Why Removing Vig Matters in Betting Models

Sportsbooks include a hidden cost in their odds called the "vig", which inflates probabilities and distorts betting models. Removing the vig (de-vigging) ensures you work with fair odds and true probabilities, helping you identify profitable bets.

Here’s the gist:

- What is Vig? It’s the bookmaker’s margin, making implied probabilities exceed 100%. For example, standard -110 odds create a 4.76% overround.

- Why Remove It? Vig skews data, making outcomes seem more likely than they are. Without removing it, your betting model is based on biased numbers.

- How to Remove Vig: Use methods like Multiplicative, Power, or Shin to adjust implied probabilities back to 100%.

- Key Tool: Platforms like WagerProof automate de-vigging, saving time and improving accuracy.

The Most Important Concept in Sports Betting | How to Calculate and Remove Vig | NoVig Fair Odds

What Is Vig and How Does It Affect Betting Odds?

Sportsbooks operate like any other business - they need to make a profit. That’s where vig (short for vigorish) comes into play. Vig is essentially the commission built into every betting line, ensuring the house makes money no matter which side wins.

Here’s how it works: Sportsbooks include vig by creating an overround, where the total implied probabilities for all possible outcomes exceed 100%. This isn’t a mistake - it’s a deliberate part of their business model. Paul Costanzo explains it well:

"By effectively taking wagers on a range of outcomes that's greater than the actual possible outcomes, overround is a simple way for bookmakers to guarantee they take in more money than they pay out."

How Vig Is Calculated

Let’s break it down with a typical point spread where both sides are set at -110 odds. To find the implied probability for negative American odds, divide the risk amount by the sum of the risk amount and $100. For -110, the calculation is $110 ÷ ($110 + $100) = 52.38%. Adding the probabilities for both sides gives a total of 104.76%. That extra 4.76%? That’s the vig.

Because of this built-in margin, bettors need to win about 52.4% of their bets at -110 odds just to break even, even though the true probability of either side winning is 50%.

The vig varies depending on the market. For standard game lines, the hold tends to be around 4–5%. But for futures markets, the hold can climb to 20–30%. For instance, in a 2021 NFL passing leader market with 38 players, the vig was 21.8%. And for Same Game Parlays, the hold can soar past 35%.

How Vig Distorts Betting Models

Vig doesn’t just raise the cost of betting - it also skews probabilities, making outcomes appear more likely than they actually are. If you use sportsbook odds with vig included in a betting model, the inflated probabilities can lead to inaccurate predictions about the likelihood of events.

Take this example: the New York Mets are listed at +130 (implied probability of 43.5%), and the Atlanta Braves are at -150 (implied probability of 60.0%). Together, these add up to 103.5%, meaning there’s a 3.5% vig. Adjusting for this, the fair probabilities are about 42% for the Mets and 58% for the Braves - adding up to 100%.

Getting accurate probabilities is essential. Even a small error, like 2.4%, can turn what looks like a good value bet into a losing one. Without removing the vig (a process known as de-vigging), you’re comparing your model’s predictions to the sportsbook’s inflated odds, rather than the true probabilities.

| Odds Type | Break-Even Win Rate | Total Implied Probability | True Probability |

|---|---|---|---|

| Fair (+100) | 50.0% | 100.0% | 50.0% |

| Standard (-110) | 52.4% | 104.8% | 50.0% |

| High Juice (-120) | 54.5% | 109.1% | 50.0% |

Understanding how vig distorts odds is key to identifying fair prices. Next, we’ll explore methods for removing vig to calculate true probabilities.

