Public vs. Sharp Money: Finding Edges

When it comes to sports betting, understanding the difference between public and sharp money can give you a real edge. Public bettors often follow popular teams, media hype, and gut feelings, while sharp bettors rely on data, analysis, and strategy to find market inefficiencies. Here's the key takeaway:

- Public money comes from casual bettors who favor favorites, overs, and high-profile games, often betting closer to game time. Their decisions are emotional and predictable.

- Sharp money comes from professional bettors who focus on value, betting early or late, often on underdogs or less popular picks. Their wagers influence betting lines significantly.

- Spotting sharp money involves tracking betting splits, reverse line movement (RLM), and gaps between bet percentages (tickets) and money percentages (handle).

For example, if only 30% of bets are on a team but they account for 60% of the money, that's a sign of sharp action. Tools like WagerProof help identify these opportunities by monitoring line movements and betting splits in real time. By following sharp money signals, you can avoid public traps and make smarter bets.

The Truth About Sharp Money & Steam Chasing | Unscripted with Bill Krackomberger

What is Public Money?

Public money - often referred to as "square" or "recreational" money - comes from casual sports fans who bet primarily for fun rather than strategy. These bettors are a major revenue source for sportsbooks, placing wagers based on gut feelings rather than detailed statistical analysis.

These casual bettors are naturally drawn to well-known teams, even when the odds don’t offer much value. Teams like the Dallas Cowboys, Los Angeles Lakers, or New York Yankees often attract their attention. As Prime Sportsbook puts it:

"Public money resembles lemmings running off a cliff to drown. It's based on fanboys, public branding and reputations, sports and social media narratives, hype, and fear of underdogs."

How Public Bettors Behave

Public bettors tend to follow predictable patterns. They favor favorites and high-scoring games (overs) while being heavily influenced by media hype, social media chatter, and recent performances. For many, the thrill lies in rooting for dominant victories rather than close underdog wins.

Public money typically pours in during high-profile, nationally televised games. In such matchups, casual bettors can make up 70–80% of the total number of bets, even though their wagers often represent a smaller share of the total money. This imbalance is exactly what sharp bettors aim to exploit.

This consistent behavior allows sportsbooks to anticipate and adjust, creating opportunities for informed bettors to capitalize on market inefficiencies.

How Public Money Affects Betting Lines

The collective habits of public bettors force sportsbooks to adjust betting lines to manage risk. While sportsbooks prioritize sharp money, they can’t ignore the sheer volume of public bets. When roughly 90% of casual bettors favor one side, sportsbooks respond by shifting lines to balance their exposure. This process, known as "line shading", often inflates spreads on popular favorites. For instance, a line might move from -7 to -7.5 to encourage action on the underdog.

In fact, sportsbooks sometimes bake public bias into their opening lines. If the "true" line should be -6, they might open it at -7, knowing the public will still bet on the favorite. This effectively adds a "tax" to the favorite, creating opportunities for sharp bettors to find value.

The outcome? Public bettors tend to win less than 50% of their bets - well below the 52.38% needed to break even at standard -110 odds. As Jimmy Boyd puts it:

"Squares bet for entertainment and emotion more than for consistent profit."

What is Sharp Money?

Sharp money, unlike public money that often stems from emotional decisions, is all about precision and strategy. These bets come from professional bettors and syndicates who see sports betting as a calculated investment rather than just a form of entertainment. For sharps, every wager is a business decision backed by data and analysis.

While public bettors typically favor popular teams and media favorites, sharp bettors focus on finding inefficiencies in the betting market. They rely on advanced metrics, statistical models, and historical data to guide their decisions. For sharps, it’s not about picking a winner - it’s about finding the right price. If the odds don’t align with the true probability of an outcome, that’s where they step in.

As Prime Sportsbook puts it:

"Sharp money is smart money, based on serious metrics that have actual impact."

Sharps don’t win every bet, but their disciplined approach pays off. They win about 55%–57% of their wagers, compared to the roughly 50% win rate of public bettors. This small edge, over time, translates into consistent profits.

