Loss Chasing vs. Value Betting: Key Differences

When it comes to sports betting, there are two main approaches: loss chasing and value betting. Here's the difference:

- Loss chasing is an emotional reaction to losses, where bettors increase their wagers to recover lost money. This often leads to impulsive decisions, financial strain, and a higher risk of gambling addiction.

- Value betting is a calculated, data-driven strategy. It focuses on identifying bets where odds undervalue the true likelihood of an outcome, aiming for long-term profitability through disciplined bankroll management.

Key Takeaways:

- Loss chasing is driven by desperation and flawed logic (e.g., "I'm due for a win").

- Value betting relies on math, focusing on Expected Value (EV) and Closing Line Value (CLV).

- Tools like WagerProof help bettors transition from emotional decisions to informed, statistical strategies.

Quick Comparison:

| Feature | Loss Chasing | Value Betting |

|---|---|---|

| Primary Driver | Emotions (desperation, anxiety) | Data (probability, logic) |

| Reaction to Loss | Increasing stakes impulsively | Sticking to a pre-defined plan |

| Bankroll Management | Erratic; often ignored | Disciplined; uses structured tools |

| Outcome View | Personal; tied to emotions | Mathematical; variance is normal |

If you’re chasing losses, it’s time to rethink your approach. Shift to value betting by focusing on data, setting clear limits, and using tools to make informed decisions.

Loss Chasing vs Value Betting: Key Differences Comparison Chart

What is Loss Chasing?

Definition and Psychological Triggers

Loss chasing refers to the emotional urge to place more bets in an attempt to recover previous losses - a behavior rooted more in emotional distress than logical decision-making. Unlike strategic betting, which follows a calculated plan, loss chasing stems from the psychological pain of losing.

This behavior is fueled by three key psychological triggers:

- Loss aversion: The emotional pain of losing far outweighs the pleasure of winning.

- Gambler's fallacy: The mistaken belief that a win is "overdue" after a streak of losses.

- Negative urgency: Impulsive decisions made during moments of heightened stress or emotional distress.

These triggers combine to create a cycle of increasingly risky behavior.

Common Behavioral Patterns

Loss chasers often escalate their betting behavior, increasing stakes dramatically - sometimes doubling their bets, as seen in strategies like the Martingale system. They may also make repeated deposits during a single session.

Other common patterns include shifting to high-risk bets, such as parlays, and extending gambling sessions far beyond their original plans. Budget limits are frequently ignored, leading to unsustainable practices that cause significant financial and emotional strain.

Consequences of Loss Chasing

Loss chasing creates a dangerous feedback loop, where mounting losses drive even riskier bets. For casual bettors, this can mean losing anywhere from $500 to $1,000 per year, while frequent chasers often lose far more.

From a psychological perspective, loss chasing is closely tied to gambling addiction. Abdullah Mahmood, a Problem Gambling Counselor at Maryhaven, explains:

It is the most universal sign that you might have a problem with gambling. All of my clients have reported chasing losses.

Statistics back this up: 60% of gamblers who meet at least one diagnostic criterion for problem gambling admit to chasing losses, a figure that jumps to 80% for those meeting three or more criteria.

Beyond financial and mental health consequences, loss chasers often disregard basic mathematical principles like house edges, odds, and expected value - concepts crucial for any sustainable betting approach.

The stark contrast between impulsive loss chasing and disciplined, strategic betting underscores the risks of falling into this harmful cycle.

What is Value Betting?

Expected Value Explained

Value betting revolves around a simple yet powerful question: "Are the offered odds better than the actual probability of an outcome?" This strategy identifies bets where the sportsbook's odds undervalue the true likelihood of an event, creating opportunities for a positive expected value (+EV).

Expected Value (EV) is a measure of your potential average gain or loss per bet over time. It's calculated using the formula: EV% = ((true probability × decimal odds) – 1) × 100.

For instance, if you believe a team has a 55% chance of winning, but the odds provided by the sportsbook imply only a 50% chance, you've spotted a value bet with an approximate +10% edge.

What sets value betting apart from casual betting is its reliance on mathematics and data. As Abhishek Nandwani from APWin puts it:

A value bet is a wager where the bookmaker's odds underestimate the true probability of an outcome.

This approach requires a solid foundation of data and analysis to make informed decisions.

Data Requirements for Finding Value

To uncover value bets, you need access to advanced tools like statistical models, odds comparison platforms, and benchmarks from sharp bookmakers. A key step in this process is converting decimal odds into implied probability, which is done by dividing 1 by the odds.

However, sportsbooks include a profit margin - often called the "vig" or "juice" - in their odds. This margin inflates the total implied probabilities for all outcomes to exceed 100%. To determine the true EV of a bet, you must first remove this margin. Platforms like WagerProof simplify this process by identifying mispriced odds across sportsbooks, highlighting potential value bets.

