Liquidity's Effect on Prediction Market Accuracy

Prediction markets price event outcomes based on probabilities, but liquidity - how easily contracts are traded - doesn't always boost accuracy. High liquidity can attract uninformed traders, leading to pricing distortions like the favorite-longshot bias, where favorites are undervalued, and longshots are overvalued.

Key insights:

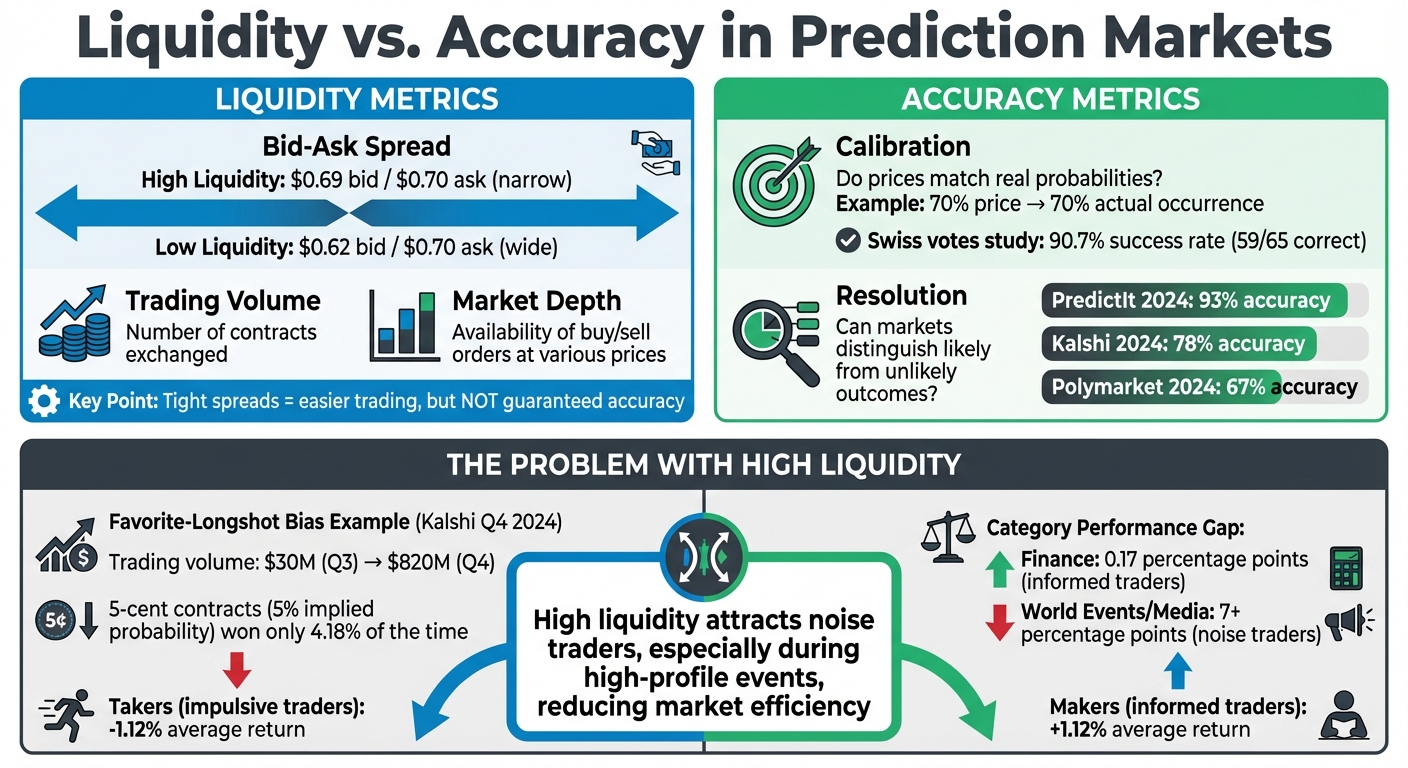

- Liquidity is measured by bid-ask spreads, trading volume, and market depth. Narrow spreads signal high liquidity.

- Accuracy depends on calibration (prices matching probabilities) and resolution (distinguishing likely outcomes).

- High liquidity often attracts "noise traders", reducing market efficiency during high-profile events.