How Sharp Bettors Operate

Sharp bettors have a clear and methodical approach. They target soft lines early in the week or wait for late limits when more money enters the market. Unlike public bettors, who often let emotions steer their choices, sharps remain detached. They’re known for betting on less popular underdogs or taking the "under" when the data supports it. Media hype and team loyalty don’t influence their decisions - everything is rooted in statistical analysis and expected value.

Another hallmark of sharp bettors is their ability to spread bets across multiple sportsbooks. This strategy helps them secure the best odds and avoid drawing attention to their betting patterns. They’re also particularly attentive to key numbers in football, such as 3 and 7, where even a half-point line movement can significantly affect value.

This disciplined, data-driven approach not only boosts their win rates but also heavily impacts how sportsbooks set and adjust their lines.

How Sharp Money Moves Lines

When sharps place their bets, sportsbooks take notice. A $2,000 wager from a known sharp bettor can influence a line more than a $1 million bet from a casual celebrity bettor. Why? Because sportsbooks trust that sharps have identified a market inefficiency.

Once a sharp bet signals an imbalance, sportsbooks adjust their lines quickly. This shift often sparks a "steam move" - a sudden and widespread line change across the market as other sportsbooks follow suit.

Market-making sportsbooks like Circa Sports and Pinnacle actively encourage sharp action. These bets help them refine their lines to create the most efficient market possible. When sharps heavily bet one side, these sportsbooks act fast, and their adjustments ripple through the entire betting ecosystem.