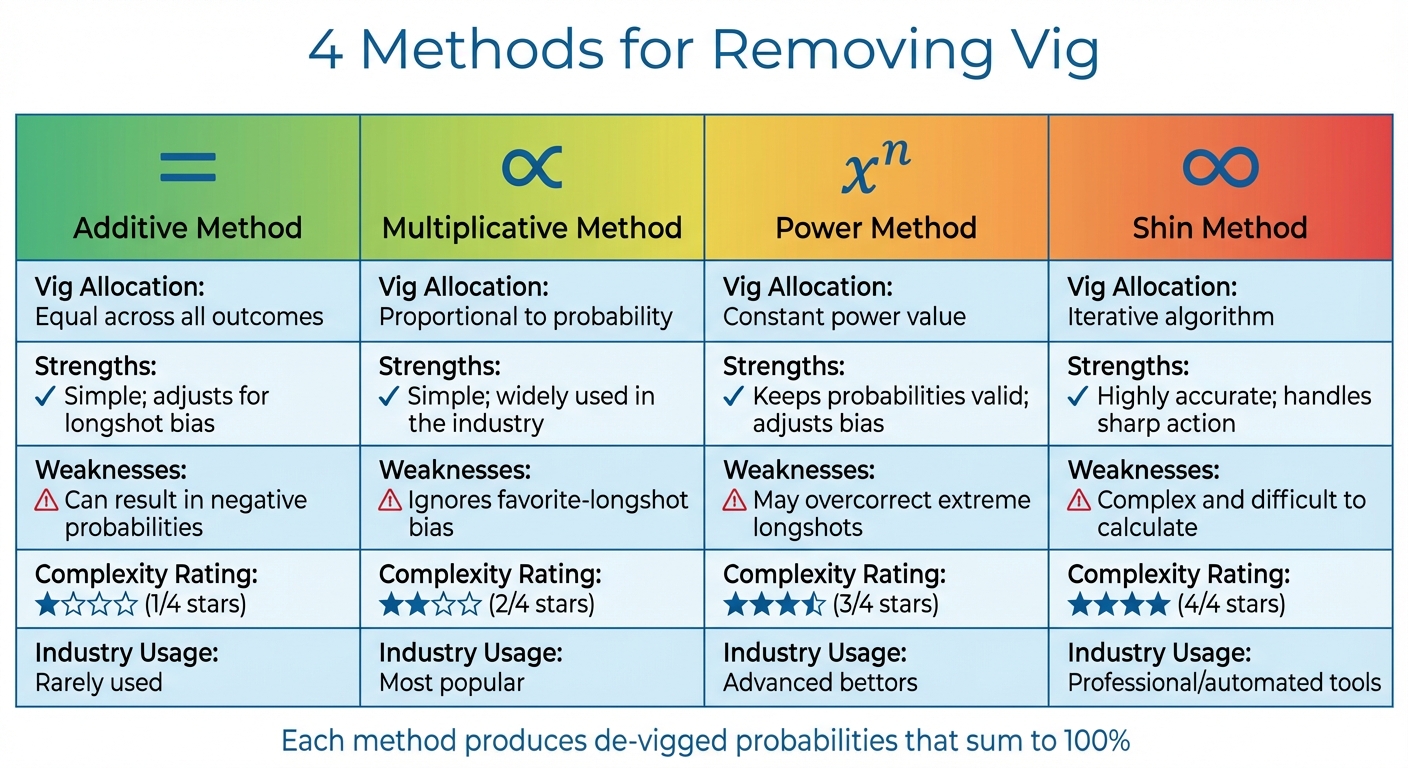

4 Methods for Removing Vig

Comparison of 4 Vig Removal Methods for Sports Betting

To tackle the distortions caused by vig and calculate true probabilities, you can use one of four key methods. Each has its own strengths and weaknesses, depending on the betting market and context.

Additive Method

The Additive Method works by evenly distributing the bookmaker's margin (overround) across all outcomes. Essentially, you subtract an equal portion of the overround from each implied probability. While this method is straightforward and accounts for the tendency to overbet on longshots, it has a glaring issue: it can lead to impossible probabilities for underdogs. For instance, in cases with a heavy favorite and a significant underdog, the subtraction could push the underdog's probability into negative territory - something that's obviously not feasible. Because of this, the Additive Method is rarely practical for most betting markets.

Multiplicative Method

The Multiplicative Method is the go-to approach in the industry. It adjusts each outcome's implied probability proportionally to its size, meaning favored outcomes are adjusted more than longshots. To apply this method, divide each implied probability by the total implied probability (the overround).

This method is widely used due to its simplicity and reliability, especially in balanced markets like point spreads or totals. However, it doesn’t account for the favorite-longshot bias, where bettors tend to overvalue longshots and undervalue favorites. Despite this limitation, it remains the most popular choice for de-vigging.

