Kelly Criterion vs. Flat Betting

Managing your bankroll is key to long-term betting success. Even with good picks, poor money management can lead to losses. Two popular strategies for handling your bankroll are the Kelly Criterion and flat betting.

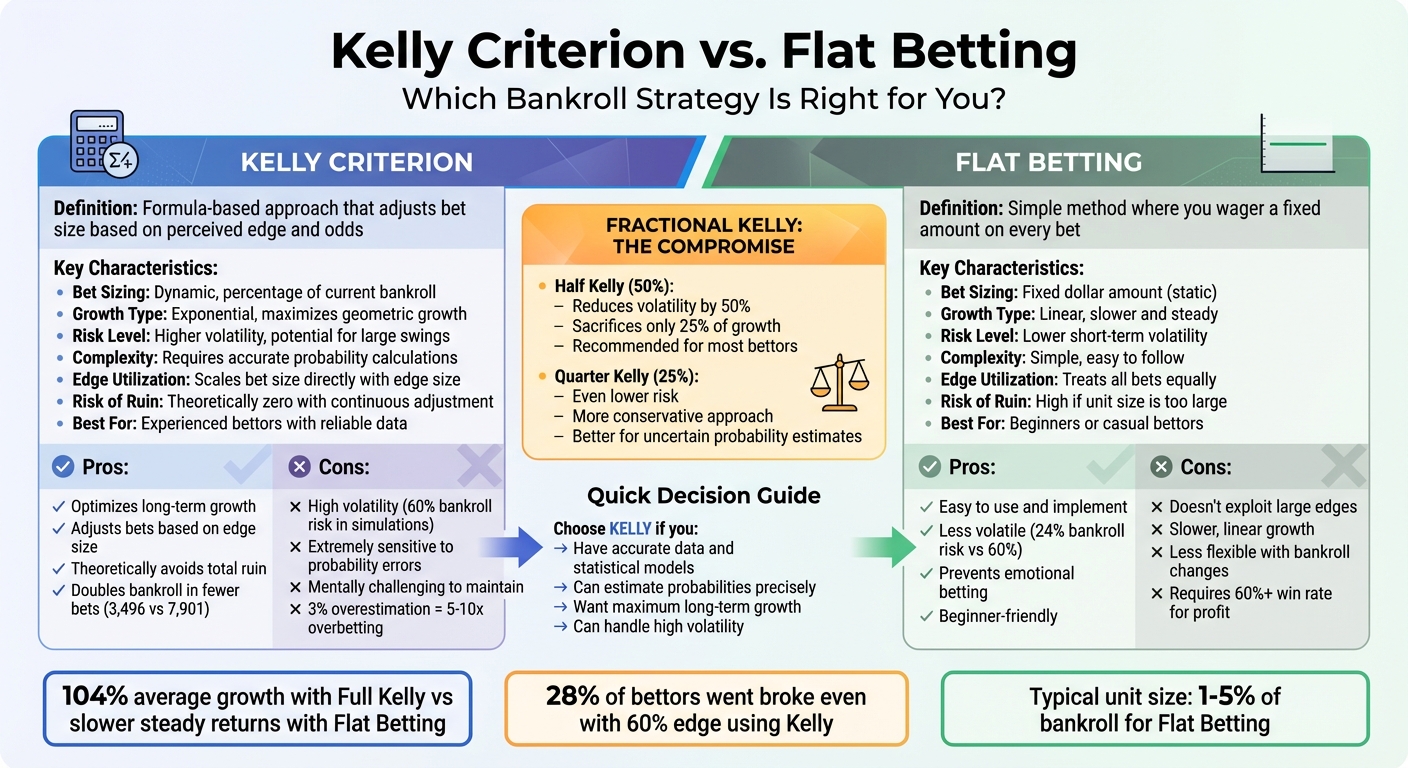

- Kelly Criterion: A formula-based approach that adjusts bet size based on your perceived edge and odds. It aims to maximize growth but comes with higher risk and complexity.

- Flat Betting: A simpler method where you wager a fixed amount on every bet. It’s beginner-friendly and less volatile but lacks the ability to capitalize on strong edges.

Quick Comparison

| Factor | Kelly Criterion | Flat Betting |

|---|---|---|

| Bet Sizing | Dynamic, based on edge | Fixed amount |

| Growth Potential | Exponential, faster growth | Linear, slower growth |

| Risk | Higher volatility | Lower volatility |

| Complexity | Requires calculations | Simple, easy to follow |

| Best For | Experienced bettors with data | Beginners or casual bettors |

Key takeaway: Use Kelly for faster growth if you can estimate probabilities accurately. Stick to flat betting for simplicity and stability. Fractional Kelly offers a middle ground by reducing volatility while maintaining growth potential.

