what you need to know:

- What are error margins? They represent the statistical uncertainty in your predictions. For example, a 60% win probability isn't exact - it has a margin of error.

- Why do they matter? Betting without considering error margins can lead to overestimating your edge. Even a small error can wipe out profits, especially on long-shot bets.

- How do sportsbooks use margins? Bookmakers include a profit margin (vig) in their odds, ensuring the total implied probabilities exceed 100%. This gives them an edge against bettors.

- How to calculate margins? Convert odds to implied probabilities, sum them up, and subtract 100% to find the bookmaker's margin. Adjust your own predictions to account for error bands, typically ±3%.

- Practical tips: Only bet when your calculated edge exceeds potential errors. For favorites (-150), aim for at least 1% EV; for underdogs (+175), look for 5% or more.

Error margins are critical for making informed decisions and spotting real opportunities in sports betting. Use tools like WagerProof to compare market odds, remove vig, and ensure your predictions align with reality.

How Bookmakers Build Error Margins Into Odds

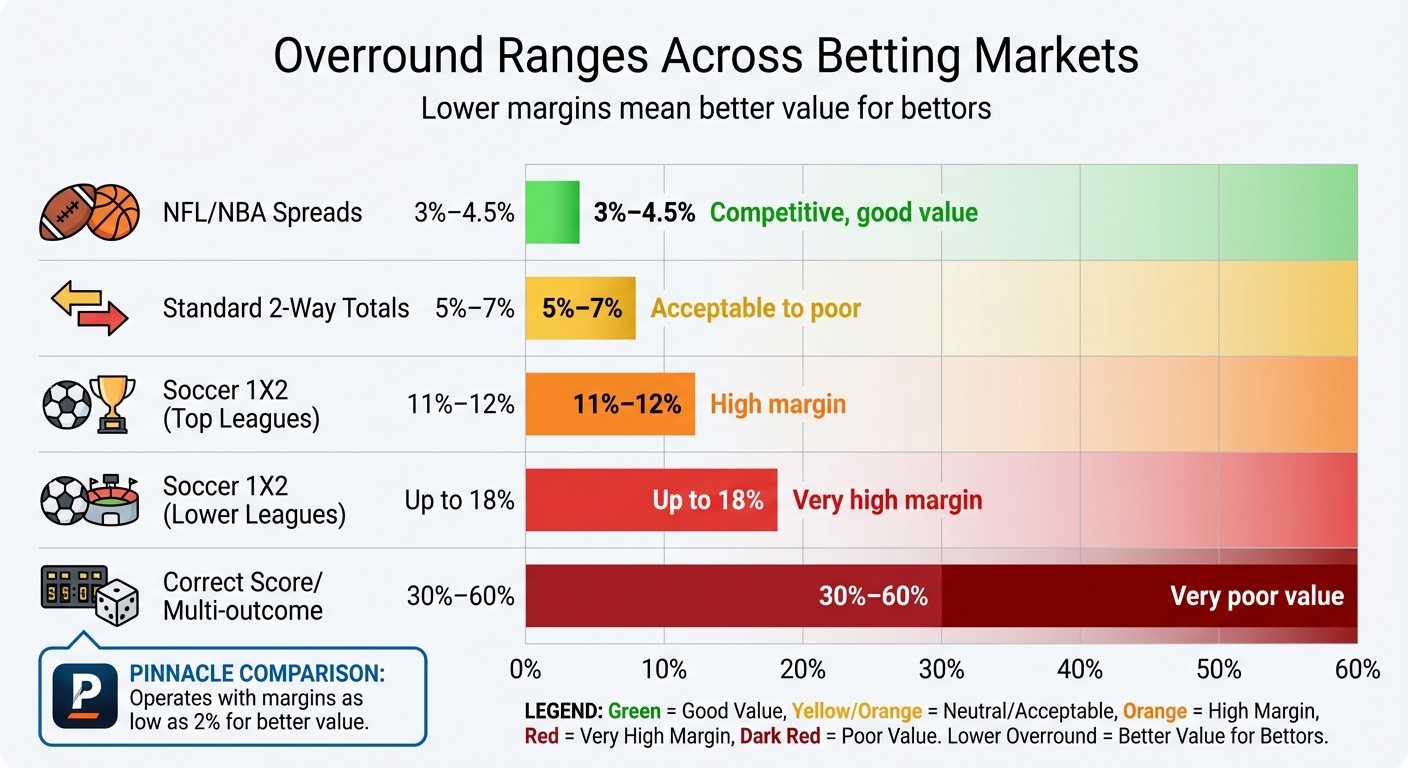

Bookmaker Overround Ranges Across Different Betting Markets

Sportsbooks design their odds with a built-in profit mechanism called the overround - also referred to as vig, juice, or margin. This overround ensures that the total implied probabilities of all possible outcomes in a betting market exceed 100%. Essentially, bookmakers offer odds that are slightly worse than the true statistical probabilities, effectively charging a hidden "fee". Let’s break this down with an example.

Take an NFL spread market where both sides are priced at -110. To win $100, you’d need to risk $110. When converted, these odds represent an implied probability of about 52.38% for each side. Adding these probabilities together gives 104.76%, rather than the 100% you'd expect in a fair market. That extra 4.76%? That’s the bookmaker’s profit margin. As Betstamp explains:

"The overround is how sportsbooks... ensure they tilt the odds ever so slightly in their favor. Instead of setting odds that perfectly reflect the true chances (which would total 100%), they build in a margin".

Understanding Overround and Vig

To calculate implied probabilities from American odds, use this method:

- For negative odds (favorites), divide the absolute value of the odds by the sum of the absolute value of the odds and 100.

- For positive odds (underdogs), divide 100 by the sum of the odds and 100.

Once you’ve calculated the implied probabilities for every outcome in a market, any total above 100% represents the bookmaker’s edge.