Power Method

The Power Method takes a more advanced approach by raising each implied probability to a constant power value until the probabilities sum to 100%. This ensures all probabilities stay within the valid range of 0 to 1, avoiding the negative probability issue seen with the Additive Method.

Henry Thomas, a Pinnacle Odds Dropper, explains: "The Power method is an extension that raises the implied probabilities to a constant power value. This ensures the de-vigged probabilities remain within the valid 0–1 range, avoiding infeasibilities."

This method strikes a balance between mathematical soundness and real-world betting behavior, making it a favorite for bettors and researchers alike. However, it can sometimes overcorrect for extreme longshots.

Shin Method

The Shin Method is the most sophisticated of the four. It uses an iterative algorithm to address favorite-longshot bias, factoring in sharp betting action. Vig is distributed unevenly, reflecting the influence of sharp bettors on how bookmakers set their lines.

Henry Thomas notes: "The Shin method... generally provides improved predictive accuracy compared to other de-vigging methods."

While this method offers exceptional accuracy and is particularly useful in markets with heavy sharp action, it’s also the most complex to calculate manually, requiring advanced tools or software.

| Method | Vig Allocation | Strengths | Weaknesses |

|---|---|---|---|

| Additive | Equal across all outcomes | Simple; adjusts for longshot bias | Can result in negative probabilities |

| Multiplicative | Proportional to probability | Simple; widely used in the industry | Ignores favorite-longshot bias |

| Power | Constant power value | Keeps probabilities valid; adjusts bias | May overcorrect extreme longshots |

| Shin | Iterative algorithm | Highly accurate; handles sharp action | Complex and difficult to calculate |

Each of these methods offers a way to generate de-vigged probabilities, which are essential for building accurate and effective betting models.

How to Use De-Vigged Odds in Betting Models

De-vigged odds are a powerful tool for spotting value bets and crafting betting models that can turn a profit. The process is straightforward: establish a fair-odds baseline, compare it to sportsbook lines, and only place bets when there’s a clear edge. One effective way to determine fair odds is by using market-leading sportsbooks as your benchmark.