Kelly Criterion vs Flat Betting: Complete Strategy Comparison

Bankroll Management, the Kelly Criterion and the Best Way to Make Money Sports Betting

What Is the Kelly Criterion?

The Kelly Criterion is a formula introduced in 1956 by John Larry Kelly Jr., a researcher at Bell Labs, to determine the ideal bet size for maximizing long-term bankroll growth. Originally created for telecommunications, it has since become a go-to strategy for professional gamblers and investors who want to scale their wagers based on their advantage over the bookmaker.

Unlike flat betting, the Kelly Criterion adjusts your bet size depending on your perceived edge. If your edge is significant, it suggests betting more. If your edge is small, it advises betting less. And if you have no edge, it recommends not betting at all. At its core, the formula focuses on maximizing the logarithmic growth of your wealth over time.

How the Kelly Formula Works

For bets with two possible outcomes, the formula is:

f = (bp – q) / b

Where:

- f: Fraction of your bankroll to bet

- b: Net odds (decimal odds minus 1)

- p: Estimated probability of winning

- q: Probability of losing (1 – p)

Here’s an example: Say you believe a bet has a 55% chance of winning, and the decimal odds are 2.00 (even money). Plugging these values into the formula:

f = (1.0 × 0.55 – 0.45) / 1.0 = 0.10 (or 10%)

If your bankroll is $1,000, the formula suggests betting $100. It’s important to recalculate the percentage after each bet to stay aligned with your changing bankroll.

Dominic Cortis, a Lecturer in Actuarial Science at the University of Malta, explains it like this:

"Kelly's criterion calculates the proportion of your own funds to bet on an outcome whose odds are higher than expected, so that your own funds grow exponentially."

Full Kelly vs. Fractional Kelly

Full Kelly involves betting the exact percentage calculated by the formula. While this approach maximizes growth, it’s also highly volatile - there’s a 50% chance you could lose half your bankroll before doubling it.

Fractional Kelly, on the other hand, involves betting only a portion of the calculated amount, such as 25% (Quarter Kelly) or 50% (Half Kelly). This approach reduces volatility and provides a safety net in case your win probabilities are overestimated. Michael Shackleford, founder of Wizard of Odds, explains:

"Betting half the Kelly amount, for example, reduces bankroll volatility by 50%, but growth by only 25%."

Many professionals lean toward fractional Kelly because it balances risk and growth, allowing them to adjust based on their tolerance for volatility.

Example Calculations

The table below demonstrates how the Kelly Criterion adjusts bet sizes based on different win probabilities and odds:

| Win Probability (p) | Decimal Odds | Net Odds (b) | Kelly % (Full) | Recommended Action |

|---|---|---|---|---|

| 55% | 2.00 | 1.0 | 10.0% | Bet 10% of your bankroll |

| 60% | 1.70 | 0.7 | 2.86% | Bet 2.86% of your bankroll |

| 25% | 6.00 | 5.0 | 10.0% | Bet 10% of your bankroll |

| 52% | 2.00 | 1.0 | 4.0% | Bet 4% of your bankroll |

| 50% | 2.00 | 1.0 | 0.0% | No edge; do not bet |

| 30% | 3.50 | 2.5 | 2.0% | Bet 2% of your bankroll |

This table highlights how bet sizes shift depending on your edge. If there’s no edge (like a 50% chance at even money), the formula advises against betting. But when there’s a strong edge - such as a 60% win probability at 1.70 odds or a 25% chance at 6.00 odds - it suggests wagering more to maximize the potential return. This dynamic approach stands in sharp contrast to flat betting, which doesn’t account for variations in your advantage.

What Is Flat Betting?

Flat betting is a straightforward bankroll strategy where you wager the same amount on every bet, no matter the odds or your perceived edge. Bettors typically determine a "unit" size, which is often 1% to 5% of their total bankroll. For instance, with a $1,000 bankroll and a 2% unit size, you'd bet $20 on each wager. Unlike progressive systems like the Martingale, flat betting doesn't involve increasing your stakes after losses or reducing them after wins. Instead, you stick with the same amount, adjusting only when recalculating your bankroll at specific intervals.

