Positive EV Betting: What It Means and How It Works

Positive EV (+EV) betting is a strategy that focuses on placing bets where the odds offered by sportsbooks are better than the actual probability of an outcome. Unlike casual betting, which often relies on gut feelings or team loyalty, +EV betting uses math and data to identify profitable opportunities over the long term. Here’s the key idea:

- Sportsbooks have a built-in edge called the "vig" (around 4.54%–5%), so you need to win at least 52.38% of bets on -110 odds to break even.

- +EV bets occur when the real probability of an event happening is higher than what the sportsbook's odds imply.

- Professional bettors aim for win rates of 54%–56%, leveraging +EV opportunities to overcome the house edge and make consistent profits.

For example, if a coin toss has a 50% chance of landing heads, but the sportsbook offers +120 odds (implying a 45.5% chance), that’s a +EV bet. While you won’t win every time, placing many +EV bets can lead to long-term gains.

To succeed, you’ll need to calculate expected value (EV), compare odds across sportsbooks, and spot mispriced lines. Tools like WagerProof can simplify this process by automating the search for value bets and providing real-time alerts. By combining disciplined betting strategies with automated tools, you can turn small edges into sustainable profits.

What Is Positive EV Betting? The Secret to Beating Sportsbooks

What Is Positive Expected Value (+EV)?

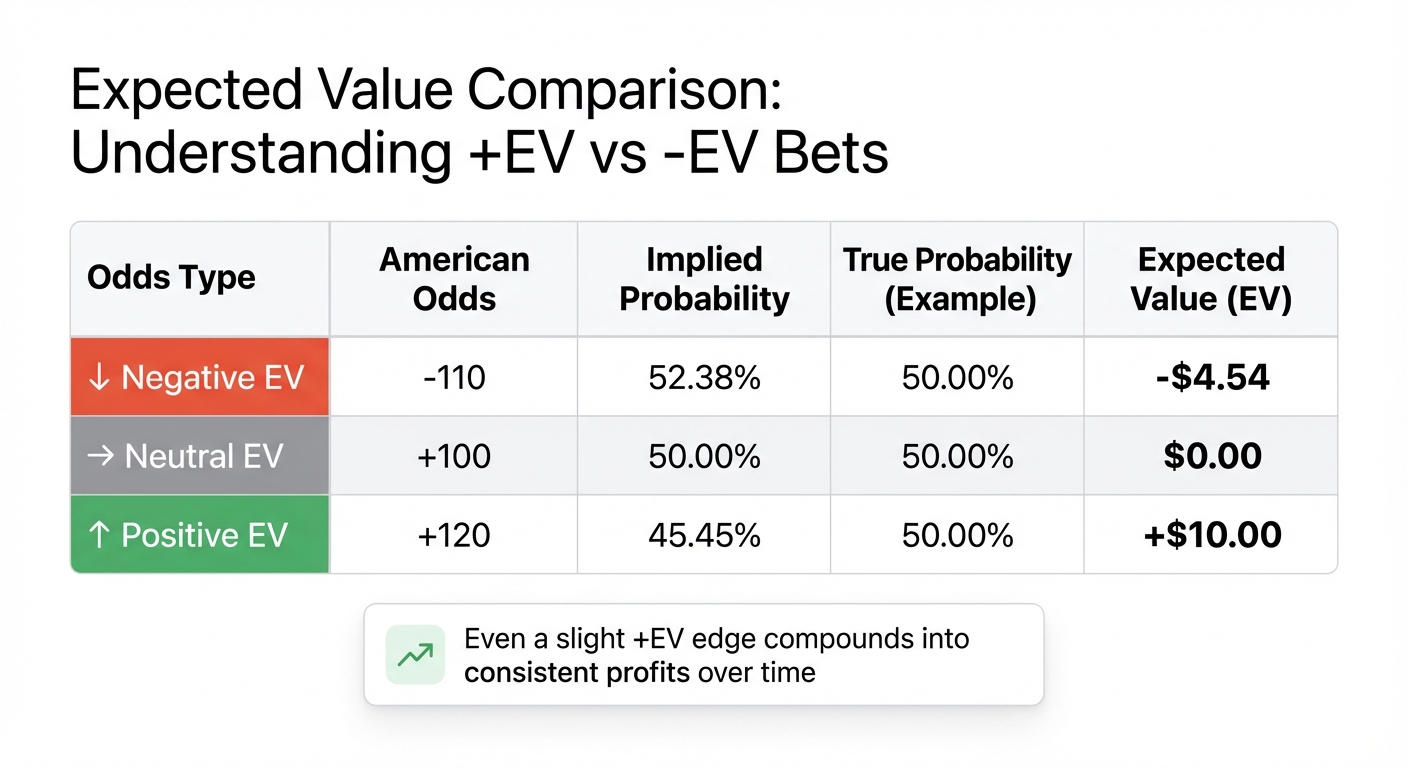

Expected Value Comparison: How Different Betting Odds Impact Long-Term Profitability

Positive Expected Value (+EV) refers to a bet where the real probability of an outcome is higher than what the odds suggest.

