Kelly Criterion: Bet Sizing Guide

The Kelly Criterion is a simple formula that helps you decide how much of your bankroll to bet based on your perceived edge. It’s designed to grow your funds over time while minimizing the risk of losing it all. Here’s the formula:

Kelly % = (bp - q) / b

Where:

- b = Net odds (decimal odds - 1)

- p = Your estimated probability of winning

- q = Probability of losing (1 - p)

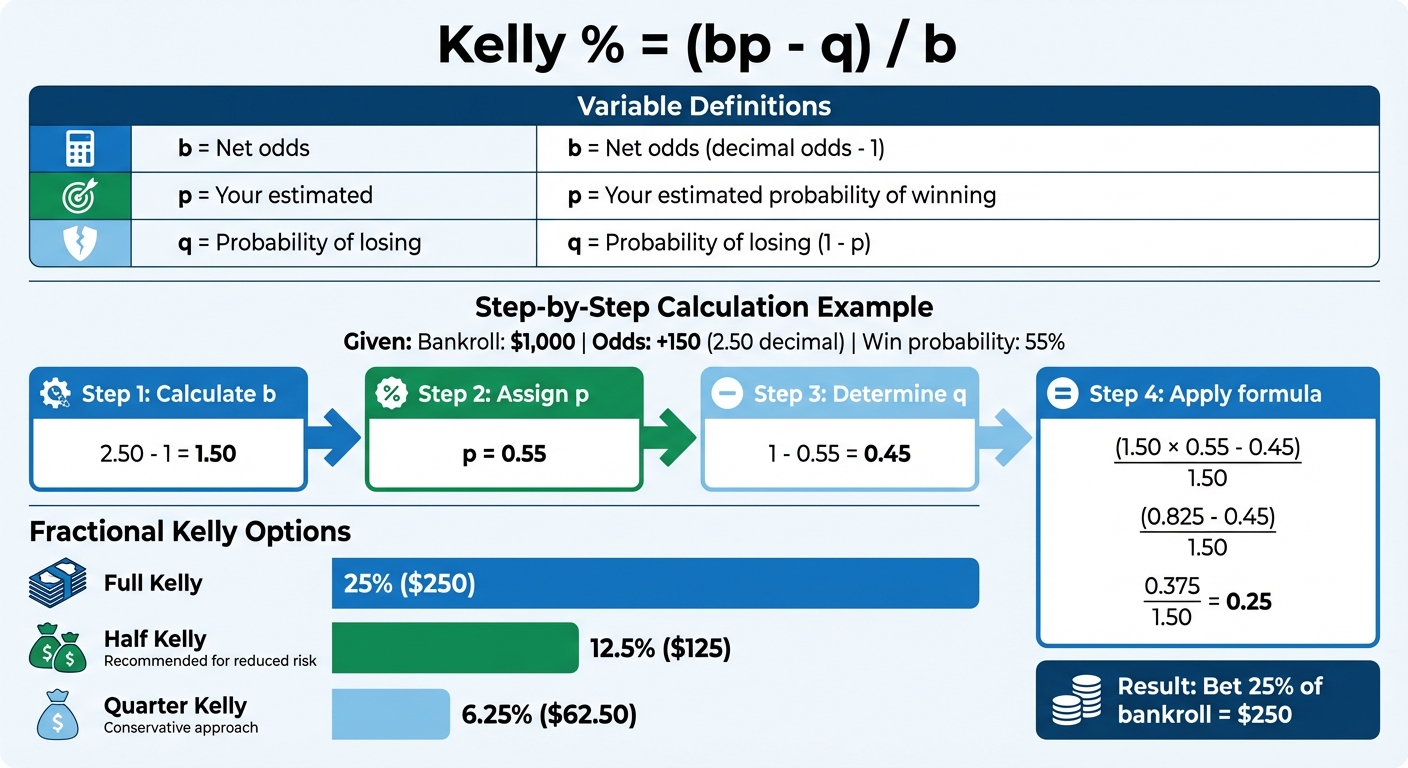

For example, if you have a $1,000 bankroll, odds of +150 (2.50 in decimal), and a 55% chance of winning:

- b = 2.50 - 1 = 1.50

- p = 0.55

- q = 1 - 0.55 = 0.45

- Plug into the formula: (1.50 × 0.55 - 0.45) / 1.50 = 0.25 (25%)

The result suggests betting 25% of your bankroll ($250). To reduce risk, many bettors use a fraction of this amount, such as Half Kelly (12.5%) or Quarter Kelly (6.25%).