Paul Trevor from Outplayed explains it well:

"The Flat betting technique suggests that you place the same bet stake on every bet irrespective of whether your bets win or lose."

To turn a profit with flat betting at even odds (2.0), you'll need a win rate above 50%. A 60% win rate is often seen as the sweet spot for steady, long-term gains. This simple approach contrasts with more dynamic strategies and sets the stage for weighing its pros and cons.

Benefits of Flat Betting

Flat betting stands out for its simplicity. You don’t need to juggle complex calculations or constantly reassess your edge. Just set your unit size and stick to it. This makes it an approachable strategy, especially for beginners who might not yet know how to estimate win probabilities accurately.

Another key advantage is the discipline it enforces. Flat betting helps you avoid emotional decisions, like chasing losses or overbetting during a winning streak. Since the stakes are usually small (1–5% of your bankroll), it's much harder to lose everything during a rough patch. This is especially helpful for newcomers, as it reduces the risk of catastrophic losses. For example, in simulations involving 20 bets with a 5% edge, flat betting risked about 24% of the bankroll, compared to 60% for the full Kelly criterion. The lower volatility makes for a smoother and less nerve-wracking betting experience.

Limitations of Flat Betting

The main drawback of flat betting is its inability to capitalize on a strong edge. By treating every wager equally, it limits your potential profits when conditions are in your favor. This approach leads to steady, linear bankroll growth, even when opportunities for bigger gains arise. While it does safeguard your bankroll against major losses, it also caps your upside.

Flat betting's success hinges entirely on the quality of your picks and maintaining a high win rate. Without consistently achieving around a 60% win rate, it may not yield meaningful profits. Instead, it could simply slow down the rate at which you lose money, making it less effective for bettors who struggle to maintain a strong edge.

Kelly Criterion vs. Flat Betting: Key Differences

The primary distinction between these two strategies lies in how they determine bet sizes and manage bankroll growth. Flat betting sticks to a fixed dollar amount - say, $20 per wager - regardless of any changes in your advantage or bankroll size. On the other hand, the Kelly Criterion calculates a percentage of your current bankroll based on your perceived edge and the odds. As your bankroll increases, so does the wager; if it decreases, the wager shrinks accordingly. This highlights the contrast between fixed and variable wager sizing in shaping long-term bankroll growth.

One of the standout features of Kelly betting is its exponential compounding of wins, compared to the linear growth achieved through flat betting. Michael Shackleford, the founder of Wizard of Odds, captures this idea perfectly:

"Kelly betting also minimizes the expected number of bets required to double the bankroll, when bet sizing is always in proportion to the current bankroll."

In fact, a simulation revealed that doubling the bankroll took only 3,496 full Kelly bets, compared to 7,901 flat bets (using a 0.5% wager).

Another key difference is how each method handles varying levels of advantage. Kelly betting adjusts wager sizes based on the magnitude of the edge, making it more efficient at leveraging favorable conditions. Flat betting, however, applies the same wager to every bet, regardless of the edge. This efficiency comes at a cost: Kelly betting introduces higher short-term volatility. For instance, in a simulation of 20 bets with a 5% edge, full Kelly betting risked about 60% of the bankroll but achieved an average growth of 104%. In contrast, flat betting risked only 24% of the bankroll, resulting in slower but steadier returns.

Comparison Table

Here’s a quick breakdown of the differences:

| Factor | Flat Betting | Kelly Criterion |

|---|---|---|

| Bet Sizing | Fixed dollar amount (static) | Percentage of current bankroll (dynamic) |

| Growth Potential | Linear; slower and steady | Exponential; maximizes geometric growth |

| Variance/Risk | Lower short-term volatility | High volatility; potential for large swings |

| Edge Utilization | Treats all bets equally | Scales bet size directly with the size of the edge |

| Complexity | Simple; best for beginners | Complex; requires accurate probability estimates |

| Risk of Ruin | High if unit size is too large | Theoretically zero with continuous adjustment |

Pros and Cons of Each Strategy

Each betting strategy comes with its own set of trade-offs, influencing how your bankroll grows and how you handle risk. Kelly betting adjusts the size of your bets based on your edge, offering the potential for exponential growth. However, it requires highly accurate probability estimates and comes with significant volatility. On the other hand, flat betting is straightforward and stable, but it doesn't take advantage of large edges, which limits your potential gains.

