Public Money vs Sharp Money: Line Movement Signals

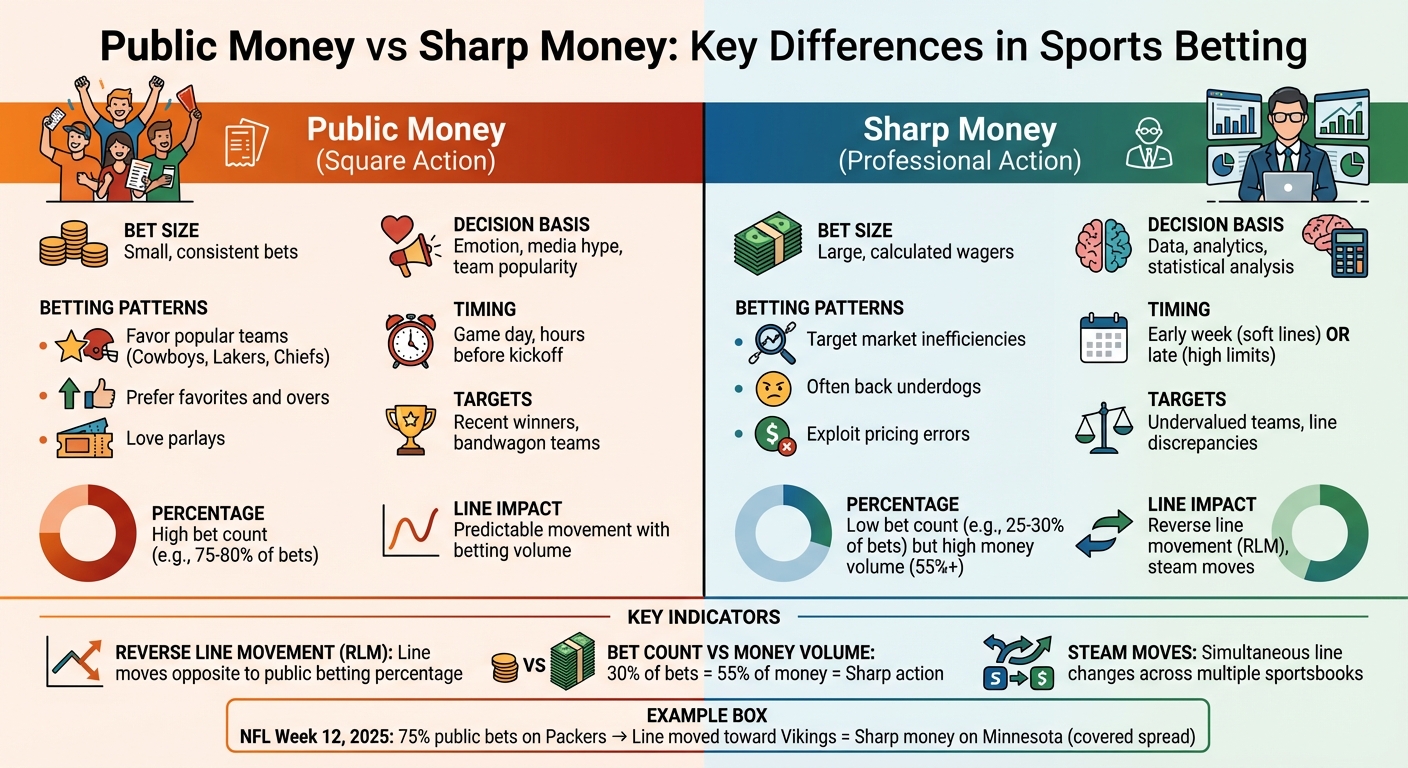

Betting lines shift for two reasons: public money and sharp money. Public money reflects casual bettors driven by emotion and media hype, while sharp money comes from professionals using data and strategy. Recognizing these differences can help you make smarter bets.

Key takeaways:

- Public money: Small bets, emotional decisions, often favoring popular teams and overs.

- Sharp money: Large, calculated bets based on data, often targeting underdogs or market inefficiencies.

