How Line Movement Signals Market Inefficiencies

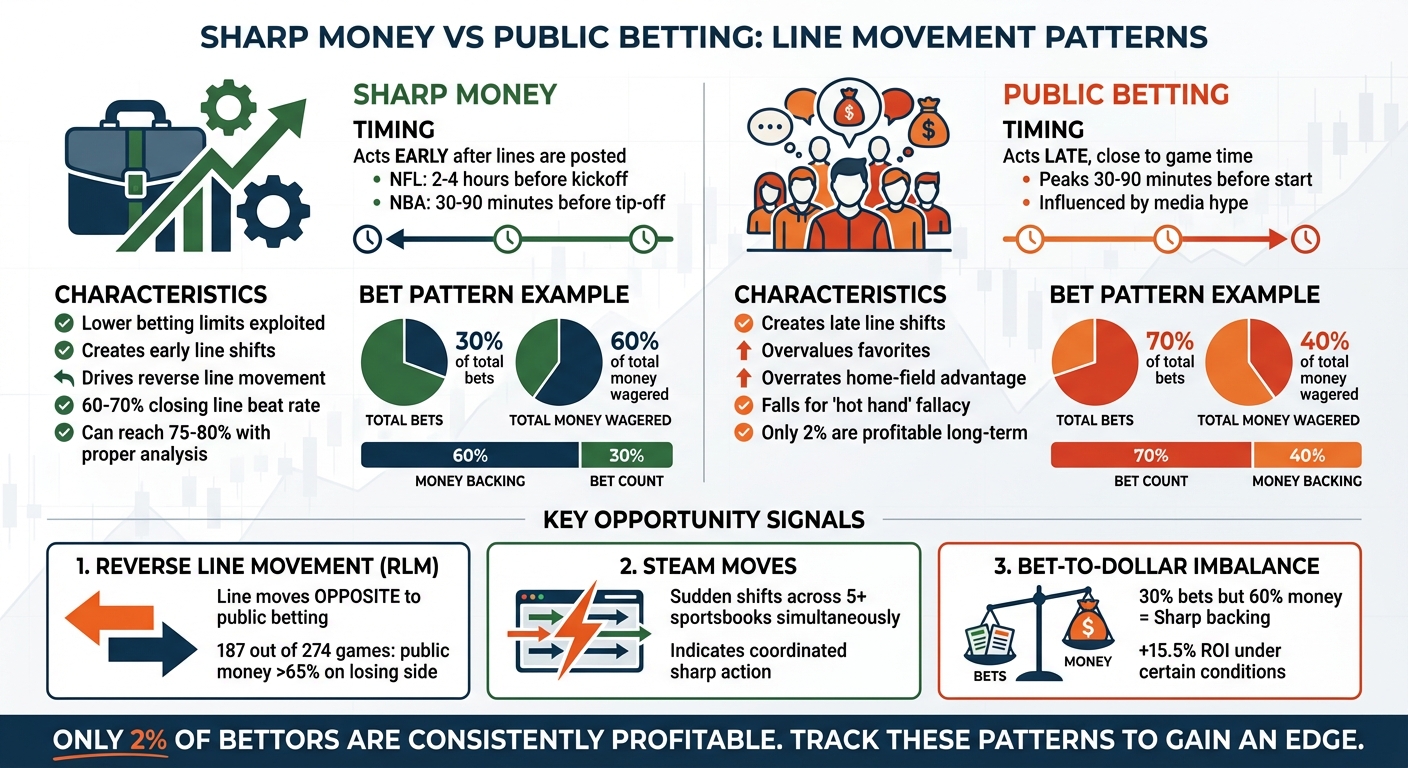

Line movement in sports betting reveals where sharp bettors and public sentiment diverge, often exposing opportunities to profit. Here's the key takeaway: sharp money drives early line changes, while public betting causes late shifts, creating inefficiencies you can exploit. By tracking these movements, comparing odds across sportsbooks, and identifying patterns like reverse line movement or bet-to-dollar imbalances, you can spot mispriced lines before they adjust.

Key Points:

- Sharp Money vs. Public Bets: Early line shifts often indicate professional wagers, while late changes reflect casual betting trends.

- Reverse Line Movement (RLM): When the line moves against public betting, it signals sharp activity.

- Bet-to-Dollar Imbalances: A team with fewer bets but higher wagered money suggests professional backing.