This method dynamically adjusts bet sizes based on your edge and bankroll, helping you avoid over-betting or chasing losses. However, its success depends on accurate probability estimates - overestimating your edge can lead to overbetting and losses. Fractional Kelly is a safer approach for most bettors.

Key Points:

- Use the Kelly Criterion for calculated bet sizing.

- Prioritize accurate win probability estimates.

- Consider Fractional Kelly for lower risk.

What is Kelly Criterion? The Must Know Concepts for Bankroll Management

How the Kelly Criterion Works

Kelly Criterion Formula Calculator: Step-by-Step Bet Sizing Guide

The Kelly Formula Explained

The Kelly Criterion helps calculate the ideal percentage of your bankroll to wager. The formula is simple: Kelly % = (bp - q) / b. Here's what the variables mean:

- b: Your net odds, which are the decimal odds minus 1.

- p: Your estimated probability of winning.

- q: Your probability of losing, calculated as 1 - p.

The result of this formula tells you what percentage of your bankroll to wager. A positive outcome means you have an edge and should bet that percentage. If the result is zero or negative, it's a signal to skip the bet.

Understanding the Variables

Let’s break down the key components of the formula:

- b (Net Odds): This is the profit for every $1 wagered. To calculate it, subtract 1 from the decimal odds. For instance, if the odds are 3.50, then b = 2.50.

- p (Win Probability): This is your estimated chance of winning, often derived from statistical models, historical data, or by adjusting the sportsbook's odds to remove their margin. To gain an edge, your estimated probability must exceed the implied probability of the odds.

- q (Loss Probability): This is simply 1 - p. For example, if your win probability is 60% (0.60), then q = 0.40.

| Variable | Definition | How to Calculate |

|---|---|---|

| b | Profit per $1 wagered | Decimal Odds - 1 (e.g., 3.00 odds gives b = 2) |

| p | Your estimated chance of winning | Based on statistical models, historical data, or adjusted odds |

| q | Your estimated chance of losing | 1 - p |

Example: Calculating Optimal Bet Size

Let’s say you have a $1,000 bankroll and find a bet with +150 odds (which is 2.50 in decimal format). You estimate the team has a 55% chance of winning.

- Calculate b: 2.50 - 1 = 1.50.

- Assign p: 0.55.

- Determine q: 1 - 0.55 = 0.45.

Now plug these into the formula:

(1.50 × 0.55 - 0.45) / 1.50 = (0.825 - 0.45) / 1.50 = 0.375 / 1.50 = 0.25 (or 25%)

The Kelly Criterion suggests wagering 25% of your bankroll, which is $250 in this case. To reduce risk, you might opt for a smaller fraction, like Half-Kelly (12.5%) or Quarter-Kelly (6.25%).

"The formula protects you from overextending on the lower-value bets or under-betting on the strongest ones!" - Alyssa Waller, GamblingSite.com

Up next, we’ll dive into the pros and cons of using this approach.

Pros and Cons of the Kelly Criterion

Once you understand how the Kelly Criterion calculates optimal wagers, it’s important to weigh its benefits and potential risks.

Advantages of the Kelly Criterion

The Kelly Criterion aims to maximize long-term bankroll growth. Unlike flat betting, it adjusts your stakes dynamically - increasing bet sizes when your bankroll grows and reducing them during losing streaks. This adaptability helps lower the risk of going broke, as you’re always betting a percentage of your current bankroll rather than a fixed amount.

Another key advantage is its focus on betting based on your edge. The formula encourages larger bets when you have a strong advantage and smaller bets when the edge is slim, striking a balance between risk and reward. If the calculation yields a zero or negative result, it serves as a clear signal to avoid placing that bet, helping you steer clear of impulsive or emotional decisions.