For instance, imagine betting on a coin toss, which has an actual 50% chance of landing on heads. If a sportsbook offers +120 odds (implying a 45.5% chance), this bet becomes +EV. Why? Because the odds underestimate the true likelihood, giving you a mathematical edge.

This approach stands in contrast to how most people bet. While typical bettors focus on who they think will win, +EV betting zeroes in on whether the odds offered are better than the true probability. This shift in focus is what separates casual betting from strategies designed to maximize long-term gains.

Expected Value (EV) Explained

Expected Value (EV) is a calculation that shows the average outcome of a bet if you were to place it repeatedly under the same conditions. It’s the backbone of profitable sports betting.

Here’s the breakdown: +EV bets indicate potential long-term profit, while -EV bets lead to eventual losses because of the house edge. Most standard bets fall into the -EV category because of the vigorish (or "vig"), a fee sportsbooks charge to ensure their advantage.

Take a typical -110 point spread bet, for example. The vig here is about 4.54%. Even on a fair 50/50 event, sportsbooks price it as if the event has a 52.38% chance of happening. That extra 2.38% represents the house edge, which bettors must overcome to break even.

Here’s a quick look at how different odds impact EV:

| Odds Type | American Odds | Implied Probability | True Probability (Example) | Expected Value (EV) |

|---|---|---|---|---|

| Negative EV | -110 | 52.38% | 50.00% | -$4.54 |

| Neutral EV | +100 | 50.00% | 50.00% | $0.00 |

| Positive EV | +120 | 45.45% | 50.00% | +$10.00 |

Even a slight +EV can make a big difference over time, turning small advantages into consistent profits.

Why +EV Matters for Long-Term Profits

Consistently finding +EV bets is the only reliable way to make money in sports betting over the long haul. While individual bets might lose, the math works in your favor when you place hundreds - or even thousands - of +EV wagers.

Sportsbooks are designed to profit from the built-in house edge. For example, on markets priced at -110/-110, they typically hold around 2.4% of total wagers. Across all bets, their profit margin usually sits between 5% and 8%. By identifying and exploiting mispriced lines, +EV betting flips the script and puts the advantage on your side.

Consider this: with just a 5% edge, a bettor wagering $1,000 per month could expect an average profit of $50. Over time, these small gains add up. Professional bettors aim for a long-term success rate of 54% to 55%. While that might not sound like much, it’s enough to generate meaningful profits when compounded over hundreds of bets.

However, the toughest part of +EV betting isn’t the math. As OpenWager puts it:

The biggest challenge in EV betting isn't the math - it's finding the true probability of an outcome.

To consistently uncover +EV opportunities, you’ll need to rely on data analysis and disciplined line shopping. Mispriced lines often arise due to factors like public bias, delayed injury reports, or differences between sportsbooks. By staying sharp and spotting these discrepancies, you can tilt the odds in your favor and build a profitable betting strategy.

How to Calculate Expected Value

The EV Formula and What Each Part Means

The formula for expected value (EV) is straightforward:

EV = (Probability of Winning × Profit) - (Probability of Losing × Stake).

Here's what each term means:

- Probability of Winning: This is your estimated chance that the bet wins, written as a decimal. For example, a 50% chance would be 0.50.

- Profit: The amount you stand to gain if the bet wins, not including your original stake. For instance, a $100 wager at +150 odds results in a $150 profit.

- Probability of Losing: This is simply 1 minus your probability of winning.

- Stake: The amount of money you wager, which is at risk if the bet loses.

If the EV is positive (+EV), the bet is expected to be profitable in the long run. A negative EV (–EV), on the other hand, suggests that consistent losses are likely. This formula balances potential profits against the risk of losing your stake.