Interestingly, value bets are often found in less mainstream markets, such as player props, lower-tier leagues, or niche sports like the NBA G League. These markets tend to have less precise data, giving bettors an edge. On the other hand, major markets like NFL point spreads are typically much more efficient, leaving little room for value.

Armed with the right data, bettors can exploit inefficiencies and place more calculated, profitable wagers.

Disciplined Value Betting Practices

Disciplined value betting stands in stark contrast to impulsive habits like chasing losses. Successful bettors rely on structured staking methods, such as the Kelly Criterion, to determine how much to wager based on their edge and bankroll size. As Patrik Lidin, Principal Writer at JustGamblers, explains:

Professional punters prioritize quality over quantity; when they have a quality bet with solid EV+, they'll bet heavily.

A long-term perspective is crucial for value bettors. Even a modest +4% EV can experience short-term fluctuations, but disciplined bettors accept this variance as part of the process toward sustained profitability. They also focus on Closing Line Value (CLV), which evaluates whether their bets consistently outperform the market's final odds.

Unlike loss chasers who impulsively increase their stakes, value bettors stick to sound bankroll management. They understand that while positive EV doesn't guarantee immediate wins, the mathematical edge ensures success over the long run.

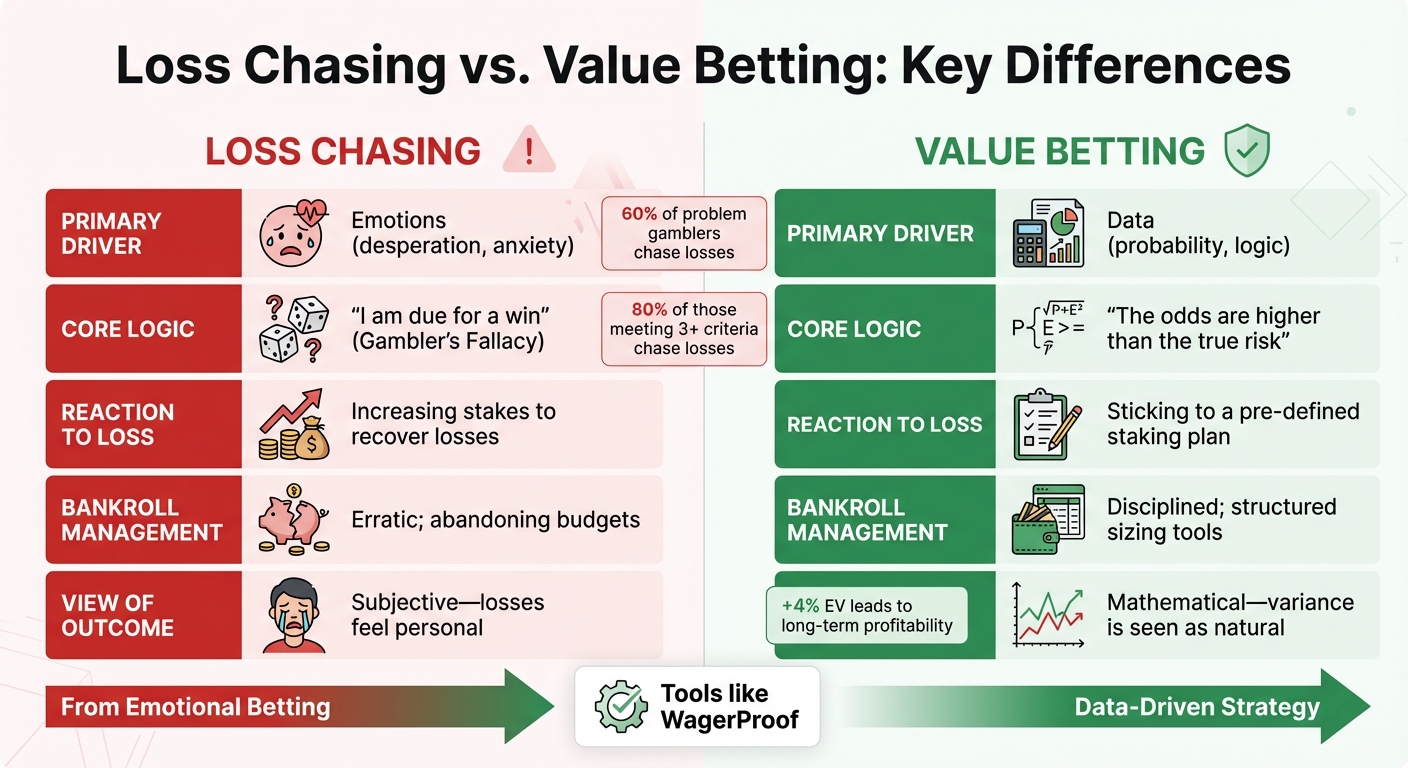

Key Differences Between Loss Chasing and Value Betting

Motivation and Decision-Making

Loss chasing is rooted in emotional responses like desperation and anxiety, often driven by the need to recover losses. This behavior is heavily influenced by loss aversion and the Gambler's Fallacy, where individuals believe a win is "due" after a streak of losses.