"Kelly betting also minimizes the expected number of bets required to double the bankroll, when bet sizing is always in proportion to the current bankroll".

For example, in a simulation of an even-money bet with a 2% edge, using a full Kelly bet (2%) took an average of 3,496 bets to double the bankroll. In comparison, a fixed 0.5% bet required 7,901 bets to achieve the same result.

However, while the approach is dynamic and data-driven, it isn’t without challenges.

Limitations and Risks

One of the biggest risks is its reliance on accurate probability estimates. The formula’s effectiveness hinges on correctly assessing your chances of winning. If you overestimate your edge, the Kelly Criterion could lead to overbetting, which significantly raises the risk of draining your bankroll.

Full Kelly betting is also highly volatile. Even if you have a real edge, a short losing streak can result in steep drawdowns, which can be tough to handle mentally. For instance, with a 55% win rate on even-money bets (suggesting a 10% Full Kelly stake), a 5-loss streak would lead to a ~41% drawdown. Betting more than the Kelly-recommended amount eliminates growth potential and can even lead to long-term losses. Additionally, the formula becomes more complex for multi-outcome wagers like parlays or horse racing, and it doesn’t account for transaction costs like sportsbook margins or exchange fees, which can eat into your expected value.

Full Kelly vs. Fractional Kelly

Striking a balance between growth and risk is crucial, which is why many bettors opt for a more conservative approach by using a fraction of the Full Kelly recommendation.

Full Kelly maximizes growth but comes with significant volatility and the potential for large drawdowns. On the other hand, Fractional Kelly - betting a set fraction of the Full Kelly amount - offers a safer alternative by reducing the impact of estimation errors and easing psychological pressure. For example, betting Half Kelly (50% of the Full Kelly amount) cuts volatility by half while only slightly reducing growth by about 25%. In the same 55% win rate scenario, using Half Kelly (5% stake) results in smaller drawdowns compared to Full Kelly.

Many professionals lean toward Quarter or Half Kelly to manage volatility and account for potential errors in their edge calculations.

"The goal is to grow your bankroll at the highest long-term rate while keeping a nonzero chance of survival. The Kelly Criterion does this by telling you the fraction of your bankroll to stake when you have a positive edge".

How to Apply the Kelly Criterion to Sports Betting

Applying the Kelly Criterion requires accurate probability estimates and disciplined bankroll management.

Step-by-Step Guide

Here’s how you can apply the Kelly Criterion to sports betting:

- Set your bankroll: Decide on the total amount of money you’re allocating for betting. This should be a separate fund specifically for wagering.

- Convert American odds to decimal: Use the formula

(odds ÷ 100) + 1for positive odds (e.g., +150 becomes 2.50). For negative odds, use100 ÷ abs(odds) + 1. - Estimate your probability of winning: Base this on statistical models, historical trends, or AI-driven predictions.

- Calculate the net odds: Subtract 1 from the decimal odds to get the net odds.

- Use the Kelly formula:

The formula is:

f* = (b × p – q) / b- b = net odds

- p = your estimated probability of winning

- q = probability of losing (1 – p)

- Adjust for safety: Multiply the result by a safety factor (e.g., 0.25 or 0.5) to reduce risk and account for uncertainty.

- Manage multiple bets: If you’re placing several bets at once, divide the Kelly percentage by the number of bets to avoid overexposure.

The key to making this work lies in how accurately you can estimate probabilities. That’s where the real challenge begins.

Tips for Accurate Probability Assessment

The effectiveness of the Kelly Criterion depends entirely on how precise your probability estimates are.

"The Kelly Criterion is not a system that turns a losing bet into a winning one. It is a sizing rule for good bets."

- Joshua Soriano, Quant Matter

To improve your probability assessments:

- Leverage historical data: Use past performance metrics to establish a baseline win rate.

- Build statistical models: Incorporate factors like team strength, player performance, and pace of play into your analysis.