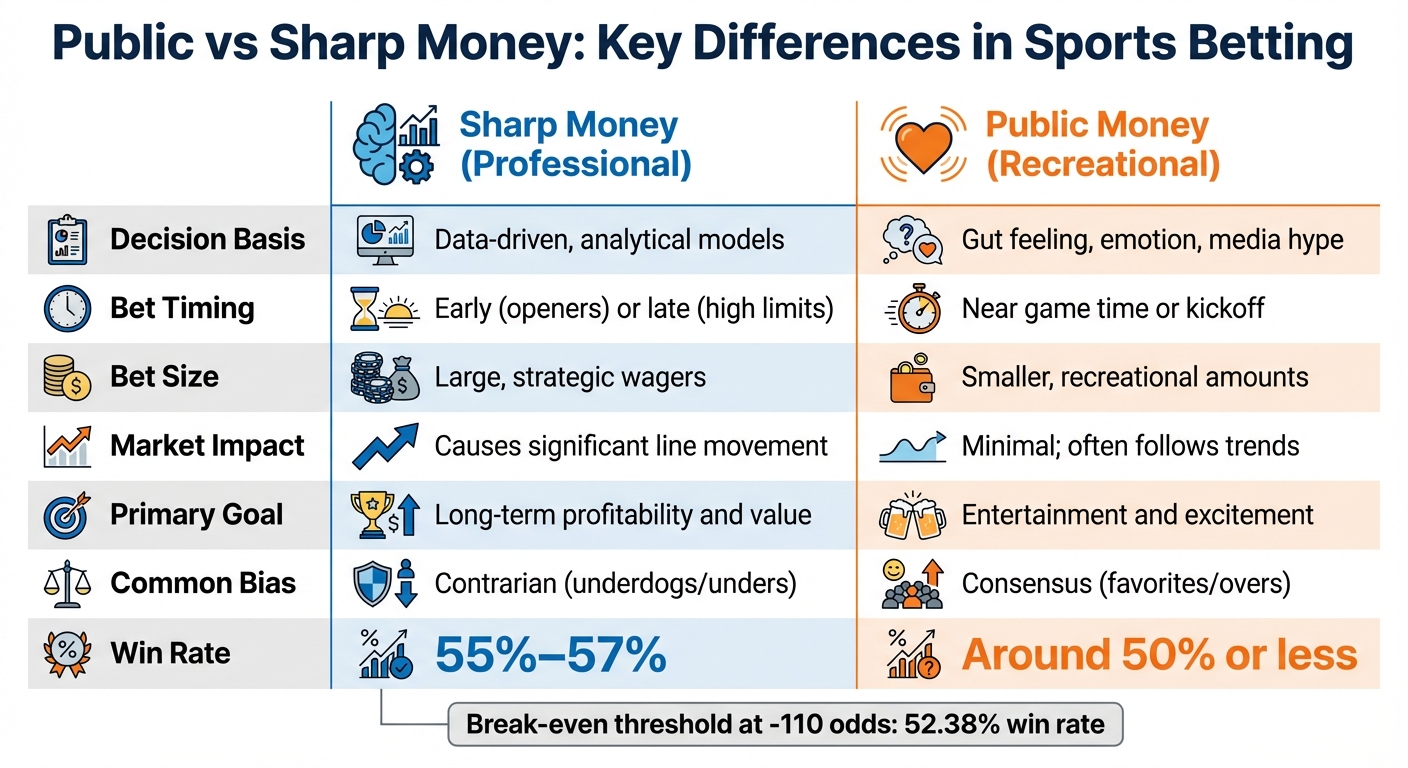

Public Money vs. Sharp Money: Key Differences

Public vs Sharp Money: Key Differences in Sports Betting

When it comes to betting, public and sharp bettors operate on completely different wavelengths. Public bets are often fueled by emotion and media buzz, while sharp bets are calculated, data-driven decisions that treat wagering more like an investment than a pastime.

Public bettors tend to place their bets closer to game time, swayed by trends, popular opinion, and last-minute hype. On the other hand, sharp bettors rely on advanced analytics, historical data, and market insights to spot opportunities. They often place their bets early to take advantage of soft opening lines or wait until limits increase closer to game time. Sharps are also unafraid to go against the grain, backing underdogs or betting the under if the numbers align with their strategy.

One fascinating aspect is how sportsbooks react to sharp money. A relatively modest $2,000 bet from a sharp bettor can have a greater impact on the betting lines than a $1 million wager from a high-profile celebrity. Why? Because sharps have a proven track record of consistently identifying value, making their bets much more influential to the market.

Comparison Table

| Aspect | Sharp Money (Professional) | Public Money (Recreational) |

|---|---|---|

| Decision Basis | Data-driven, analytical models | Gut feeling, emotion, media hype |

| Bet Timing | Early (openers) or late (high limits) | Near game time or kickoff |

| Bet Size | Large, strategic wagers | Smaller, recreational amounts |

| Market Impact | Causes significant line movement | Minimal; often follows trends |

| Primary Goal | Long-term profitability and value | Entertainment and excitement |

| Common Bias | Contrarian (underdogs/unders) | Consensus (favorites/overs) |

| Win Rate | 55%–57% | Around 50% or less |

Reverse Line Movement: When Lines Move Against Public Bets

Building on the concepts of sharp and public money, reverse line movement (RLM) provides a clearer picture of how professional bettors influence market adjustments. RLM happens when a betting line shifts in the opposite direction of public money. For instance, imagine 75% of bettors are backing the Dallas Cowboys at -3, but instead of the line moving to -3.5 or -4, it shifts to -2.5. That’s a telltale sign of sharp money at play, signaling that professional bettors are targeting a line they believe is mispriced.

Why does this happen? Sportsbooks prioritize the actions of professional bettors over casual ones. They closely monitor long-term betting performance and adjust lines when sharp bettors place significant wagers - even if it means moving against the majority of public bets.

RLM highlights market inefficiencies that sharp bettors exploit. Casual bettors often overvalue favorites or popular teams, swayed by media hype rather than hard data. When sharps spot a line that doesn’t align with the true probabilities, they bet heavily on the less popular side, forcing sportsbooks to adjust. A study of 274 RLM games found that in 187 cases, the side with more than 65% of public money ended up losing. Another analysis of over 200 games showed a 68% success rate when following RLM signals.

The most reliable RLM signals tend to occur in high-volume markets like the NFL, particularly when lines move across key numbers such as 3 or 7. Sportsbooks are hesitant to shift off these critical margins unless sharp action demands it. Early in the week, RLM often reflects sharps locking in favorable positions before public money inflates the lines. Late-week movements, on the other hand, may indicate sharp reactions to last-minute factors like injury updates or weather changes.

Take MLB Opening Day in March 2023 as an example. The Chicago White Sox opened at +145 against the Houston Astros. Despite the Astros attracting about 60% of the betting action, the line shifted in favor of the White Sox, dropping to +130. This RLM pointed to sharp interest in Chicago, and the White Sox ultimately won the game 3-1.