Bookmakers further safeguard their profits by "balancing the book." This means they adjust odds to encourage equal betting on both sides, ensuring they pay out less than they collect. If one side draws too much money, creating an imbalance, sportsbooks may "lay off" their risk by placing bets with other bookmakers or exchanges.

Overround Examples Across Different Sports

The size of the overround varies depending on the sport, league, and type of bet. High-profile markets with large betting volumes, such as NFL or NBA spreads, tend to have lower margins because competition forces bookmakers to offer better odds. On the other hand, niche markets and exotic bets often come with significantly higher overrounds, sometimes exceeding 20%.

Here’s a snapshot of overround ranges across different betting markets:

| Market Type | Overround Range | Value Assessment |

|---|---|---|

| NFL/NBA Spreads | 3%–4.5% | Competitive, good value |

| Standard 2-Way Totals | 5%–7% | Acceptable to poor |

| Soccer 1X2 (Top Leagues) | 11%–12% | High margin |

| Soccer 1X2 (Lower Leagues) | Up to 18% | Very high margin |

| Correct Score/Multi-outcome | 30%–60% | Very poor value |

For instance, the average margin in soccer betting typically falls between 6% and 8%. However, top-tier sportsbooks like Pinnacle often operate with margins as low as 2% to attract sharper bettors. On the flip side, high-margin markets such as "First Goalscorer" or novelty bets can carry overrounds exceeding 20%, making them much harder to profit from over time.

How to Calculate Error Margins

Understanding how to calculate error margins helps you measure the gap between market odds and your predictions. These margins account for both the bookmaker's built-in edge and the uncertainty in your own estimates, guiding you toward more informed betting decisions.

Statistical Formulas for Error Margins

Start by converting odds into implied probabilities. For decimal odds, use the formula: (1 / odds) * 100. For example, odds of 2.00 translate to 50%. For American odds, the formulas differ based on whether the odds are negative (favorites) or positive (underdogs):

- Favorites (negative odds): (Negative Odds / (Negative Odds + 100)) * 100

- Underdogs (positive odds): (100 / (Positive Odds + 100)) * 100.

Next, sum the implied probabilities for all outcomes. If the total exceeds 100%, the surplus represents the bookmaker's margin. For instance, if a two-way market totals 104.76%, the house edge is 4.76%.

To find the "fair" or no-vig probability for each outcome, divide the implied probability of that outcome by the total sum. For example, if Liverpool's raw implied probability is 90.1% in a market totaling 104.9%, divide 90.1% by 1.049. This gives a fair probability of about 85.7%.

