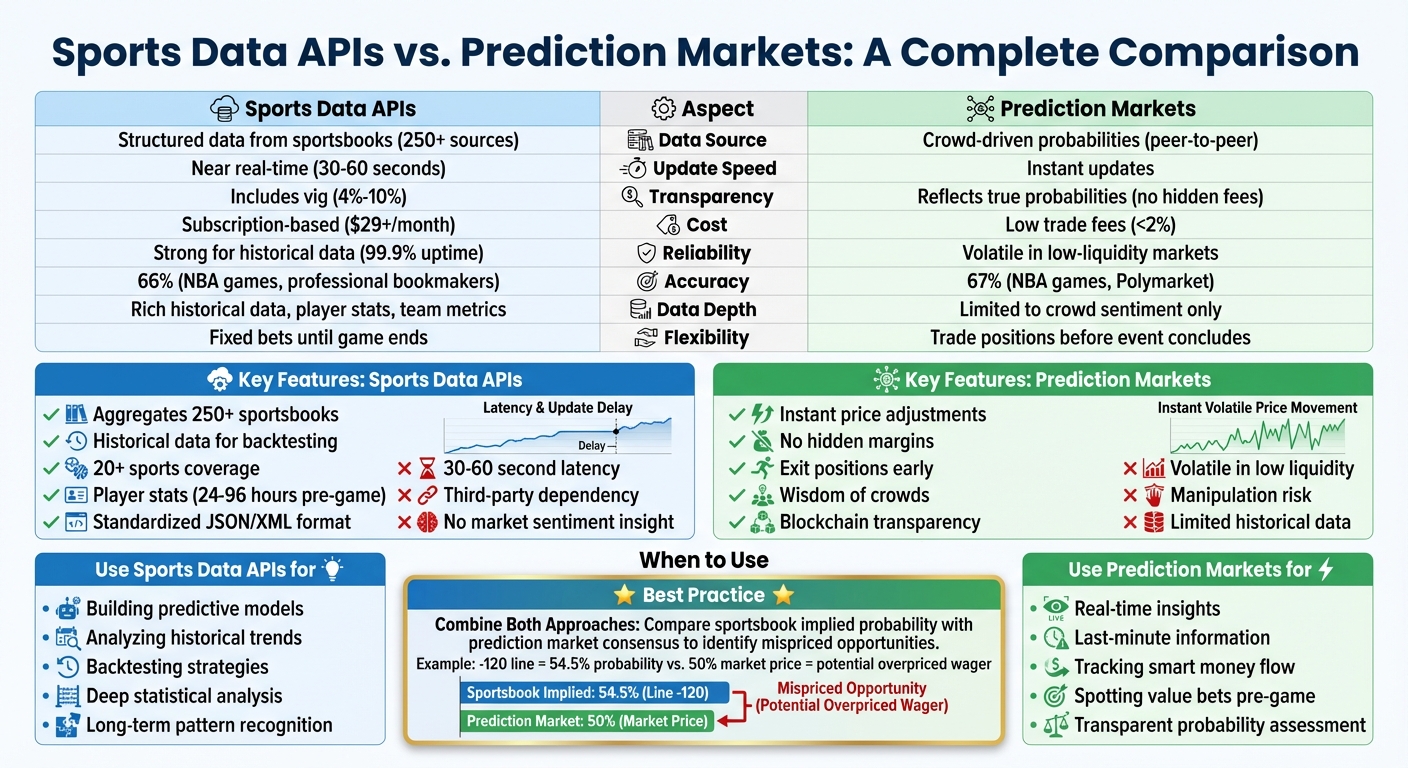

Sports Data APIs vs. Prediction Markets

Sports betting relies heavily on two key data sources: Sports Data APIs and Prediction Markets. Each serves a different purpose and caters to distinct needs:

- Sports Data APIs: Provide real-time and historical data (odds, scores, player stats) directly from sportsbooks. Best for building detailed models and analyzing trends. However, odds include a "vig" (4%-10%) that skews true probabilities.

- Prediction Markets: Operate like stock markets where prices (e.g., $0.60) reflect the probability of events (60%). These markets are transparent, adjust instantly to new information, and lack the built-in fees of sportsbooks. However, they can be volatile in low-liquidity situations.

Key takeaway: APIs are ideal for in-depth analysis and historical trends, while prediction markets excel at real-time insights and crowd-driven probabilities. Combining both can provide a clearer edge.

Quick Comparison

| Aspect | Sports Data APIs | Prediction Markets |

|---|---|---|

| Data Source | Structured data from sportsbooks | Crowd-driven probabilities |

| Update Speed | Near real-time (30-60 seconds) | Instant updates |

| Transparency | Includes vig (4%-10%) | Reflects true probabilities |

| Cost | Subscription-based ($29+/month) | Low trade fees (<2%) |

| Reliability | Strong for historical data | Volatile in low-liquidity markets |

When to use: Use APIs for historical trends or building models; use prediction markets for instant insights or spotting value bets just before a game.