Platforms like WagerProof capitalize on insights from RLM by alerting users to these kinds of market discrepancies. By identifying mismatched spreads and uncovering hidden edges, WagerProof helps bettors make smarter, more informed decisions in their wagering strategies.

Betting Percentages vs. Money Percentages: Finding Value

Understanding the difference between betting percentages (tickets) and money percentages (handle) is key to spotting where sharp bettors are placing their wagers. Betting percentages represent the number of individual wagers placed on each side, often reflecting public opinion. On the other hand, money percentages show the total dollar amount wagered on each side, giving insight into where the larger, sharper bets are going.

When these two figures don’t align, it can be a strong indicator of sharp action. For example, if a team gets only 30% of the bets but 55% of the money, it suggests that while the number of bets is low, significant money is being wagered on that side. As Wayne Allyn Root puts it, "Whichever side the handle is weighted to can signal the sharp action (if the amount of tickets on that side are low), or if that side is being heavily bet by the public (if the ticket percentage is high)". This distinction helps identify whether the action is driven by sharp bettors or general public sentiment.

"If a team has 10 percent or more money than tickets, it may suggest bigger wagers are concentrated there."

- Josh Applebaum, Author

A gap of 10% or more between money and ticket percentages can signal sharp action or a potential public trap. For instance, a 42% difference between bets and money strongly points to sharp money backing one side. Conversely, if a team has 75% of the bets but only 45% of the money, it could indicate a "public trap", where recreational bettors are loading up on one side while sharp money is betting the other. These divergences between ticket and handle percentages are foundational for identifying sharp moves.

Platforms like WagerProof automatically alert users to these significant gaps in ticket and money percentages. By monitoring spreads, moneylines, and totals, the platform helps bettors identify where professionals are likely finding value - and where public sentiment might be steering casual bettors off course.

Real Examples of Percentage Gaps

The table below outlines some common scenarios and offers potential strategies based on the data.

| Scenario | Bet % | Money % | Meaning | Potential Action |

|---|---|---|---|---|

| Public Consensus | 80% | 82% | Public and sharp money are aligned; no clear edge exists. | No clear edge; rely on your own model. |

| Sharp Lean | 30% | 55% | Few bets but large wagers back this side, indicating sharp action. | Consider following the sharp money. |

| Public Trap | 75% | 45% | A high volume of small bets contrasts with a lower money percentage, suggesting contrarian play. | Explore a "fade the public" approach. |

| Total Discrepancy | 70% (Over) | 45% (Over) | Public heavily favors the Over, but sharp money leans toward the Under. | Look for value on the Under. |

How to Bet Using Sharp Money Signals

To make smarter bets, it's crucial to understand the difference between public and sharp action. Sharp money signals - like reverse line movement, bet-money gaps, or steam moves - can help you time your bets effectively. Sharp bettors often strike early in the week to grab favorable opening lines or wait until late, when betting limits are higher. On the other hand, public money tends to pour in on game day, often right before kickoff or tip-off.

"Sportsbooks primarily fear sharp money, not public money."

- Jimmy Boyd, Sports Handicapper

Pay close attention to line movements around key numbers in football, such as 3 and 7. These numbers are critical because sportsbooks rarely shift off them unless significant sharp action is involved. Reverse line movement near these thresholds can be a strong indicator of sharp betting. Similarly, "steam moves" - sudden, simultaneous line shifts across multiple sportsbooks - often point to coordinated action by betting syndicates or sharp groups. These tools are essential for using data to your advantage.

Using Data to Track Sharp Money

Real-time tools like WagerProof can help you stay on top of sharp money activity. Platforms like this monitor key metrics across multiple sportsbooks, including line movements, betting splits, and money percentages. By analyzing market leaders like Pinnacle and Circa Sports, WagerProof identifies outliers and discrepancies as they happen. When these market-making books adjust their lines, the rest of the market tends to follow.

For example, if a team has a 10% or greater gap between its bet percentage and money percentage - like 35% of bets but 58% of the money - this often signals sharp action. Tools like WagerProof highlight these opportunities in real time, helping you capitalize on value before lines shift.