In contrast, value betting takes a calculated approach, focusing on identifying opportunities where the odds undervalue the true probabilities. As betting expert Mike Lovatt explains:

The job of a professional sports bettor is not to guess outcomes but to find good value in the odds offered.

While loss chasers rely on flawed reasoning and emotions, value bettors stick to a disciplined, data-driven strategy. They assess the quality of a bet based on its long-term potential rather than its immediate outcome.

Here's how the two approaches compare:

| Feature | Loss Chasing | Value Betting |

|---|---|---|

| Primary Driver | Emotions (desperation, anxiety) | Data (probability, logic) |

| Core Logic | "I am due for a win" (Gambler's Fallacy) | "The odds are higher than the true risk" |

| Reaction to Loss | Increasing stakes to recover losses | Sticking to a pre-defined staking plan |

| Bankroll Management | Erratic; abandoning budgets | Disciplined; structured sizing tools |

| View of Outcome | Subjective - losses feel personal | Mathematical - variance is seen as natural |

Dr. Rani Hoff, Emeritus Professor of Psychiatry at Yale School of Medicine, highlights the psychological aspect of loss chasing:

Chasing is an addiction hallmark related to difficulty cutting back and withdrawal symptoms.

Bankroll Impact and Long-Term Results

The financial consequences of these two approaches differ drastically. Loss chasing often leads to reckless spending, as bettors abandon budgets in favor of risky strategies like the Martingale system, which involves doubling stakes after every loss. These impulsive moves create volatile bankroll swings and can quickly drain funds.

Value betting, however, prioritizes steady, long-term growth. By placing bets with a positive expected value (+EV), bettors aim for gradual gains. For example, even with a modest +4% edge, short-term variance can result in smaller-than-expected returns - such as being up only 5 units instead of an expected 16 over 400 bets. Value bettors understand that these fluctuations are part of the mathematical process, not a result of bad luck.

Loss chasing is also strongly associated with problem gambling. It’s the most common behavior among individuals with gambling issues, with 80% of those meeting 3–4 diagnostic criteria reporting chasing behavior. Notably, loss chasing is the only clinical criterion for Gambling Disorder that isn’t shared with substance use disorders. On the other hand, value betting treats wagering as an investment, emphasizing disciplined bankroll management to maximize long-term growth.

The Role of Data and Tools

A key component of value betting is the effective use of data. Analytical tools play a crucial role in calculating true win probabilities and comparing them to the bookmaker's implied odds. Platforms like WagerProof provide access to advanced data sources, including statistical models, prediction markets, and automated edge detection, helping bettors identify genuine value opportunities.

Loss chasing, by contrast, ignores data and relies on impulsive decisions rather than analysis. A May 2025 study published in the Journal of Gambling Studies examined 36,331 bwin sports betting subscribers and found that metrics like increasing bet sizes, choosing higher-risk odds, and shortening the time between bets can predict gambling harm.

How to Identify and Stop Loss Chasing

Self-Assessment Questions

The first step to addressing loss chasing is taking a hard look at your behavior. Ask yourself: Do you increase your bet sizes after a loss, hoping to "break even"? This is one of the clearest indicators of chasing losses. Also, think about whether you tend to bet on high-odds outcomes right after losing, without fully analyzing the situation.

Have you ever borrowed money, sold belongings, or hidden your betting habits? These actions often point to loss chasing. And perhaps the most telling sign: Do you feel like you can’t stop gambling, even when you want to? If you answered "yes" to any of these questions, there’s a good chance you’re chasing losses instead of making value-driven decisions. Research backs this up - 60% of gamblers who meet at least one diagnostic criterion for disordered gambling report loss-chasing behavior, and that number jumps to 80% for those meeting three or more criteria.

These questions aren’t just for introspection - they’re the foundation for tracking your habits and making meaningful changes.

Using Data Tools for Tracking

Once you’ve identified your patterns, objective data can help you dig deeper into your betting habits. Start by keeping a detailed betting log. Track the amount you wager, the timing of your bets, and your reasoning behind each decision. This creates a feedback loop, helping you spot the difference between rational, value-based decisions and emotional reactions.

Pay close attention to how quickly you place bets after a loss. Rapid betting right after losing often signals "within-session chasing" - the urge to recover losses immediately. Tools like WagerProof can help you measure whether your bets are based on actual value. Tracking your Closing Line Value (CLV) is especially useful. If your CLV is consistently negative despite expecting positive outcomes, it could mean your probability model needs adjustment.