EV Calculation Examples

Let’s break it down with some examples:

Say you’re betting on a team with +150 odds and you estimate their chances of winning at 45%. If you place a $100 bet, a win would bring a $150 profit, while a loss would cost your $100 stake. Using the formula:

(0.45 × $150) - (0.55 × $100) = $67.50 - $55.00 = +$12.50 EV

This means you can expect to gain $12.50 for every $100 wagered on this bet.

Now consider a coin toss with +120 odds and a true 50% chance of winning. If you wager $100, a win would net you $120 in profit. The calculation looks like this:

(0.5 × $120) - (0.5 × $100) = $60 - $50 = +$10.00 EV

Even though the event is a 50/50 shot, the +120 odds give you a $10 advantage for every $100 bet.

However, standard –110 odds tell a different story. Even with a 50/50 chance, the calculation results in a negative EV because of the sportsbook’s margin. To break even at –110 odds, you’d need to win roughly 52.4% of the time. This is why professional bettors aim for long-term win rates of 54% to 55% to overcome the house edge. These concepts are key to identifying +EV opportunities, which will be explored further in the next section.

How to Find +EV Betting Opportunities

Using Prediction Markets and Historical Data

To uncover +EV (positive expected value) bets, you need to compare your assessment of an event's true probability with the sportsbook's odds. This can be done through two primary methods: market-based modeling and projections-based modeling.

Market-based modeling works similarly to analyzing stock prices. Here, sharp sportsbooks - those with high limits and quick reactions to professional betting activity - serve as indicators. When they adjust their lines, it often reflects input from knowledgeable bettors. If a more casual, public-facing sportsbook hasn’t updated its odds yet, this discrepancy could signal a betting opportunity.

Projections-based modeling, on the other hand, relies on historical data to calculate probabilities. This includes analyzing player stats, team performance, injuries, and matchup trends. If your calculated probability exceeds the sportsbook's implied probability, you’ve found a +EV bet. For instance, ESPN's model gave the Philadelphia Eagles a 56.1% chance to beat the Kansas City Chiefs in the Super Bowl. With the Eagles opening at +110 (implying a 47.6% probability), there was a clear edge. As sharp money entered the market, the line shifted to +104, and Philadelphia went on to win 40–22.

Both approaches require you to remove the vig (the sportsbook’s built-in margin) to uncover the true odds. Once you’ve done that, the next step is to identify discrepancies through line shopping and market timing.

Finding Outliers and Value Bets

To turn these strategies into actionable bets, focus on two key practices: line shopping and timing.

Line shopping involves comparing odds across multiple sportsbooks to identify outliers. Even small differences in odds can have a big impact on long-term profitability. Use sharp sportsbooks as a baseline and place bets at softer sportsbooks offering better odds for the same outcome.

Timing also plays a vital role. In football, early-week lines often present value before sportsbooks adjust to sharp betting activity. For sports with daily games, like the NBA or MLB, the optimal window is typically 24–48 hours before the game starts. Keep an eye out for reverse line movement as well - this occurs when odds shift in the opposite direction of public betting trends, often indicating sharp money .

Public bias can create additional opportunities. Sportsbooks sometimes adjust lines based on media hype or casual bettors’ preferences. A great example is Super Bowl XLVIII in 2014, where the public heavily favored Denver’s high-powered offense. Meanwhile, sharp bettors identified value in Seattle’s top-ranked defense. The result? Seattle dominated with a 43–8 victory, exposing the market’s misjudgment.

Platforms like WagerProof simplify this process by automating the search for outliers. It provides real-time alerts when prediction market spreads don't align, flags opportunities to fade games, and highlights value bets across multiple sportsbooks. This eliminates the need for manual odds comparison and helps you act quickly on potential edges.

How WagerProof Helps You Find +EV Bets

Automated Outlier Detection

Manually hunting for +EV bets is no small task. It involves sifting through countless sportsbooks, comparing thousands of lines, and calculating true odds after removing the vig - all before the opportunity slips away. WagerProof takes this burden off your shoulders. The platform scans multiple sportsbooks in real time, instantly flagging market mispricings.

When spreads across sportsbooks don’t align, WagerProof sends you instant alerts. Timing is everything here. The system calculates true odds, pinpointing situations where one sportsbook offers significantly better odds than others. These alerts clearly highlight which games to fade and uncover edges that other platforms might miss - all without requiring you to spend hours crunching numbers. This automation strengthens the mathematical foundation behind +EV betting.