While leveraging data is a powerful strategy, it's equally important to steer clear of common betting mistakes.

Common Public Betting Errors to Avoid

Public bettors often fall into predictable patterns, such as overvaluing favorites, home teams, and overs. These tendencies are frequently influenced by hype or recent wins, creating exploitable opportunities for sharper bettors.

"The public loses. Not every time, but over the long haul, being on the same side as the majority of bettors isn't a sound strategy."

One major mistake is chasing last week's winners. Public bettors tend to overreact to recent performances, backing teams fresh off a big win without considering whether the line has already adjusted. Emotional decisions - like betting on hometown teams or trying to recover losses - can also lead to poor outcomes.

Sharp bettors take a different approach. They rely on analytics, historical trends, and market inefficiencies to guide their decisions. Instead of following the crowd, they’re willing to back less popular sides when the data supports it. To break even at standard -110 odds, you need a win rate of 52.38%. Professional sharps aim for a long-term win rate closer to 55%. By avoiding common public betting habits and focusing on data-driven insights, you can improve your chances of reaching that level.

Conclusion

Casual bettors often follow favorites and hype, while sharp bettors take a more calculated approach, focusing on data and exploiting inefficiencies in the betting market. Public money tends to be driven by media narratives and gut instincts, but sharps rely on analytics to uncover hidden value.

Sportsbooks pay close attention to sharp bettors because their wagers help refine the odds and expose where the public might be going wrong.

"The public doesn't usually win. Maybe the house loses to the sharps but they definitely win against the public."

- Outlier Team

This balance between public betting and sharp strategies highlights the importance of a data-driven approach. Recognizing patterns like reverse line movement, monitoring betting splits with notable discrepancies, or spotting steam moves across multiple sportsbooks can be game-changing for anyone looking to improve their betting strategy.

With these principles in mind, leveraging real-time tools becomes essential. Platforms like WagerProof provide the resources to identify sharp money signals and steer clear of common public betting pitfalls. Offering features like real-time betting splits, line movement tracking, and automated alerts, WagerProof ensures you stay ahead of the curve. The platform even highlights outliers and value bets, showing exactly where sharp money is flowing. Plus, with expert picks from Real Human Editors and WagerBot Chat powered by live pro data, you’re equipped to make smarter, more informed bets.

FAQs

What is sharp money in sports betting, and how can I spot it?

Sharp money refers to wagers made by seasoned bettors or those with extensive knowledge of a sport, often backed by access to advanced analytics and insider information. Recognizing sharp money can provide valuable insights and uncover smarter betting opportunities.

So, how can you identify sharp money? Look for key patterns like reverse line movement, where the betting line shifts in the opposite direction of where most public bets are placed. Pay attention to sudden odds changes that occur without any obvious external reasons. Watch out for steam moves, which are rapid, simultaneous line changes across multiple sportsbooks. Lastly, compare the percentage of bets with the percentage of money wagered - large discrepancies often hint at where sharp bettors are focusing their attention. These clues can help guide you toward more informed betting decisions.

What is reverse line movement, and how can it help bettors?

Reverse line movement (RLM) in sports betting happens when the betting line moves in the opposite direction of where most public bets are going. Normally, betting lines shift to balance the action on both sides, but RLM indicates that sharp bettors - seasoned professionals with deep knowledge - are heavily betting against the public. This kind of movement often suggests that sharps have access to insights or information that the average bettor doesn't.

Why does RLM matter? It can point to opportunities where the odds might not reflect the true probabilities. By paying attention to these shifts, bettors can spot games where sharp money is driving the market and potentially gain an advantage by siding with the professionals instead of following the crowd.

What’s the difference between betting percentages and money percentages?

Betting percentages show the share of total bets placed on a specific outcome. They represent the number of individual wagers, often influenced by public opinion or preferences.

Money percentages, however, focus on the proportion of total money wagered on each side. This provides insight into where the larger dollar amounts are being placed, often hinting at the activity of sharp or professional bettors.

The main distinction lies in what each measures: betting percentages track the number of bets, while money percentages reveal the amount of money bet. For example, if a side has fewer bets but a higher money percentage, it could indicate interest from experienced or professional bettors, offering a potential edge.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free