- Line movement: Public money moves lines predictably, while sharp money creates reverse line movement (RLM), where lines shift against public betting trends.

Example: In NFL Week 12 (2025), despite 75% of public bets on the Packers, the line moved toward the Vikings, signaling sharp money. Minnesota covered the spread.

To spot sharp action:

- Look for RLM (e.g., line moves against public bets).

- Check if a small percentage of bets accounts for a large percentage of money.

- Tools like WagerProof can help analyze real-time betting data.

Understanding these patterns can give you an edge in sports betting.

Public Money vs Sharp Money: Key Differences in Sports Betting

How to Read Line Movement & Public Betting Percentage

What Is Public Money?

To truly grasp how line movements work, you need to understand the concept of public money. Often referred to as "square action", public money comes from casual bettors who tend to bet based on emotion rather than analysis. These are the fans who follow their favorite teams, jump on the bandwagon of recent winners, or buy into the narratives pushed by mainstream media. Instead of diving into stats or market inefficiencies, public bettors usually make decisions based on team popularity and media buzz.

Sportsbooks are well aware of these tendencies. They know that high-profile teams like the Dallas Cowboys, Los Angeles Lakers, or Kansas City Chiefs will attract a flood of bets simply because of their massive fan bases and constant media spotlight. When oddsmakers set lines, they aren't just trying to predict the final score - they're managing risk and ensuring their profits through the standard vig (the typical -110 commission, meaning you bet $110 to win $100).

How Public Bettors Behave

Public bettors are fairly predictable. They tend to place smaller, consistent bets and often favor teams that are recent winners or widely popular. Favorites and "overs" are their go-to choices. If a team has a big win, public bettors are quick to back them again, believing recent success will continue. They also have a soft spot for parlays, even though the odds of winning are much lower.

Another telltale sign of public money is timing. Casual bettors tend to place their bets on game day, often in the hours leading up to kickoff when pregame excitement is at its peak. These patterns give sportsbooks plenty of opportunities to adjust their lines accordingly.

How Public Money Moves Lines

The behavior of public bettors doesn't just define public money - it also has a direct impact on how sportsbooks tweak their lines. When betting becomes heavily one-sided, sportsbooks shift the line to balance their risk. For instance, if 80% of bets are on one team at -7, the line might move to -7.5 or -8 to encourage bets on the opposing side. These adjustments can create opportunities for sharp bettors to step in and capitalize.

Take this scenario: In a Chiefs vs. Broncos matchup, the Chiefs open as -7 favorites. If 80% of public bets pour in on Kansas City, the sportsbook might drop the line to -6.5 by kickoff. This shift signals that sharp money is coming in on the Broncos, despite the heavy public backing for the Chiefs. This kind of reverse line movement is a key indicator that separates public money from sharp money - a critical clue for experienced bettors looking to find an edge.

What Is Sharp Money?

Sharp money refers to bets placed by professional gamblers and betting syndicates who approach sports betting as a calculated investment. Unlike casual bettors who often follow trends or hype, sharps rely on advanced statistical analysis and historical data to uncover inefficiencies in the betting market. Their goal isn't to follow the crowd but to capitalize on pricing errors.

Ron Raymond, a seasoned sports handicapper from ATSStats.com, sums it up well:

"The sharp bettor isn't trying to pick winners - they are trying to identify where the public is wrong and take advantage of the price distortion."

This means sharps aren't afraid to back underdogs when their analysis shows the odds are in their favor.

How Sharp Bettors Operate

Sharp bettors follow a disciplined, data-driven approach. They calculate the actual probability of an outcome, compare it to the odds offered by sportsbooks, and act when they find discrepancies. Their decisions are grounded in facts, not emotions, and they often factor in details like injury updates, weather conditions, and other situational variables that casual bettors might ignore.

Timing is also a crucial part of their strategy. Sharps often place bets early in the week to take advantage of "soft" opening lines or wait until later, when betting limits increase, to secure the best possible value. They also monitor early line movements at top sportsbooks, which can signal where professional money is being placed.