Pros and Cons Table

Here's a quick comparison of the strengths and weaknesses of both strategies:

| Strategy | Pros | Cons |

|---|---|---|

| Kelly Criterion | Optimizes long-term growth; adjusts bets based on edge size; theoretically avoids total ruin by reducing stakes as bankroll shrinks | High volatility; highly sensitive to errors in probability estimates; mentally challenging to stick with |

| Flat Betting | Easy to use; less volatile; helps prevent emotional betting; beginner-friendly | Doesn't exploit large edges; treats all bets the same; slower, linear growth; less flexible if bankroll decreases |

One key variation, Half Kelly, offers a middle ground. It reduces risk by cutting volatility in half and lowers the chance of significant losses while sacrificing only 25% of the expected growth compared to Full Kelly.

Simulations and Long-Term Outcomes

Simulations show that Kelly betting outperforms flat betting over time - if your probability estimates are accurate. For example, Kelly can double a bankroll in far fewer bets compared to flat betting. But here's the catch: even a small overestimation of your win probability, say by 3%, can lead to betting 5 to 10 times more than you should, which can wipe you out.

Joey Shackelford of Wizard of Odds highlights this risk:

"The Kelly Criterion's biggest weakness: it's extremely sensitive to probability estimation errors. If you overestimate your win probability, Kelly tells you to bet too much, which can be disastrous."

Another critical takeaway: doubling the recommended Kelly bet size eliminates any long-term growth, even if you have a positive edge. A behavioral study on a simple 60% edge coin flip found that 28% of participants still went broke. While Kelly rewards precision, it punishes overconfidence harshly. These findings underline the importance of choosing a strategy that aligns with your risk tolerance and ability to estimate probabilities accurately.

When to Use Each Strategy

Deciding between the Kelly Criterion and flat betting boils down to your experience level, your ability to evaluate your edge accurately, and how much volatility you're comfortable handling. Neither strategy is inherently "better" - each caters to different betting goals and styles. Here's a closer look at when each approach makes the most sense.

Kelly Criterion: Best for Data-Driven Bettors

The Kelly Criterion is ideal for bettors who rely on solid data and can confidently gauge probabilities to identify value. If you're using tools like WagerProof to compare your calculated probabilities with market odds and spot overlays, Kelly can help you maximize your advantage.

"Kelly isn't about hitting more winners - it's about growing your money as efficiently as possible while avoiding ruin."

This method works best when you have precise, objective data - think speed figures, trainer trends, or robust statistical models. Relying on intuition instead of hard numbers can lead to trouble. For those with strong data insights, starting with Half Kelly or Quarter Kelly can reduce volatility while still outperforming flat betting over time. The key is its flexibility: your wagers scale with your proven edge, making it a dynamic option for serious bettors.

Flat Betting: Best for Beginners or Simple Approaches

Flat betting, on the other hand, is a straightforward choice that works well for beginners or anyone favoring a simpler system. It eliminates the need for constant recalculations and protects against emotional decisions, like chasing losses. If you're betting for fun or don't feel confident in estimating probabilities with precision, flat betting offers a safer path.

"Flat betting ensures you don't get carried away and put too much money on a single race. It helps beginners avoid catastrophic losses."

This approach is all about consistency and risk control, making it a great starting point for learning disciplined bankroll management. It allows you to focus on improving your skills without the added pressure of adjusting wager sizes based on complex calculations.

How to Implement Each Strategy

How to Use the Kelly Criterion

To get started with the Kelly Criterion, first establish your bankroll - this is the amount you're prepared to risk. Next, determine your win probability by considering statistical models, team performance, and injury updates. If you're working with decimal odds, convert them to net odds by subtracting 1 (e.g., 1.91 becomes 0.91). Then, calculate the probability of losing by subtracting your win probability from 1.

Once you have these numbers, plug them into the Kelly formula: (bp - q)/b, where:

- b is the net odds,

- p is your win probability,

- q is your chance of losing.

The result will indicate the fraction of your bankroll to wager. To account for potential errors in estimating probabilities, many bettors use a fractional Kelly multiplier (like 0.25 or 0.5) to reduce risk and volatility. This is why professional bettors often opt for Quarter Kelly or Half Kelly strategies.

"The Kelly Criterion formula finds the sweet spot between risk and reward." – APWin

It's wise to set a maximum bet cap, typically between 2–5% of your total bankroll, no matter what the Kelly formula suggests. When placing multiple bets simultaneously, adjust your Kelly fraction by dividing it by the square root of the number of bets to maintain consistent risk levels. Regularly review and adjust your bankroll to ensure your calculations remain accurate.