- Tools like WagerProof help spot mispriced opportunities by analyzing prediction market trends and deviations.

Takeaway: Liquidity enables trading but doesn't guarantee accurate predictions. Look for markets with informed participants and use tools to identify value bets.

Liquidity vs Accuracy in Prediction Markets: Key Metrics and Performance Data

What Liquidity and Accuracy Mean in Prediction Markets

Liquidity: Definition and Measurement

Liquidity shows how easily a contract can be traded without causing major price shifts. In a market with good liquidity, a $100 trade happens close to the current price. In contrast, a less liquid or "thin" market might see the same trade push the price significantly.

One key indicator of liquidity is the bid-ask spread, which is the difference between the highest price buyers are willing to pay (bid) and the lowest price sellers are asking (ask). A narrow spread - like $0.69 bid and $0.70 ask - signals high liquidity, allowing trades to happen quickly and cheaply. On the other hand, a wider spread - such as $0.62 bid and $0.70 ask - shows lower liquidity and higher transaction costs.

"The bid-ask spread is a de facto measure of market liquidity. The tighter the spread, the more liquid the market for the security." - Investopedia

Other factors, like trading volume (the number of contracts exchanged) and market depth (the availability of buy and sell orders at various prices), also shed light on liquidity. A deeper market can handle larger trades with minimal impact on price.

While liquidity focuses on how efficiently trades occur, accuracy tells us how well market prices reflect actual outcomes.

Accuracy: How to Measure Prediction Market Performance

Just as liquidity is evaluated with bid-ask spreads and trading activity, accuracy in prediction markets is measured through calibration and resolution. These metrics determine how closely market prices align with real-world results.

Calibration checks if market prices correspond to probabilities. For example, if an event priced at 70% happens 70% of the time, the market is well-calibrated. A study of 65 direct democratic votes in Switzerland (2012–2015) showed that a real-money prediction market correctly forecasted the winner in 59 cases - an impressive 90.7% success rate.

"Prediction market accuracy varies primarily according to the setup of the market, with the features of the event and especially the composition of the participant sample hardly mattering." - Oliver Strijbis, SNSF Professor, University of Zurich

Resolution measures how well markets separate likely outcomes from unlikely ones. For example, during the 2024 U.S. presidential campaign, PredictIt markets correctly predicted outcomes 93% of the time on election eve. Meanwhile, Kalshi markets showed an average accuracy of 78%, and Polymarket achieved 67%. These figures highlight how effectively prediction markets can assess probabilities, even under different platforms and conditions.

The New Gambling? How Prediction Markets Challenge U.S. Law

Why Higher Liquidity Doesn't Always Mean Better Accuracy

While it's often assumed that more trading improves pricing through better information flow, research suggests that high liquidity can actually reduce the accuracy of prediction markets. This surprising outcome highlights the delicate interplay between liquidity and the quality of information - a key point in understanding market behavior.

The problem isn't liquidity itself but the kinds of traders it attracts and their motivations. When markets become easier to trade - thanks to tight spreads and deep order books - they often draw in participants who aren't basing their trades on verified information. Instead, these traders are influenced by social media buzz, emotional reactions, or simply chasing price momentum.

"Liquidity does not reduce, and sometimes increases, deviations of prices from financial and sporting event outcomes." - Paul C. Tetlock, Finance Professor, Columbia Business School

This sets the stage for how noise traders can distort market signals and reduce accuracy.

How Liquidity Attracts Noise Traders

Liquid markets can create a misleading sense of security. A tight bid-ask spread and stable prices may look like signs of a well-informed market, but often, this reflects synchronized attention rather than a thorough processing of facts.

Noise traders, who act on non-factual influences, tend to dominate highly liquid markets during high-profile events, such as weekend sports games or viral political moments. Research on the Betfair exchange revealed that liquidity significantly decreased market efficiency for weekend matches when noise traders were most active. By contrast, weekday markets, with fewer noise traders, showed no such issues.

The situation becomes worse when less-informed limit order traders unknowingly trade against participants with better information. This mismatch can slow down the market's ability to adjust prices based on new information.

"One explanation is that limit order traders are naïve about other traders' knowledge and unwittingly bet against them, which can slow the response of prices to information." - Paul C. Tetlock, Professor of Finance, Columbia Business School

One result of this imbalance is the emergence of pricing biases, such as the favorite-longshot bias.