How Sharp Money Moves Lines

Sharp bettors don't just make informed bets - they influence the entire betting market. Sportsbooks closely monitor sharp action because even small bets from respected sharp accounts can cause significant line adjustments. Betting analyst Jimmy Boyd highlights this dynamic:

"$1M bet from Drake won't move a line, but $2,000 from a profiled sharp account may."

This influence is evident in phenomena like reverse line movement (RLM), where a line shifts against the side receiving the majority of public bets, indicating sharp money is on the other side. Another telltale sign is a line freeze, where the odds remain unchanged despite heavy public betting, signaling sharp action is balancing the market. Additionally, coordinated, simultaneous line changes across multiple sportsbooks - known as steam moves - are a clear marker of sharp syndicate activity.

How to Tell Public Money from Sharp Money

Understanding the difference between public and sharp money is key to interpreting line movements. Sportsbooks don’t weigh all wagers equally - they prioritize sharp action over public betting, even if the public places the majority of bets.

Bet Count vs. Money Volume

One way to identify sharp action is by comparing the number of bets to the total money wagered using real-time sports data platforms. When these figures differ significantly, it’s often a sign that sharp bettors are involved. For example, if a team attracts only 30% of all bets but accounts for 55% of the money, this discrepancy suggests sharp bettors are backing that side. Public bettors typically place numerous small bets, while sharps make fewer but much larger, calculated wagers.

Sportsbooks are more concerned with managing their risk against sharp bettors than with the sheer volume of public bets. A handful of large wagers from sharp accounts can move a line far more than thousands of small public bets. This dynamic often leads to other indicators, like reverse line movement.

Reverse Line Movement

Reverse line movement (RLM) is a strong indicator of sharp money. It happens when the betting line shifts in the opposite direction of public betting percentages. For example, even if 75% of public bets are on one side, the line might move against that side, signaling sharp action.

Let’s say 80% of bets favor a favorite listed at -7, but the line drops to -6.5 or -6. This shift shows that sportsbooks are adjusting for sharp money, not public volume. The same applies to totals: if 70% of bets are on the Over, but the total drops from 51 to 49, it’s likely due to sharp bettors backing the Under. These movements can highlight opportunities, especially for underdogs.

Underdog Betting Patterns

Sharp bettors often target undervalued underdogs, while public money usually flows toward popular teams. As Ron Raymond from ATSStats.com explains:

"The public moves it with emotion, and the sharp money moves it with information."

Public bettors are influenced by emotion, media narratives, and recent performances, leading them to favor favorites and overs in prominent games. Sharps, on the other hand, rely on data and analytics to find market inefficiencies. Since public money often pushes lines toward popular sides as game day approaches, waiting until closer to kickoff can provide better odds on underdogs, as sharp action is already reflected in the line.

How to Use Line Movement in Your Betting

Let’s dive deeper into how you can use line movement to guide your betting strategy. The trick lies in understanding when these shifts are meaningful and how to steer clear of misleading signals.

Early vs. Late Line Movement

Early line movement happens shortly after sportsbooks release their opening lines. This activity is often driven by sharp bettors who quickly identify inefficiencies in the odds. Sportsbooks like Circa Sports and Pinnacle, which cater to professional bettors, are usually the first to adjust their lines, with others following suit.

On the other hand, late line movement occurs closer to game time, often reflecting a mix of public money and sharp action taking advantage of higher betting limits. If you’re considering betting on an underdog, waiting until game day might work in your favor. Public money often inflates the favorite’s price, creating better value for underdog bets.

Avoiding Misleading Signals

Once you grasp how early and late movements differ, the next step is to analyze these shifts critically. Not every line change is a sign of sharp action. Always check for external factors like breaking news, injuries, or weather updates, as these can cause legitimate but unrelated shifts in the lines.

Be cautious of deceptive steam moves. These occur when sharp groups place smaller bets to intentionally shift the line, only to later place a much larger wager on the opposite side at a better price. Remember, sharp money carries more weight than flashy celebrity bets.

