Public Money Data: Finding Undervalued Lines

Public money data helps you identify betting opportunities by showing where casual bettors and professional bettors (sharps) differ. Here's the key takeaway: sportsbooks adjust lines not just based on game odds but also on betting behavior. When sharps and the public are on opposite sides, it often creates value for those who know how to interpret the data.

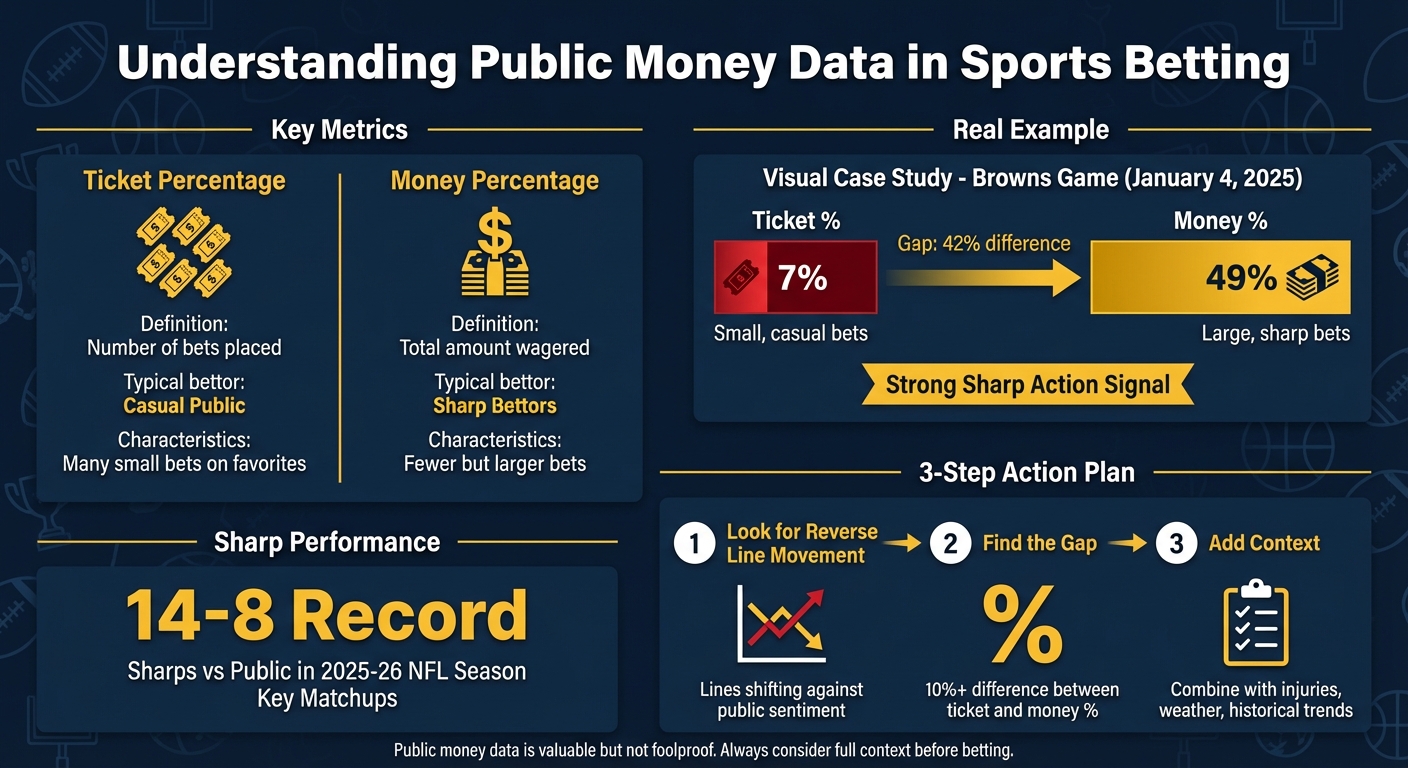

Quick facts:

- Ticket Percentage: Number of bets placed.

- Money Percentage: Total amount wagered.

- A large gap between these percentages often signals sharp action.

- Sharps achieved a 14–8 record against the public during the 2025–26 NFL season in key matchups.

- Tools like WagerProof highlight mismatches and line movements, simplifying the process.

To make better bets:

- Look for reverse line movement (lines shifting against public sentiment).

- Focus on games with a 10%+ gap between ticket and money percentages.

- Combine public money insights with other metrics like injury updates or historical trends.

Public money data is a valuable tool, but it’s not foolproof. Always consider the full context, such as injuries or weather, before placing bets.

Public vs Sharp Betting: Understanding Ticket and Money Percentages

How to Read Line Movement & Public Betting Percentage

What Is Public Money Data?

Public money data focuses on two main metrics: bet percentage (the number of individual wagers) and money percentage (the total dollar amount wagered). These two figures often don't align, and the gap between them can reveal where professional bettors - often referred to as "sharps" - are placing their money.