- Timing Matters: Sharp bets typically occur early, while public influence peaks closer to game time.

- Closing Line Value (CLV): Beating the closing line consistently is a strong indicator of long-term success.

To capitalize on these insights:

- Monitor line shifts early and late.

- Compare odds across sportsbooks for discrepancies.

- Use tools like WagerProof to identify inefficiencies.

- Manage your bankroll carefully and track your CLV.

Sportsbooks prioritize balancing risk, not predicting outcomes, leaving gaps you can exploit. With the right strategy, you can turn these inefficiencies into profit.

Sharp Money vs Public Betting: Line Movement Patterns in Sports Betting

Line Movement and Market Dynamics Explained

What Line Movement Means

Sportsbooks adjust odds or point spreads based on factors like betting volume, sharp wagers, or breaking news - such as injuries, weather updates, or coaching decisions. For example, if a line shifts from –4.5 to –3, it reflects the sportsbook’s reaction to one or more of these influences.

As Sloan Piva from The Sporting News explains:

"The sportsbooks' job is to make money off bettors and to avoid taking on too much liability with certain bets. Your job is to try to make money off the books."

The primary goal for sportsbooks is to manage their liability, not to predict game outcomes. These adjustments are at the heart of why betting markets often stray from being perfectly efficient.

Efficient vs. Inefficient Markets

In theory, betting odds should account for all available information. However, real-world markets often deviate from this ideal due to bettor behavior and the strategies employed by bookmakers. High-profile games, like primetime NFL matchups, generally have more accurate lines because oddsmakers dedicate significant resources to setting them. With nearly 50% of all sports bets in the U.S. placed on the NFL, these lines are tested thoroughly by the sheer volume of bets.

On the other hand, games with lower visibility - such as those involving smaller market teams or played in non-primetime slots - see larger and more frequent line shifts. Oddsmakers allocate fewer resources to these matchups. Additionally, public bettors often favor popular teams or bet heavily on overs, prompting sportsbooks to adjust lines accordingly. These adjustments can create movements that don’t align with true probabilities. Spotting these inefficiencies is an essential skill for bettors, as explored further in the next section on tracking line movement.

Why Bettors Should Track Line Movement

Monitoring line changes provides insight into market trends and sharp money activity. It helps bettors identify moments when professional wagers differ from public sentiment. For instance, if a team attracts just 30% of total bets but accounts for 60% of the total money wagered, it’s a clear sign that sharp bettors are backing that side.

Line movement also highlights timing patterns. Sharp bettors often act early when betting limits are lower, while casual bets tend to influence lines closer to game time - typically 30 to 90 minutes before tip-off for NBA games and 2 to 4 hours before NFL kickoffs. By observing these shifts, you can spot instances where public betting has pushed a line to an inefficient level, potentially creating opportunities to bet on the opposite side.

How to Track Line Movement to Find +EV Bets | Sports Betting Strategy Explained

How Sportsbooks Create Pricing Errors

Let’s dig deeper into how sportsbooks create pricing errors, continuing our look at market inefficiencies.

Bettor Biases That Sportsbooks Target

Sportsbooks don’t just set lines to balance betting action on both sides - they actively exploit common bettor mistakes. Jay Simon from American University explains:

"Bookmakers set betting lines... in a manner that deliberately exploited known biases of the population of bettors; that is, they did not simply attempt to receive an equal volume of bets on each side."

One of the most profitable biases sportsbooks leverage is the tendency to overvalue favorites, especially in high-profile games where emotions run high. Another frequent error is overrating home-field advantage. Research highlights that in NFL games where win probabilities fall between 30% and 70%, home teams are often overvalued, creating opportunities for bettors who back the away side. Other common pitfalls include the "hot hand" fallacy - betting on teams riding winning streaks - and an unwillingness to bet against personal favorites. These tendencies explain why sportsbooks may leave flawed lines untouched, as they know casual bettors will often fall into these traps.

Why Bad Lines Stay in the Market

Sportsbooks don’t always aim for perfect predictions. Instead, they focus on maximizing profits, which sometimes means letting inefficient lines remain. If a line attracts heavy public betting on one side, sportsbooks may hold it steady to encourage more casual wagers, even if it increases their risk from sharp bettors. Sloan Piva from The Sporting News puts it this way:

"Odds do not simply reflect the sportsbooks' final score projection, but rather the amount that will give the book the greatest chance of winning or at least not taking on too much liability."