- Compare with market odds: Convert sportsbook odds (after removing the vig) into implied probabilities and ensure your estimates show a genuine edge.

- Update your estimates: Start with an initial probability and adjust it as new information becomes available, such as injury updates or weather conditions. However, avoid overreacting to small sample sizes.

- Track your bets: Keep a record of your estimated probabilities, odds, and outcomes. Use this log to refine your model and identify patterns.

"Estimation error is the main risk in Kelly use."

- Joshua Soriano, Quant Matter

To safeguard against errors, set a maximum stake limit - no more than 5% of your bankroll per bet.

Using WagerProof to Simplify Kelly Calculations

WagerProof makes applying the Kelly Criterion easier by integrating real-time data and AI-driven tools. This platform ensures your probability inputs and risk thresholds are consistently accurate.

The Edge Finder identifies value bets by flagging situations where market spreads don’t align with your calculated probabilities. This helps you spot opportunities where a Kelly-sized wager might be justified. Unlike other services that provide picks without context, WagerProof offers transparency by sharing detailed data, historical stats, and public betting trends.

With WagerBot Chat, you gain access to an AI assistant tailored for sports betting. Connected to live data, it refines your probability estimates by factoring in real-time updates like injuries, team form, and matchup history. This allows you to adjust your calculations dynamically as new information becomes available, giving you a more accurate edge when using the Kelly Criterion.

Conclusion

The Kelly Criterion provides a structured, mathematical approach to determining the ideal bet size. It's designed to grow your bankroll over the long term while minimizing the risk of losing it all. By adjusting your bets based on your current capital and the strength of your advantage, it ensures a disciplined and proportional strategy.

One of its standout features is its adaptability - it increases bet sizes during winning streaks and reduces them during losses. This approach removes emotional decision-making from the equation and prioritizes protecting your funds.

"The Kelly Criterion isn't about guaranteeing wins; it's a strategy for managing your bankroll by using math to place larger wagers on plays where you have an edge." - Alonzo Solano, Editor-in-Chief, Boss of Betting

For those looking to reduce volatility or account for potential inaccuracies in their estimates, the Fractional Kelly method offers a more conservative alternative.

FAQs

What makes the Kelly Criterion different from flat betting?

The Kelly Criterion takes a different approach from flat betting by adjusting the size of each wager based on your perceived advantage and the odds at play. Instead of sticking to a fixed amount or percentage for every bet, Kelly betting calculates the ideal percentage of your bankroll to wager. This method aims to strike a balance - maximizing long-term growth while keeping the risk of losing everything in check.

Put simply, Kelly betting lets you vary your stakes depending on how confident you are in your edge and the odds being offered. This way, you can capitalize on opportunities where the odds are in your favor. Flat betting, by contrast, doesn’t adapt to changes in confidence or edge, which can slow down growth or increase risks if your edge is misjudged. For those who can accurately gauge probabilities, the Kelly Criterion provides a more strategic and mathematically grounded way to manage a bankroll.

What happens if you use inaccurate probability estimates with the Kelly Criterion?

Using the Kelly Criterion with flawed probability estimates can cause major problems. This formula hinges on accurate calculations of your edge, and providing incorrect inputs can result in overbetting or underbetting. Overbetting exposes you to the danger of substantial losses, while underbetting limits your chances to maximize profits.

To make the most of the Kelly Criterion, you need to rely on trustworthy data for your calculations. If the probabilities are off, your bet sizes can end up skewed, which might lead to poor bankroll management and financial trouble.

Why do some bettors prefer using Fractional Kelly instead of Full Kelly?

Many bettors choose Fractional Kelly instead of Full Kelly as a way to manage risk more cautiously and avoid the possibility of steep losses. By wagering only a portion of the suggested Kelly amount, they can reduce the ups and downs that often accompany Full Kelly, particularly during losing streaks.

Although Fractional Kelly may lead to slower growth compared to Full Kelly, it provides a safer, more measured approach. This method prioritizes long-term stability and lowers the risk of going bust, making it a favored strategy for those who prefer consistent progress over chasing high returns.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free