Public Money vs. Bet Percentages

Casual bettors, or the general public, tend to place numerous small bets on favorites. In contrast, sharps bet less frequently but with much larger sums. This discrepancy can highlight situations where professionals are betting against the public.

Take this example: On January 4, 2025, only 7% of the total bets supported the Browns, but 49% of the total money wagered was on them. That 42% difference strongly indicated sharp action favoring the underdog. These gaps are key to understanding how sharp money influences betting markets.

How Public Money Moves Betting Lines

These metrics are essential because they directly affect how sportsbooks adjust betting lines. Contrary to popular belief, sportsbooks don't just aim to balance casual bets on both sides. Instead, they adjust lines to manage the financial risk posed by sharp money.

When sharps place large bets, sportsbooks may shift the line - even if it means attracting more public bets on the opposite side. This creates a phenomenon known as reverse line movement, where the line moves against the majority of public ticket volume.

Here's an example: Imagine the Chiefs open as 7-point favorites (-7), but the line moves to -6.5 even though most public bets are backing Kansas City. This shift suggests that sharp bettors are putting significant money on the opposing team. In such cases, sportsbooks are willing to accept more small public bets on one side because the larger, sharper bets on the other side represent a bigger liability. Understanding this dynamic helps bettors spot opportunities to take advantage of pricing inefficiencies.

How to Find Undervalued Lines Using Public Money Data

Spotting Mismatches Between Public Money and Bet Percentages

One way to identify undervalued lines is by calculating the gap between the percentage of bets and the percentage of money. For example, if a team gets 30% of the bets but accounts for 50% of the money, this suggests sharp, strategic betting activity.

Another key indicator is reverse line movement (RLM). This happens when the betting line moves in the opposite direction of public sentiment. For instance, if 75% of bets are on a favorite, but the spread shifts from –7 to –6, it signals that sharp bettors are backing the underdog. In another case, consider an NBA totals market where the "Over" receives 66% of tickets but only 41% of the money, and the total moves from 230.5 to 229. This points to sharp money favoring the "Under".

Sharps typically act early, targeting opening lines or high-limit periods, while public money tends to flood in closer to game time. If you notice a line moving toward the side with a higher money percentage but fewer bets early in the week, it’s likely driven by sharp money. Similarly, sudden and uniform line shifts across multiple sportsbooks - known as steam moves - often indicate coordinated sharp betting activity.

Using WagerProof to Access Public Money Data

Once you’ve spotted potential value, tools like WagerProof can simplify your analysis. WagerProof’s Edge Finder automatically highlights mismatches between public money and betting percentages, saving you from manually monitoring multiple sources. It provides real-time alerts when betting market trends deviate from public money patterns, helping you identify sharp action contradicting public sentiment.

What sets WagerProof apart is its transparent approach. It doesn’t just flag undervalued lines - it explains why they qualify. The platform combines public bet and money data, historical trends, and advanced statistical models in one place, giving you the same level of insight as professional bettors without the need to build your own tracking system. Plus, WagerBot Chat allows you to access live pro data, so you can confidently ask about current mismatches and ensure your information is always up to date.

Criteria for Identifying Undervalued Lines

When to Bet Against the Public

You should consider betting against the public when over 70% of bets are placed on one side, but the line either stays the same or shifts in the opposite direction. This often signals that sportsbooks are adjusting to sharp money bets rather than public opinion.

Take the example of Super Bowl 60: the Seattle Seahawks attracted 75% of tickets at -4.5, but a large percentage of money was on the New England Patriots. The line staying flat indicated potential value in betting on the Patriots.

Sharp bettors tend to place their wagers early, either when the lines open or during midweek, while public bets usually flood in closer to game time. This late influx of public money often inflates the odds for favorites, creating opportunities to find value by betting against the public trends.

"The sharp bettor isn't trying to pick winners - they are trying to identify where the public is wrong and take advantage of the price distortion." - Ron Raymond, Founder of ATSstats.com

To maximize your chances, combine these public money insights with other key metrics.

Combining Public Money Data with Other Metrics

Identifying undervalued lines through public money data is just the first step. To refine your strategy, consider additional metrics. Pay close attention to line movements around critical numbers like 3 and 7 in football, as these hold more weight in high-volume markets. Public money percentages also carry more significance in popular markets, such as NFL sides or marquee NBA games, compared to smaller markets where a few casual bets can skew the data.

Platforms like WagerProof can simplify this process by integrating public money data with historical trends, prediction markets, and other key statistics. This makes it easier to confirm whether public sentiment is misaligned with the actual value. Additionally, tools like WagerBot Chat provide live professional data and deeper insights, helping you understand not just the numbers but the context behind them.

Common Mistakes and Best Practices

Don't Rely Only on Public Money Data

Betting based solely on public money trends can lead to trouble. For instance, seeing that 70% of bets are on one side and automatically wagering the other way might seem like a clever move. But relying on public money data as your only guide is risky - it’s just one piece of a much larger puzzle.