Example: Favorite-Longshot Bias in Liquid Markets

The favorite-longshot bias illustrates how liquidity can exacerbate pricing inefficiencies. This bias occurs when favorites are underpriced, and longshots are overpriced relative to their actual chances of winning. Instead of correcting these inefficiencies, liquid markets often amplify them.

Take the Kalshi exchange, for example. After trading volume surged from $30 million in Q3 2024 to $820 million in Q4 2024, experienced market makers began capitalizing on uninformed traders. Contracts priced at 5 cents (implying a 5% probability) only won 4.18% of the time, clearly showing a longshot bias. In this environment, impulsive "Takers" - those executing against existing orders - suffered an average excess return of -1.12%, while "Makers" captured a corresponding +1.12%. In popular categories like "World Events" and "Media", this gap widened to over 7 percentage points, whereas the "Finance" category, which attracts participants with a better grasp of probabilities, showed a much smaller gap of just 0.17 percentage points.

This phenomenon isn't new. A 2008 study of the TradeSports exchange found that limit orders placed during periods of high information flow often had negative expected returns because they were filled by traders with superior knowledge.

For savvy bettors, this creates opportunities. High trading volume often signals a "hot" market driven by hype rather than value. When everyone is reacting to the same viral moment or headline, prices can deviate significantly from reality - opening the door for value bets to emerge.

How Financial Incentives Drive Price Discovery

When real money enters prediction markets, they shift from being mere opinion polls to becoming powerful tools for aggregating information. This transformation happens because participants who make incorrect predictions lose their capital, while those with sharper insights gain more influence over time.

This concept hinges on the idea of "skin in the game." Market prices are shaped by the capital at stake, effectively weighting trades based on the confidence and quality of the information behind them. For instance, a single $10,000 bet carries significantly more weight than a hundred casual social media opinions.

Prediction Markets vs. Polling

The fundamental difference between prediction markets and traditional polls lies in what people are willing to risk versus what they simply state. Polls capture expressed beliefs, which can often be influenced by social pressures or biases. On the other hand, prediction markets reveal genuine preferences by recording what participants are willing to back with their money.

Polling methods are often costly and slow to adapt to breaking news. Prediction markets, however, are largely self-sustaining and update prices in real-time as new information surfaces. When a major event occurs, market prices can adjust within minutes.

"The power of prediction markets derives from the fact that they provide incentives for truthful revelation, they provide incentives for research and information discovery, and the market provides an algorithm for aggregating opinions."

- Victoria Liu and Djavaneh Bierwirth, Wharton Student Fellows

This dynamic also creates opportunities for arbitrage, which plays a key role in maintaining market consistency.

How Arbitrage Maintains Price Consistency

Arbitrage acts as the market's internal correction mechanism. If the prices of mutually exclusive outcomes (like "Yes" and "No" contracts) don't sum to $1.00, arbitrageurs step in to exploit the mismatch. This forces prices back into alignment, ensuring they follow basic probability rules.

However, while arbitrage ensures consistency, it doesn't guarantee accuracy. In markets dominated by noise traders - participants swayed by emotion or poor information - arbitrage might stabilize incorrect consensus prices. For example, "Yes" and "No" contracts may still sum to $1.00, but both could be far from reflecting the actual likelihood of an event.

Research on the Kalshi platform highlights this distinction. In categories like Finance, where trades rely on well-evaluated probabilities, the gap between market prices and real-world outcomes was just 0.17 percentage points. In contrast, in areas like World Events and Media - where hype and narratives often dominate - this gap widened to over 7 percentage points. This shows that it's not just the liquidity in the market but the quality of information driving trades that determines how accurate the prices are.

"Whenever prices diverge from reality for any reason, they create a bounty for anyone who knows better to step in and correct them."

- Aashish Reddy, Author

When interpreting signals from prediction markets, it's crucial to look beyond trading volume or tight spreads. The most reliable markets are those where participants are highly engaged, well-informed, and less prone to emotional biases. In such environments, financial incentives and arbitrage combine to produce prices that closely reflect reality.

How to Use This Information When Betting

How to Evaluate Prediction Market Signals

Now that we've touched on liquidity and accuracy, let's talk about how to turn these insights into smarter betting strategies.