This tactic is especially noticeable in lower-profile games - those involving smaller-market teams or scheduled during crowded kickoff times - where sportsbooks allocate fewer resources. As a result, pricing errors in these games can be more common and linger longer. With nearly half of all U.S. sports bets placed on NFL games, sportsbooks prioritize their sharpest modeling for primetime matchups, leaving less attention for games that draw fewer eyes.

Finding Pricing Errors Through Line Movement

Now that we’ve covered why sportsbooks occasionally leave less-than-ideal lines on the board, let’s dive into how you can identify these pricing errors by analyzing line movement.

When Lines Move Matters

The timing of line shifts can tell you a lot. Early changes often indicate sharp money at play, while later moves tend to reflect public betting trends or last-minute news like injuries. Professional bettors usually act soon after the odds are posted, taking advantage of softer lines before sportsbooks gather more data.

As game time nears, casual bettors start placing wagers, often influenced by media hype or personal preferences. However, sudden line changes in the final hours can signal sharp syndicate action or responses to breaking injury updates. For example, sharp movement in NFL games typically happens 2–4 hours before kickoff, while NBA lines often see major adjustments 30–90 minutes before tip-off.

Recognizing these timing patterns naturally leads to comparing odds across sportsbooks, where inconsistencies can highlight pricing errors.

Comparing Odds Between Sportsbooks

Odds discrepancies between sportsbooks are a goldmine for spotting inefficiencies. If one sportsbook’s line stays static while others adjust, it might be lagging behind on updated information. These differences often stem from varying resources and betting volumes across sportsbooks. Games with smaller-market teams or those scheduled during busy kickoff times are particularly prone to these fluctuations, as oddsmakers allocate fewer resources to them.

A key concept here is Closing Line Value (CLV), which is often seen as the ultimate measure of betting success. Beating the closing line consistently shows alignment with sharp money. As the LoserWins Strategy Guide explains:

"The closing line is generally considered the most accurate representation of true probability. It's been tested by the market."

This sets the stage for identifying specific patterns in line movement that can signal real opportunities.

Line Movement Patterns That Signal Opportunity

By combining insights about timing and odds comparisons, you can pinpoint specific line movement patterns - such as reverse line movement, steam moves, and bet-to-dollar imbalances - that indicate sharp money activity.

Reverse Line Movement (RLM) happens when the line moves in the opposite direction of public betting. For instance, in a tracked sample, public money exceeded 65% on the losing side in 187 out of 274 games with reverse line movement.

Steam Moves are coordinated shifts across multiple sportsbooks at the same time, often triggered by professional syndicates or major breaking news. Monitoring aggregated feeds can help you distinguish genuine market-wide moves from isolated adjustments.

Bet-to-Dollar Imbalances highlight where sharp bettors are focusing. For example, if a team gets only 30% of the total bets but accounts for 60% of the money wagered, it’s a strong sign that high-stakes professionals are involved. Under certain conditions, this pattern has been linked to a +15.5% ROI.

| Pattern Type | What It Looks Like | What It Means |

|---|---|---|

| Reverse Line Movement | Over 75% public bets on one side, but the line moves the opposite way | Sharp money opposes public betting |

| Steam Move | Sudden, identical shifts across 5+ sportsbooks | Coordinated sharp action or major news |

| Bet/Dollar Ratio | 30% of bets but 60% of total money | Indicates heavy sharp wagers |

How to Profit from Line Movement Analysis

Following Sharp Money Through Line Changes

To effectively track professional bettors, it’s essential to understand when they act and how the market reacts. Sharp money typically comes in right after lines are posted, well before sportsbooks have fully adjusted. For instance, early moves - especially 2–4 hours before NFL kickoffs or 30–90 minutes before NBA tip-offs - are strong indicators of sharp action.

Pay attention to bet-to-dollar ratios. If a team gets only 30% of the total bets but accounts for 60% of the money, it’s likely that larger wagers from professionals are influencing the market. However, avoid chasing steam moves after the lines have already shifted. By the time you notice a rapid line change across several sportsbooks, the value is usually gone.

Using sharp sportsbooks like Pinnacle or Circa as benchmarks can also help. If your sportsbook’s line hasn’t moved while these market leaders have adjusted, you’ve likely found a stale line worth betting on. While professional bettors beat the closing line about 60–70% of the time, mastering line movement analysis can boost your success rate to 75–80%.