Not every line movement indicates sharp money. Lines often shift due to factors like injury updates, weather changes, or public overreaction to recent performances. For example, if a star quarterback’s status changes from "probable" to "questionable" shortly before a game, the line may move because of this new information, not because sharp bettors are involved. Jumping in without understanding the context can lead to costly mistakes.

Another frequent misstep is chasing perceived value after a major line shift. If a line moves from –3 to –5.5, chances are the value is already gone. Similarly, bettors often fail to consider how key numbers in football impact value. In the NFL, a shift from –2.5 to –3 carries much more weight than a move from –5 to –5.5, as 3 and 7 are the most common victory margins.

Before placing any bets, make sure to check for last-minute updates like injuries or weather changes. A simple checklist can help: focus on games where at least 65% of tickets are on one side, identify the contrarian play, ensure there’s a 10%+ gap between ticket and money percentages, and confirm no major news undermines your signal. Also, steer clear of low-volume markets, such as small-college games, where a few casual bets can distort the data and make it unreliable.

Building a Sustainable Betting Strategy

To improve your long-term success, combine these insights into a broader, well-rounded strategy. Public money analysis becomes far more effective when paired with real-time tools that highlight value. For instance, WagerProof's value bet alerts can pinpoint mismatches between public sentiment and actual line value, saving you the hassle of manually tracking dozens of games. Tools like WagerBot Chat also provide live professional data, helping you distinguish sharp action from mere market noise.

Consider using fractional Kelly betting to manage your bankroll and reduce risk during losing streaks. Instead of wagering the full amount calculated by the Kelly Criterion, bet only half or a quarter of that amount. This method keeps you in the game while still allowing you to capitalize on profitable opportunities. Interestingly, data shows that peer-to-peer platforms often achieve over 40% profitability compared to just 2% on traditional sportsbooks. This success stems from leveraging multiple data points rather than relying on a single metric.

Conclusion

Public money data gives a glimpse into where the majority of bets are being placed and where the big money is flowing. By identifying gaps between the percentage of bets and the percentage of money, you can uncover situations where sharp bettors might be going against public opinion. These moments can highlight undervalued lines before the market catches up.

However, public money data is just one piece of the puzzle. To truly find value, you need to combine it with other factors. For instance, during the 2025–26 NFL season, the general public's record against the spread stood at 145–139 by late January 2026. This shows that simply fading the public isn’t a guaranteed path to profit - context matters. A well-rounded strategy is essential for making informed decisions.

That’s where tools like WagerProof come in. It simplifies the process by flagging outliers and potential value bets, so you don’t have to sift through dozens of games manually. Instead of juggling data from multiple sportsbooks, the platform alerts you when spreads in prediction markets don’t align. With WagerBot Chat tapping into live professional data, you can separate meaningful sharp action from mere noise.

WagerProof offers real-time alerts, historical analytics, and expert picks curated by Real Human Editors. By pairing public money insights with these features, you can move beyond gut instincts and build a more consistent, data-driven betting strategy.

FAQs

What is reverse line movement, and how can I spot it using public money data?

Reverse line movement occurs when the betting line shifts in a direction opposite to where the majority of public bets are landing. This often suggests that sharp bettors - those with a track record of making informed, high-stakes wagers - are backing the less popular side, causing the odds to adjust.

To identify reverse line movement, look at the relationship between public betting percentages and the line movement. For instance, if most bets are on Team A but the line moves to favor Team B, that’s a potential sign of reverse line movement. Tools like WagerProof can be incredibly useful for monitoring public money trends and spotting these shifts as they happen, giving you a potential advantage in refining your betting approach.

How do sharp bettors influence betting lines?

Sharp bettors, often seasoned professionals or highly skilled individuals, play a crucial role in influencing betting lines. These bettors use their extensive knowledge of sports, historical performance data, and market trends to pinpoint inefficiencies and strategically place high-stakes wagers. Sportsbooks take sharp action seriously, often adjusting their lines in response, as these bettors are considered more accurate in predicting outcomes.

The movement of betting lines driven by sharp money can offer valuable clues for other bettors. By observing where sharp money is flowing - especially when analyzed alongside public betting data - bettors can uncover undervalued opportunities and make better-informed decisions. In essence, sharp bettors help shape the market, creating openings for others to take advantage of odds discrepancies.

Why should I look beyond public money data when placing bets?

Public money data can offer a glimpse into general betting patterns, but it often mirrors the emotional or impulsive choices of casual bettors. Relying on this data alone can sometimes lead to overestimating or misjudging the real value of a betting line.

To make more informed wagers, it's important to factor in other key elements like sharp money, line movement, and historical performance trends. These insights can help you spot opportunities that others might miss and avoid falling for market hype or overreactions. By broadening your analysis, you stand a better chance of identifying lines with hidden value and making smarter betting decisions.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free