When you see a price jump in a prediction market, the first step is to figure out why. For example, if a contract suddenly climbs from $0.55 to $0.70 but there's no verified news backing the move, it's likely driven by attention or viral buzz rather than actual new information.

"Treat liquidity as an execution signal. It tells you how easily you can trade an event contract, not whether the outcome is likely."

Check the bid/ask spreads. A narrow spread means there's strong liquidity, making it easier to trade without price distortion. On the other hand, a wide spread could indicate skewed pricing or limited market participation. Market categories can also influence pricing, so it's important to factor in these nuances when interpreting signals.

Be cautious with low-probability "YES" contracts. For instance, contracts priced at 5 cents tend to win only about 4.18% of the time, which reflects a mispricing of around –16.36%. It gets worse at the 1-cent level, where "YES" contracts have historically shown an expected value of –41%, while "NO" contracts in the same range return approximately +23%.

Finding Value Bets with WagerProof

Turning your evaluation of market signals into actionable bets is where WagerProof steps in.

WagerProof monitors prediction markets to spot inefficiencies in real time. It sends alerts whenever spreads don't align, flagging arbitrage opportunities and price mismatches. Its "fade signals" are particularly useful. They highlight moments when betting volume spikes without any solid information to back it up - those times when the market chases hype instead of logic, especially in emotionally charged scenarios.

The platform's Edge Finder pulls together market data, historical trends, betting percentages, and money distribution into one transparent view. This helps you see not just the current price but also the reasons behind any discrepancies. And with WagerBot Chat linked to live professional data, you get answers based on hard numbers, not guesses. The goal is to shift your mindset from being an impulsive bettor to thinking more like a liquidity provider, using these tools to avoid what’s often called the "optimism tax".

Conclusion

Liquidity shows how easily trades can happen, but it doesn't guarantee accuracy. High trading volume might stem from solid, verified information - or it could just be hype fueling a trading frenzy. When hype-driven traders distort prices, even the most active markets can stray far from reality. Understanding this is key for making smarter betting choices.

"The real question isn't 'is this market active?' It's why it got active. Did something really change, or did the internet get loud?" - Virginia Gandolfo

Knowing whether activity is based on solid information or just noise is crucial for spotting profitable opportunities.

Accurate data and effective tools make all the difference. WagerProof helps you avoid falling into liquidity traps by highlighting outliers, flagging mismatched spreads, and providing access to live professional data. Their fade signals and Edge Finder are designed to pinpoint moments when the crowd is chasing hype rather than logic.

Always read the settlement rules and double-check the spreads. Be mindful of when high volume might be masking noise, and rely on trustworthy market signals for your next move. With clear data and targeted tools, you can separate real opportunities from the distractions of market hype.

"Liquidity isn't the problem. Treating it like proof is the problem"

FAQs

Can a high-volume market still be wrong?

Yes, even in markets with heavy trading activity, prices can miss the mark. This happens when traders overreact or make decisions based on incomplete information, causing prices to stray from actual outcomes. These inefficiencies remind us why it's crucial to dig into the underlying data and trends instead of depending solely on trading volume.

How can I tell hype-driven moves from real news?

To separate genuine news from hype in prediction markets, pay close attention to liquidity. Markets with high liquidity often provide more reliable signals, whereas low liquidity can leave them vulnerable to manipulation. Be alert for abrupt spikes in trading activity or unusual price swings - these could be red flags for hype-driven moves. To dig deeper, cross-check market trends with external data sources and tools like WagerProof. These resources can give you real-time insights to determine whether market movements stem from solid information or overblown reactions.

What liquidity signals matter most before betting?

When analyzing liquidity, a few key signals stand out: market depth, the size of liquidity pools, and the nature of price movements.

- Market depth: This refers to the ability of the market to handle large trades without significant price changes. Shallow markets often lead to more volatile price swings.

- Liquidity pool size: Smaller pools can amplify volatility, while overly large pools might suppress price discovery, especially if dominated by passive liquidity providers.

- Price movement dynamics: It's crucial to differentiate between genuine price shifts driven by market activity and those resulting from liquidity rebalancing.

By paying attention to these factors, you can better spot meaningful trends and filter out unnecessary market noise.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free