If you notice steam moves - sudden and simultaneous line changes across multiple sportsbooks - it’s often a sign of coordinated action by sharp syndicates.

Using WagerProof for Line Movement Analysis

WagerProof is a valuable tool for analyzing line movement in real time. By providing public betting data and money lean percentages, it helps you spot when sharp money is influencing the lines. The platform highlights outlier bets and flags opportunities where public betting patterns diverge from prediction market spreads.

Unlike pick sites that simply offer recommendations, WagerProof gives you the transparency to understand why a line is moving. It displays the percentage of bets versus money on each side, making it easier to identify reverse line movement and genuine sharp action. Tools like the Edge Finder and historical analytics give you the data needed to distinguish between sharp positioning and public noise effectively.

Conclusion

Understanding the difference between public and sharp money can help you make smarter betting decisions. Public money, often influenced by emotions and media hype, tends to move lines due to sheer volume. On the other hand, sharp money relies on data to spot pricing errors and capitalize on them. As Ron Raymond, Founder of ATSstats.com, explains:

"The sharp bettor isn't trying to pick winners - they are trying to identify where the public is wrong and take advantage of the price distortion".

Line movements reveal more than just betting activity - they highlight the strategic divide between casual and informed wagers. Keep an eye out for sharp signals like reverse line movement or steam moves. For instance, when a line shifts against heavy public betting, it’s likely sharp money driving the change. Similarly, simultaneous line adjustments across multiple sportsbooks often indicate the influence of betting syndicates. Sharps typically act early to secure the best lines or wait until just before kickoff when limits are highest, while public bettors tend to flood in closer to game time.

Tools like WagerProof can make a big difference here. WagerProof provides real-time data on bet counts and money volume, while its Edge Finder and historical analytics help distinguish sharp positioning from public noise, giving you a clearer picture of why lines are moving.

Don’t chase every line shift - look for confirmation through reverse line movement. Pay attention to sharp sportsbooks like Circa Sports and Pinnacle for early signals. Be wary of public traps, such as betting on "America's Teams", where lines that seem too good to be true often are. By using these strategies and tools, you can turn line movements into a consistent advantage.

FAQs

What’s the difference between public money and sharp money in line movements?

Public money and sharp money come from very different sources and have distinct effects on how betting lines move. Public money refers to bets placed by casual bettors - people who often place smaller wagers based on emotions or team loyalty. These bets usually lead to obvious, crowd-driven shifts in the lines.

In contrast, sharp money is tied to professional bettors or those with deep knowledge of the game. These individuals rely on detailed data, analysis, and market inefficiencies to make informed bets. Sharp money often causes less obvious changes, like reverse line movement. This happens when the line moves in the opposite direction of where most public bets are placed, signaling that professionals are influencing the market.

A good way to spot sharp money is by comparing the percentage of total bets to the percentage of total money wagered. For example, if a small percentage of bets accounts for a disproportionately large share of the money, it’s likely due to sharp action. Watching these patterns and noticing when lines shift against public trends can give you clues about where sharp money is shaping the market.

What are some signs of reverse line movement in sports betting?

Reverse line movement happens when betting lines shift in a way that goes against the majority of public bets. For instance, if most of the wagers are backing one team, but the line moves to favor the other, it’s often a clue that professional bettors - known as sharps - are making substantial, calculated bets.

This shift is largely influenced by sharp money, as these experienced bettors use their deep knowledge and large wagers to sway the market. Recognizing reverse line movement can be a valuable tool for spotting instances where public opinion might not align with the actual odds, potentially giving you an edge in placing smarter bets.

How does WagerProof help spot sharp money in sports betting?

WagerProof simplifies the process of spotting sharp money by analyzing real-time betting data and identifying reverse line movement - a critical sign of professional betting activity. It pinpoints mismatches between public betting trends and influential sharp wagers, delivering automatic alerts and insights through its statistical models.

By using WagerProof, you can effortlessly uncover trends and potential value plays that might slip under the radar, helping you make smarter, more informed betting decisions based on data.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free