Your own predictions also involve error margins. A common method, borrowed from polling, calculates the margin of error as 98% / √n, where n is the sample size. With 1,000 data points, the margin of error is roughly 3%; with 10,000 data points, it drops to about 1%. In sports betting, apply a fixed error band - typically ±3% - around your estimated win probability. Colin Davy from Betscope emphasizes this uncertainty:

"All win probabilities used in the EV formula are exactly that: an estimate... if a quantity is an estimate, by definition, it also has error baked into the process".

With these formulas in hand, let’s see how they work in a real-world betting scenario.

Sports Betting Examples

Imagine your model predicts a 60% chance for the Kansas City Chiefs to cover the spread, while the bookmaker's fair probability (after removing the vig) is 52%. Your edge here is 60% – 52% = 8%. Keep in mind, higher payouts amplify the impact of estimation errors. For a -150 favorite, a 1% edge might justify a bet, but for a +175 underdog, aim for at least a 5% edge to account for error.

Errors typically affect your predictions more than the market’s pricing, especially in liquid markets like NFL spreads. These markets benefit from the collective input of thousands of bettors, making odds generally efficient. If your model shows high expected value, approach it cautiously and ensure your edge is significant enough to cover potential errors. Always strip out the vig before comparing your prediction to the fair probability.

Using Error Margins to Find Value Bets

Building on the earlier calculation methods, error margins can play a key role in spotting genuine value bets. This approach connects mathematical analysis to practical betting decisions. Value betting happens when your estimated probability of an outcome is higher than the bookmaker's implied probability - after factoring out the vig. Error margins help determine whether your perceived edge is real or just noise in your model.

Comparing Probabilities to Identify Edges

The formula to calculate your edge is straightforward:

Edge = (Your Probability – Implied Probability) × 100%.

A positive edge indicates a potential value bet. For instance, if you estimate an outcome's probability at 58% and the bookmaker's fair probability (after removing the vig) is 50%, your edge would be 8%.

But not all edges are equal. Higher payouts increase the impact of estimation errors, meaning you need larger edges for underdogs compared to favorites. This sliding scale accounts for the uncertainty in your model and helps you avoid false positives - cases where minor errors in your estimates could turn what looks like a winning bet into a losing one.

From here, it’s essential to explore how model accuracy and sample size influence your betting edge.

Evaluating Prediction Model Errors

The accuracy of your model is just as crucial as the edge itself. To gauge this, track how often your predicted probabilities align with actual results over a substantial sample size. If your model consistently overestimates underdogs or underestimates favorites, that bias can chip away at your long-term profits.

Sample size also plays a major role in reliability. For example, a small sample of 10 games produces a 95% confidence interval of ±31%, while a much larger sample of 1,000 games narrows that interval to ±3.1%.

When your model significantly diverges from market probabilities, it’s wise to assume a bias toward error. To counteract this, apply a safety threshold - such as requiring a minimum expected value (EV) of 2%. This is especially important in liquid markets like NFL spreads, where most available information is already factored into the odds.

Applying Error Margins with WagerProof Tools

Using WagerProof's Edge Finder and Models

WagerProof's Edge Finder scans through 50 sportsbook feeds to identify differences between market odds and fair value odds. This tool plays a crucial role in managing error margins, a recurring theme in this guide. By converting odds from various formats into implied probabilities and removing the bookmaker's vig, it uncovers the true probability. This process, known as de-vigging, is especially important since typical NFL spreads include a built-in overround.

The platform also helps you adjust for estimation errors by applying sliding EV thresholds that vary based on payout size. For instance, you might accept a 1% edge for a -150 favorite but look for a 5% edge when betting on a +175 underdog. This method accounts for the amplified effect of errors on higher payouts. Even small miscalculations can flip an edge from positive to negative, emphasizing the importance of adjusting thresholds.

WagerProof's models also flag any major discrepancies between your estimates and market probabilities. These large gaps often indicate an error in your model. The platform enables you to cross-check your perceived edges against sharper reference lines before risking your bankroll, ensuring your bets are better informed.

In addition to edge detection, WagerProof's real-time market data enhances your decision-making process.