Transitioning to Value Betting

With self-reflection and tracking in place, the next step is to shift from chasing losses to a disciplined, value-driven approach. Start by setting firm rules. For example, establish a "hard stop": limit your daily losses to no more than 20–25% of your bankroll. Once you hit that limit, log out of the app or step away entirely.

Use tools like the Kelly Criterion to size your bets based on your calculated edge, rather than relying on gut feelings. During losing streaks, cut your bet size in half to protect your bankroll while waiting for variance to even out. WagerProof’s Edge Finder can highlight opportunities where the odds are better than the true probabilities, helping you focus on long-term success rather than short-term recoveries.

Finally, set clear stop-loss limits and profit goals. A loss limit protects your bankroll, while a profit target ensures you don’t give back your winnings out of overconfidence. These boundaries are key to staying disciplined and avoiding the emotional rollercoaster of chasing losses.

I Lost $10,000 Chasing Losses... Here's The Truth About This Simple Rule

Conclusion

Betting often boils down to two opposing forces: emotion and math. Loss chasing is fueled by the emotional sting of losing - an experience that feels twice as painful as the thrill of winning. This emotional pull can lead to impulsive decisions aimed at "breaking even". On the other hand, value betting relies on math. It identifies opportunities where the odds are better than the true probability of an outcome, giving you a long-term edge.

The difference in approach has a direct impact on your finances. Loss chasing can drain your bankroll fast. Value betting, however, emphasizes process over results. Individual losses are seen as part of natural variance, with the math balancing out over hundreds of bets.

This is where data-driven tools come into play. Platforms like WagerProof take the guesswork out of betting by replacing gut feelings with disciplined strategies. These tools highlight value bets, track Closing Line Value (CLV), and use real-time data to pinpoint mispriced odds and calculate Expected Value (EV). Instead of chasing losses with risky high-odds bets, you’re making informed decisions based on statistical models.

Loss chasing locks you into a cycle you can’t win, but a disciplined, math-based approach lays the groundwork for long-term success. Set clear stop-loss limits, monitor your metrics, and let the tools handle the heavy lifting. This shift turns betting from an emotional rollercoaster into a sustainable, data-driven strategy.

FAQs

How can I stop chasing losses and start value betting instead?

To move away from chasing losses and embrace value betting, the key lies in discipline and a strategy rooted in data. Start by setting a fixed bankroll and wagering only a small, steady percentage of it - around 1–2% per bet. This approach helps you avoid the temptation to raise your stakes after a loss. Additionally, define strict loss limits for each session or day and stick to them. This will help you break the habit of trying to recoup losses through impulsive betting.

Understanding implied probability is crucial. Compare the odds provided by bookmakers to your own assessment of an event’s likelihood. If the odds indicate a positive expected value (EV), you’ve identified a potential value bet. To refine your estimates, rely on solid data, thorough research, and statistical models. This will help you find instances where the bookmaker’s odds don’t align with reality.

For added efficiency, tools like WagerProof can be game-changers. They offer real-time alerts for value bets and highlight market discrepancies, allowing you to zero in on opportunities with the strongest potential returns. By consistently tracking your results and fine-tuning your approach, you’ll develop smarter and more reliable betting habits over time.

What tools can help you find value bets more effectively?

To spot value bets effectively, you need tools that turn complex data into clear, actionable insights. A value-bet calculator is a great start - it helps you compare a bookmaker's implied probability with your own estimates, pinpointing mismatches that could signal a value opportunity. For those looking to dive deeper, tools like expected value calculators can provide precise probability forecasts and identify odds that might be undervalued.

WagerProof takes things up a notch by integrating real-time sports data, betting trends, and predictive market spreads into a single, user-friendly platform. It automatically detects anomalies and sends alerts when market odds deviate from expected values. This not only saves you time but also helps you make more informed betting decisions.

What causes loss chasing in sports betting?

Loss chasing happens when the emotional urge to recover lost money takes over, pushing bettors to place bigger or more frequent bets in an attempt to break even. This behavior is heavily influenced by loss aversion - the idea that losing feels far worse than winning feels good. That emotional imbalance creates a powerful drive to “fix” the loss.

Cognitive biases add fuel to the fire. Take the gambler’s fallacy, for instance: it tricks people into thinking a win is bound to happen after a series of losses, even though the odds haven’t changed. On top of that, the brain’s dopamine system plays a sneaky role. Occasional wins trigger a rewarding rush, reinforcing the urge to keep betting in search of that same high. Emotional states like frustration or anxiety make things even harder, often lowering self-control - especially during fast-paced betting sessions.

Understanding these triggers is crucial to breaking the cycle. Tools like WagerProof can help by encouraging bettors to make decisions based on data and value rather than emotion, steering them toward smarter, more disciplined betting habits.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free