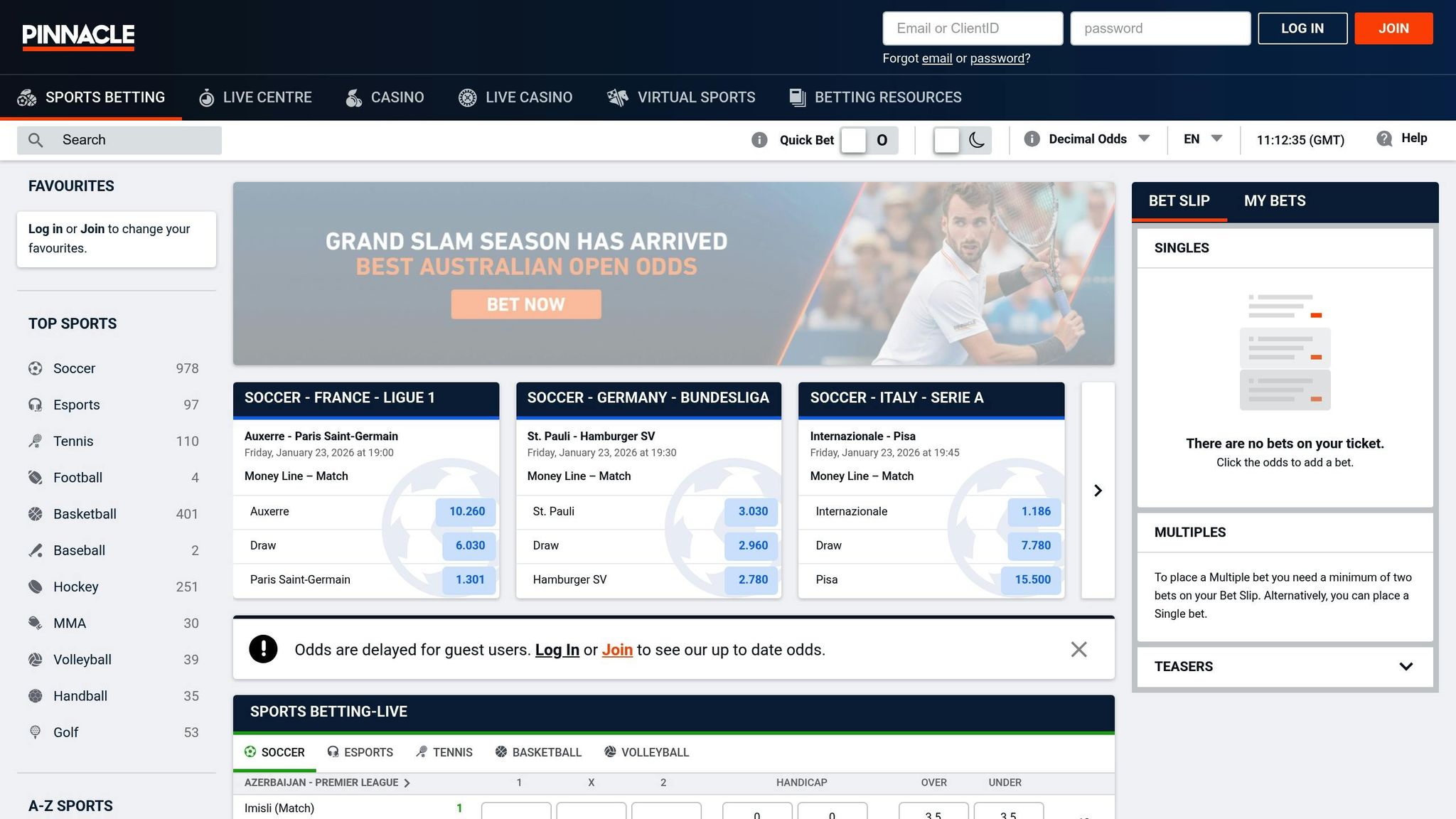

Using Pinnacle Odds as a Baseline

Sharp bettors often rely on market-making sportsbooks like Pinnacle and Circa Sports as their go-to sources for fair odds. These sportsbooks accept high betting limits and adjust their lines based on expert bettors’ activity, making their odds a highly accurate reflection of true probabilities. For instance, if Pinnacle lists the Mets at +130 and the Braves at -150, de-vigging those odds would adjust them to fair prices, such as Mets +139 and Braves -139. These adjusted figures act as a benchmark for comparing other sportsbook lines, helping to enhance the accuracy of your betting model.

Finding Mispriced Opportunities

The real value lies in comparing your calculated No Vig Price (NVP) to the odds offered by recreational sportsbooks, which are often slower to update their lines. When there’s a significant gap, it signals a potential +EV (positive expected value) opportunity. To quantify this edge, you can use the formula:

EV% = (Book Odds / Fair Odds) - 1.

Professional bettors in high-liquidity markets generally aim for at least a 1–2% EV before placing a bet. Keep in mind that at standard -110 odds, you must win 52.38% of your bets just to break even. By comparing sportsbook odds to your calculated fair odds, you can ensure your model focuses on real advantages rather than inflated probabilities.

No Vig Price (NVP) as a Decision Tool

The No Vig Price is at the heart of identifying value in sports betting. It acts as a benchmark for determining a bet’s true worth, aligning your model with actual market probabilities. Think of it like a stock trader evaluating whether a stock is overvalued or undervalued. The NVP represents the breakeven point - if you can secure odds better than the NVP, it’s like buying a stock at a discount.

"No Vig odds are the single most important concept in sports betting analytics. It is the dividing line between gambling and investing." – edgeslip.com

Calculating the NVP also protects you from falling into high-vig traps. Certain markets, like "First Touchdown Scorer" or futures, often carry holds of 20–30%, while Same Game Parlays can have holds exceeding 35%. With such high vig, finding a +EV edge is nearly impossible, no matter how solid your model might be. By using the NVP as a filter, you can quickly identify bets worth pursuing and steer clear of those likely to drain your bankroll, ensuring your model stays focused on genuinely profitable opportunities.

Why Removing Vig Matters for Model Accuracy

When you use raw sportsbook odds to build a betting model, you're starting with skewed data. The vig - or bookmaker's margin - creates an overround where implied probabilities exceed 100%. For example, standard -110 lines already include this overround, which distorts the data and can throw off your model's accuracy. To address this, it's essential to correct for these market biases.