Tools like WagerProof can simplify this process by integrating live sportsbook odds with probability models, helping you quickly identify your edge.

Now that you've seen the dynamic nature of Kelly sizing, let's explore the simplicity of flat betting.

How to Use Flat Betting

Flat betting offers a straightforward alternative to the more complex Kelly Criterion. With this method, you wager a fixed percentage of your bankroll on every bet. For beginners, this is typically 1–2%, while experienced bettors might go as high as 3–5%. For instance, if your bankroll is $1,000 and you choose 2%, your unit size would be $20.

The key to flat betting is consistency. Bet the same fixed amount on every wager, regardless of how confident you feel about the outcome or how enticing the odds may seem. This strategy minimizes emotional decision-making and helps you avoid overextending yourself.

Discipline is crucial. Reevaluate your unit size periodically - weekly or monthly works well - and resist the temptation to adjust your bets during winning or losing streaks. Keeping a detailed record of your wagers can also help you stay objective and avoid chasing losses after a tough break.

"A staking plan stops you from emotional betting and chasing losses... you won't be tempted to bet above your pay grade." – Alex Windsor, Managing Editor, BettingTools

Flat betting's simplicity makes it an excellent choice for those who value a steady, disciplined approach to wagering.

Conclusion: Choosing the Right Strategy

Deciding between the Kelly Criterion and flat betting comes down to your comfort with risk, the accuracy of your data, and your overall betting objectives. For beginners, flat betting is a solid choice. By sticking to a fixed stake of 1–3%, it helps limit losses and instills discipline - key elements for anyone starting out.

On the other hand, the Kelly Criterion is tailored for those who have a proven edge and want to maximize their bankroll growth over time. It adjusts bet sizes based on your advantage, making it a powerful tool for data-savvy bettors.

If you’re looking for something in between, Fractional Kelly might be your answer. It reduces the volatility of full Kelly betting while still offering much of its growth potential. This approach is ideal for those who want to balance risk and reward without experiencing dramatic swings in their bankroll.

However, keep in mind that the Kelly Criterion is highly sensitive to errors in estimating your win probability. A small miscalculation - like overestimating your chances of winning by just 3% - could lead to over-betting by 5 to 10 times the optimal amount. That’s why having accurate and reliable data is critical. Tools like WagerProof can be game-changers, offering real-time sports data, prediction market comparisons, and statistical models to help identify genuine betting edges. With features like automated outlier detection and expert-reviewed picks, these tools can guide you in making smarter decisions, whether you lean toward Kelly, flat betting, or a mix of both.

Ultimately, the strategy you choose should align with your skills, data access, and comfort level. As you refine your edge and grow more confident, you can always tweak your approach to strike the right balance between growth and risk.

FAQs

What is the Kelly Criterion, and how does it determine bet sizes?

The Kelly Criterion is a formula designed to determine the optimal percentage of your bankroll to bet. It factors in your perceived edge - essentially, how much better your chances of winning are compared to the odds being offered. The goal? To maximize long-term growth while keeping the risk of big losses in check.

By scaling your bet sizes based on your advantage, the Kelly Criterion strikes a balance between playing it safe and taking calculated risks. This flexible strategy has become a go-to for bettors aiming to manage their bankroll wisely over the long haul.

What are the advantages of using fractional Kelly instead of full Kelly?

Using a fractional Kelly strategy is a smart way to manage the trade-off between growth and risk. By betting a fraction of the full Kelly amount, you can reduce the swings in your bankroll, making it easier to handle the ups and downs that come with betting.

This approach works well for those who lean toward caution or want to protect themselves from the unpredictable nature of sports outcomes. If you're not entirely confident in how accurate your calculated edge is, fractional Kelly offers a safer way to aim for steady, long-term growth.

Why would a beginner prefer flat betting instead of using the Kelly Criterion?

Flat betting is a solid starting point for beginners because it keeps things simple and easy to manage. By placing the same wager on every bet, regardless of how confident you feel or the perceived advantage, this method helps avoid unnecessary complications. It allows newcomers to focus on understanding the fundamentals without the pressure of making advanced calculations. Plus, sticking to a consistent amount can help minimize big losses, making it a safer way to handle your bankroll as you learn.

On the other hand, the Kelly Criterion demands more advanced calculations and relies on accurate estimates of probabilities and potential edges. This level of precision can be overwhelming for someone just starting out. Flat betting, with its straightforward and disciplined approach, provides a steady foundation for beginners to build their skills.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free