Pro-Level Data and Expert Picks

Beyond automated detection, WagerProof enhances your betting strategy with expert-driven insights. The platform combines prediction markets, public betting percentages, historical stats, and statistical models into a single, easy-to-understand interface. It doesn’t just tell you a bet has value - it shows you why. Real Human Editors provide expert picks based on historical data, player trends, and situational factors like injuries or weather that automated systems might overlook.

This level of transparency helps you understand the logic behind the recommendations, empowering you to learn the process instead of just following tips blindly. You’ll see how sharp money moves lines, where public bias skews the market, and which statistical advantages justify a wager. By blending data with expert insights, WagerProof helps you refine your betting approach and build the skills to identify +EV opportunities on your own.

WagerBot Chat: AI Sports Betting Assistant

WagerBot Chat is an AI-powered assistant designed specifically for sports betting. It connects to live professional data sources, delivering precise, real-time insights. Unlike generic AI tools, WagerBot taps into current odds, injury updates, and market shifts to answer your questions about games or strategies.

This AI assistant also helps you manage risk by suggesting bet sizes tailored to your edge and bankroll, including guidance on the Kelly Criterion. WagerBot reacts quickly to breaking news - like a key player injury - assessing how it might impact the market before odds adjust, giving you a critical timing advantage. Available on web, iOS, and Android, it also provides access to WagerProof’s exclusive Discord community, where members share insights and discuss market trends. These tools ensure that every +EV opportunity is easy to spot and act on.

Conclusion

Positive EV betting creates a long-term advantage by identifying situations where the actual probability of an outcome is better than the odds suggest. As the Outlier Team explains:

Positive EV betting is like investing in stocks with strong fundamentals - you won't win every day, but over time, you generate steady returns.

However, manually calculating EV across countless markets - removing the vig, comparing odds, and acting before lines shift - is an overwhelming task. This is where automation becomes crucial. Tools like WagerProof simplify the process by scanning markets in real time, identifying mispriced lines, and notifying you of value bets before they vanish. By leveraging prediction markets, statistical models, and expert insights, WagerProof doesn’t just highlight bets - it explains why they’re +EV.

To turn these small edges into consistent profits, volume and disciplined staking are key. Using strategies like fractional Kelly staking helps protect your bankroll during inevitable losing streaks while maximizing growth. The focus should always remain on the process and not on short-term results. Tracking every bet and sticking to a disciplined approach is what transforms small advantages into sustainable success.

Start by combining automated tools with a thoughtful betting strategy. Use WagerProof’s real-time alerts and WagerBot Chat to uncover your first +EV opportunities. Then, compare these insights with your own analysis to refine your ability to spot value independently. These tools are designed to help you bet smarter, not just follow tips blindly.

Take these strategies and put them into action.

FAQs

What is expected value (EV) in betting, and how do I calculate it?

Expected value (EV) is a mathematical tool that helps you figure out if a bet is likely to pay off over time. It weighs the potential winnings against the risk you're taking, factoring in the probability of different outcomes.

The formula for EV is straightforward:

EV = (Probability of Winning × Profit) - (Probability of Losing × Bet Amount)

Let’s break it down with an example. Say you bet $100 at +150 odds, and you believe the true probability of winning is 65%. The EV calculation would look like this:

(0.65 × $150) - (0.35 × $100) = $97.50 - $35 = $62.50

This $62.50 positive EV indicates the bet is favorable in the long run. Spotting these +EV opportunities can give you an edge, especially if your probability estimates are sharper than those reflected in the sportsbook's odds.

What are the best tools for finding +EV betting opportunities?

Finding positive expected value (+EV) betting opportunities becomes much simpler with tools designed to analyze sports data and pinpoint market inefficiencies. These tools rely on advanced statistical models, real-time updates, and market comparisons to uncover bets with a stronger chance of being profitable.

Take WagerProof as an example. This platform provides real-time sports data, including prediction markets, historical statistics, and public betting trends. It automatically spots outliers and value bets, making it easier to identify +EV opportunities. Unlike traditional pick services, WagerProof emphasizes transparency and data-driven analysis, giving you the tools to make smarter, more informed betting decisions.

What makes positive EV betting essential for long-term success?

Positive EV (+EV) betting is all about making bets where you have a mathematical advantage. It means identifying situations where the actual likelihood of an outcome is greater than what the odds imply. Over time, these bets are expected to yield profits.

By sticking to +EV bets, you can rely less on luck and focus more on consistent, calculated growth. Over many bets, this strategy allows you to capitalize on favorable odds while keeping unnecessary risks to a minimum.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free