"If you do not know the 'No Vig' price of a market, you cannot calculate your edge. And if you cannot calculate your edge, you are betting blind." – Edgeslip

This issue becomes even more pronounced in high-vig markets. The larger the vig, the harder it is to identify profitable opportunities - even with a strong model. Without removing the vig, you're essentially working with odds that hide the true value of a bet.

Correcting for Market Biases

Removing the vig doesn't just clean up distorted odds - it also helps address systematic biases in the market. For example, the favorite-longshot bias arises because bettors tend to overvalue longshots, prompting bookmakers to adjust odds more heavily against underdogs. Advanced de-vigging techniques, such as the Shin Method, take these imbalances into account and produce more accurate probabilities.

Consider this: at standard -110 odds, you need a win rate of 52.38% just to break even. In a no-vig scenario, the break-even point drops to 50% . Research shows that betting in no-vig environments, such as exchanges, can increase profitability to as much as 40%, compared to just 2% with traditional sportsbooks. The reason? The vig acts as a hidden drag on every bet, compounding over time and undermining both profitability and model accuracy.

Correcting for these biases is essential, but it can be a tedious process - especially if you're doing it manually.

How WagerProof Simplifies Vig Removal

Manually removing the vig is not only time-consuming but also prone to mistakes. That’s where WagerProof comes in. This platform automates the process, providing de-vigged probabilities and fair odds in real time. By pulling data from sharp market makers and applying proven de-vigging methods, WagerProof identifies opportunities where prediction market spreads diverge or recreational books offer better-than-no-vig prices. These insights are flagged automatically, allowing you to focus on refining your models rather than getting bogged down in spreadsheets.

With tools like WagerProof, you can eliminate the guesswork and work with cleaner, more accurate data for smarter betting decisions.

Conclusion

The key to profitable betting lies in removing the vig. With standard -110 lines, you need a 52.38% win rate to break even, but no-vig odds reduce this to just 50%. That seemingly small 2.38% difference can snowball over time, significantly cutting into your profits.

Understanding no-vig odds is crucial for spotting value and calculating your edge. Whether you use the Multiplicative or Shin method, de-vigging helps uncover fair odds and true probabilities - even in markets with steep bookmaker margins, like futures (with 20–30% holds) or Same Game Parlays (often exceeding a 35% hold). These high-vig scenarios make finding value especially challenging.

Thankfully, you don’t need to crunch the numbers yourself. Platforms like WagerProof handle the heavy lifting by sourcing data from sharp market makers and applying proven de-vigging methods in real time. This automation highlights mispriced opportunities - whether it’s mismatched spreads in prediction markets or recreational sportsbooks offering better-than-no-vig prices - so you can focus on making smarter bets instead of running calculations.

FAQs

Why is removing the vig important for accurate betting models?

To improve the accuracy of betting models, removing the vig - the bookmaker's margin - is a crucial step. The vig is built into the odds by bookmakers to guarantee their profit, but it distorts the actual probabilities of outcomes.

When you strip away the vig, you reveal the true implied probabilities, allowing you to calculate fair odds. This clarity makes it easier to spot value bets and make more informed, data-driven choices. Over time, focusing on genuine probabilities instead of inflated odds can lead to better decision-making and improved profitability.

What makes the Shin Method effective for removing the vig?

The Shin Method stands out as a solid approach to eliminating the vig because it acknowledges that certain outcomes might be swayed by bettors who have access to better information. By addressing this imbalance, the method delivers more precise implied probabilities, which can sharpen the accuracy of your betting models. In essence, it ensures you're relying on cleaner, more dependable data to make well-informed decisions.

How does WagerProof simplify removing the vig for accurate betting probabilities?

WagerProof makes removing the vig straightforward by providing real-time sports data and tools that calculate fair odds and implied probabilities. It automatically spots outliers and value bets, helping you strip away the bookmaker's margin to reveal accurate probabilities.

With WagerProof, you get access to professional-grade tools that simplify the de-vigging process, allowing you to make smarter, data-backed betting choices without relying on guesswork.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free