Incorporating technology into your strategy can simplify this process even further.

Using WagerProof to Find Mispriced Lines

WagerProof’s Edge Finder tool takes the guesswork out of identifying pricing discrepancies. It scans multiple sportsbooks in real time, highlighting lines that lag behind market-wide adjustments. This makes it easier to spot market inefficiencies without manually comparing odds.

The platform doesn’t just show discrepancies - it explains them. Automated alerts flag key indicators like reverse line movement, steam moves, and bet-to-dollar imbalances as they happen. Additionally, WagerBot Chat connects you to live professional betting data, offering instant insights to differentiate sharp action from public betting trends.

Managing Your Bankroll When Betting Inefficiencies

Once you’ve identified a mispriced line, disciplined bankroll management becomes critical. Betting on inefficiencies carries inherent risks, and proper money management is the key to long-term success. Start with a consistent unit size and adjust only when the line movement supports your edge. For example, if you spot a positive expected value bet at -105 and notice the odds drop to -118 at sharp books, you might increase your stake from 1 unit to 1.25 or 1.5 units.

Conversely, if odds move against your initial analysis, consider reducing your wager or skipping the bet entirely. This approach helps protect your bankroll when market sentiment shifts unexpectedly. Remember, only about 2% of bettors are profitable on traditional sportsbooks. To join that elite group, you need to endure variance and stick to a strategy that maximizes your mathematical edge. Tracking your Closing Line Value (CLV) is one of the best ways to measure whether you’re consistently finding value or just riding a streak of luck.

Conclusion

Line movement can expose pricing errors - but only if you catch them before they disappear. By distinguishing between sharp money driving early shifts and public sentiment causing late moves, you gain access to the same insights that professional bettors rely on to maintain their edge. Timing is everything here. One bettor, for instance, increased their success rate from 52% to 68% by systematically tracking reverse line movement signals. This knowledge opens the door to practical strategies.

The trick lies in identifying and acting on the right signals at the right moment. Tools like reverse line movement, bet-to-dollar ratios, and Closing Line Value help pinpoint the gap between professional and public betting activity. As Chris Tashjian from Outlier notes:

"By learning to interpret line movement, you can gain a significant edge over others who blindly place +EV bets without considering where the market is headed".

Platforms like WagerProof’s Edge Finder highlight reverse line movement and steam moves in real time, while WagerBot Chat provides live professional data for instant analysis.

Here’s the reality: only 2% of bettors consistently profit on traditional sportsbooks. But breaking down line movement can push your closing line beat rates to 75–80%, which is often the tipping point between long-term success and failure. The formula is simple - track key indicators, stick to disciplined bankroll management, and avoid chasing steam after the value is gone.

Ready to get started? Focus on sharp sportsbooks like Pinnacle and Circa, target high-volume markets where signals are strongest, and leverage tools like WagerProof to streamline your process. The inefficiencies exist - you just need the right strategy to capitalize on them. Stick with these methods, and you’ll stay ahead in this ever-changing market.

FAQs

How can I tell if a line move is sharp money or injury news?

A line move driven by sharp money occurs when influential bettors place large wagers, causing the line to shift even if public betting trends suggest otherwise. Similarly, reverse line movement happens when the line moves in the opposite direction of where the majority of public bets are placed, often indicating sharp action. On the other hand, line moves tied to injuries usually align with breaking news and are often highlighted by media reports or updates from team insiders.

What’s the best way to use CLV to judge my betting results?

CLV, or Closing Line Value, is one of the most reliable ways to gauge how well you're doing as a bettor. It works by comparing the odds you placed your bets at with the final closing odds. If you consistently get better odds than the market’s closing line, it’s a strong sign that you’re finding value in your bets.

A positive CLV means you’re identifying wagers with positive expected value (+EV). This not only points to potential long-term profitability but also helps you fine-tune your approach - whether it’s deciding when to place your bets or hunting for the best odds available.

When should I avoid betting after a steam move?

Avoid placing bets immediately after a steam move if you're just chasing it without proper insight. It can be tough to tell whether the move is genuine, as sharp bettors sometimes adjust lines strategically to throw others off. Jumping in without a clear understanding of the situation can result in losses. Instead, take the time to analyze the reasoning behind the move before making any decisions.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free