Real-Time Data from WagerProof

WagerProof provides real-time feeds that track prediction markets, public betting percentages, and money movement across various sportsbooks. This information helps you determine whether a line shift reflects genuine market movement or is simply driven by public bias. By comparing "soft" sportsbook lines to sharper references, you can assess whether your perceived edge truly exists.

The platform also tracks Closing Line Value (CLV), a key indicator of long-term betting success. Beating the final market price consistently shows that you're making smarter bets. Additionally, WagerProof highlights the savings potential of using lower-vig books. For example, opting for books offering -105 lines instead of -110 nearly halves the vig, reducing the overround from 4.76% to 2.44%. For a recreational bettor placing 100 bets annually at $100 each with a 50% win rate, this adjustment can save around $230 per year - money that would otherwise go to the sportsbook.

Key Takeaways

Error margins play a significant role in shaping your betting strategy. Every win probability you calculate comes with an inherent uncertainty - usually around ±3%. This means that a bet with a 6% expected value (EV) could shrink to just 1%, or even turn negative, once you account for this margin of error. Simply chasing every positive EV bet without factoring in these uncertainties can lead to long-term losses. To mitigate this, it's smart to set safety thresholds: aim for a minimum of 1% EV on short-odds bets, and at least 5% for longshots to account for the amplified risks tied to higher payouts.

Payout magnification can also wipe out your edge. For instance, a small estimation error might barely impact a bet on a -150 favorite, but it can completely erase any advantage when betting on a +230 underdog. The bigger the potential payout, the more these errors are amplified, making it crucial to adjust EV thresholds based on the type of bet. This adaptability helps safeguard your bankroll from unexpected swings.

When your model's predictions differ from sportsbook lines, the odds often favor the market being more accurate. To counter this, a larger edge is necessary when your model diverges significantly from market odds. Even slight discrepancies in your model's calculations should be carefully examined. Using tools that combine insights from multiple predictive models can help minimize single-model errors and boost confidence in your betting decisions.

For practical application, tools like WagerProof's Edge Finder can be invaluable. It uses real-time data to highlight discrepancies between your calculations and market-implied probabilities. By incorporating resources like prediction markets, public betting percentages, and Closing Line Value, it ensures you verify your edge before putting money on the line.

Ultimately, success in sports betting hinges on consistently finding real edges while managing the natural variance in your estimates. By understanding error margins, adjusting EV thresholds, and leveraging reliable data tools, you can position yourself for long-term profitability. These strategies underscore the importance of blending statistical insights with practical tools to stay ahead in the game.

FAQs

What are error margins, and how do they impact my betting strategy?

Error margins reflect the degree of uncertainty in a bet's expected value or implied probability. A larger margin means there's more uncertainty, signaling that you might want to tread carefully - either by placing smaller bets or avoiding the wager altogether. Conversely, a smaller margin suggests higher confidence, which can justify making larger, more strategic bets.

By understanding error margins, you can make better-informed decisions, distinguishing between bets that have genuine potential and those that come with excessive risk. Tools like WagerProof can be incredibly helpful, offering transparent, real-time data and insights to identify these opportunities effectively.

What’s the difference between overround and vig in sports betting?

In sports betting, the term overround refers to the built-in margin of a market. It’s calculated by adding up all the implied probabilities of the outcomes, which will exceed 100%. This extra percentage ensures the sportsbook secures a profit, no matter the result.

On the other hand, vig - short for vigorish or juice - is the specific fee or commission the sportsbook charges on individual bets. While overround reflects the overall profit margin for the market, vig is the sportsbook’s cut from each wager, guaranteeing their earnings regardless of how the event unfolds.

How do I calculate a bookmaker's margin from the odds?

To figure out the bookmaker's margin (or overround), you'll need to calculate the implied probability for each decimal odd using this formula: 100 ÷ odd. Once you've done that, add up all the implied probabilities for the possible outcomes of the event. If the total is greater than 100%, the amount over 100% is the bookmaker's margin.

For instance, if the implied probabilities add up to 105%, the bookmaker's margin is 5%. This margin guarantees that the bookmaker makes a profit no matter how the event turns out. Knowing this can help you place bets with a clearer understanding of the odds.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free