Sports Data APIs vs Prediction Markets: Complete Comparison Guide

I built a Kalshi NFL Prediction Market Bot in Python (it was too slow)

Sports Data APIs Explained

Sports data APIs are tools designed for developers, delivering structured betting data straight from sportsbooks. This includes odds, scores, player stats, and market movements, all formatted in standardized structures like JSON or XML. These APIs enable betting analysts and developers to seamlessly integrate this information into their systems.

The data delivery happens through two primary methods. RESTful endpoints are used for retrieving extensive datasets like league schedules or player profiles. Meanwhile, push feeds are designed for live updates, offering sub-second latency - an essential feature for live betting scenarios.

Sports data is organized into three levels: Events, Markets, and Outcomes. Each change in odds is timestamped, creating a "Line Movement" record that tracks market shifts influenced by factors like liquidity or breaking news, such as injury updates. These features form the foundation of how these APIs operate.

Main Features of Sports Data APIs

One of the standout features of sports data APIs is their ability to aggregate and standardize data. Leading providers source information from more than 250 sportsbooks worldwide, converting it into a unified format. This eliminates the need for manual comparisons between sportsbooks.

These APIs also excel in real-time tracking. Beyond just odds, they monitor when betting lines are suspended, adjusted, or removed. For post-game evaluations, "resulting" feeds provide final scores and settled outcomes, with a 72-hour window for stat corrections. This is particularly important for prop bets that depend on official league data.

The increasing focus on detailed player statistics has driven greater API functionality. Sportsbooks now release data on individual player performances - like rebounds, home runs, or passing yards - anywhere from 24 to 96 hours before the game starts. Additionally, most APIs guarantee 99.9% uptime, ensuring a steady flow of information.

Benefits of Sports Data APIs

Sports data APIs bring several operational advantages, starting with scalability. With a single integration, you can access odds from hundreds of sportsbooks at once. This streamlined structure also simplifies algorithmic analysis, as the clean, normalized data can be directly fed into betting models without requiring heavy preprocessing.

Another advantage is the wide coverage. APIs provide data for over 20 sports, including niche markets like alternate lines, player milestones (e.g., scoring 25+ points), and futures. For developers building tools like comparison platforms or analytics dashboards, this all-in-one solution saves both time and resources.

Historical data access is another key benefit. It allows analysts to backtest strategies by studying how odds evolved in the lead-up to an event. This insight helps refine predictive models based on actual market behavior and outcomes.

Drawbacks of Sports Data APIs

However, sports data APIs are not without challenges. One major issue is the dependency on third-party providers. Your application relies on their uptime, data accuracy, and pricing. While top providers offer near-perfect uptime, any disruption can directly affect your platform. For instance, Sportradar limits trial accounts to 30 days, 1,000 total calls, and 1 query per second, which may restrict thorough testing.

Latency is another concern. Even high-performing APIs might only refresh every 30 to 60 seconds for certain markets, leaving gaps during rapid line movements. Additionally, these APIs don’t provide insight into market sentiment or crowd behavior. They deliver odds - essentially the sportsbook's adjusted probabilities - but not the underlying factors influencing those numbers.

"Betting odds do not represent the 'true' probability of an event. They represent the probability adjusted for the bookmaker's risk and profit margin."

This observation by Sofoluwe Mayowa, a Gambling Writer, highlights a key limitation. Furthermore, sportsbooks include a built-in margin (vig) of 4% to 10%, ensuring the odds favor the house. Unlike prediction markets, which offer dynamic probability insights, these APIs operate within a more rigid structure.

Prediction Markets Explained

Prediction markets function like financial exchanges where participants trade contracts based on the likelihood of future events. These platforms use a peer-to-peer setup, meaning they simply facilitate trades between users. Contract prices range from $0.00 to $1.00 (or 0 to 100 cents), which reflects the market's consensus on the probability of an event. For instance, if a contract is priced at 72¢, it suggests a 72% chance of that event happening.

Here’s how it works: if the event occurs, the contract pays out $1.00; if it doesn’t, the contract pays nothing. Unlike traditional betting, where odds are fixed, prediction market prices shift dynamically as new information becomes available. Even more appealing is the ability to sell your position before the event concludes, giving you the chance to lock in gains or cut losses as the probabilities evolve.

How Prediction Markets Function

Prediction markets thrive on the "wisdom of crowds" concept, where the diverse perspectives of participants - combined with financial stakes - help drive accurate and efficient probabilities. When new information surfaces, like a player injury or breaking news, traders respond immediately, causing prices to adjust in real time to reflect the updated consensus.

"It's basically a financial market. They provide a platform, and the platform allows you to bet against other people."

- Koleman Strumpf, Economics Professor, Wake Forest University

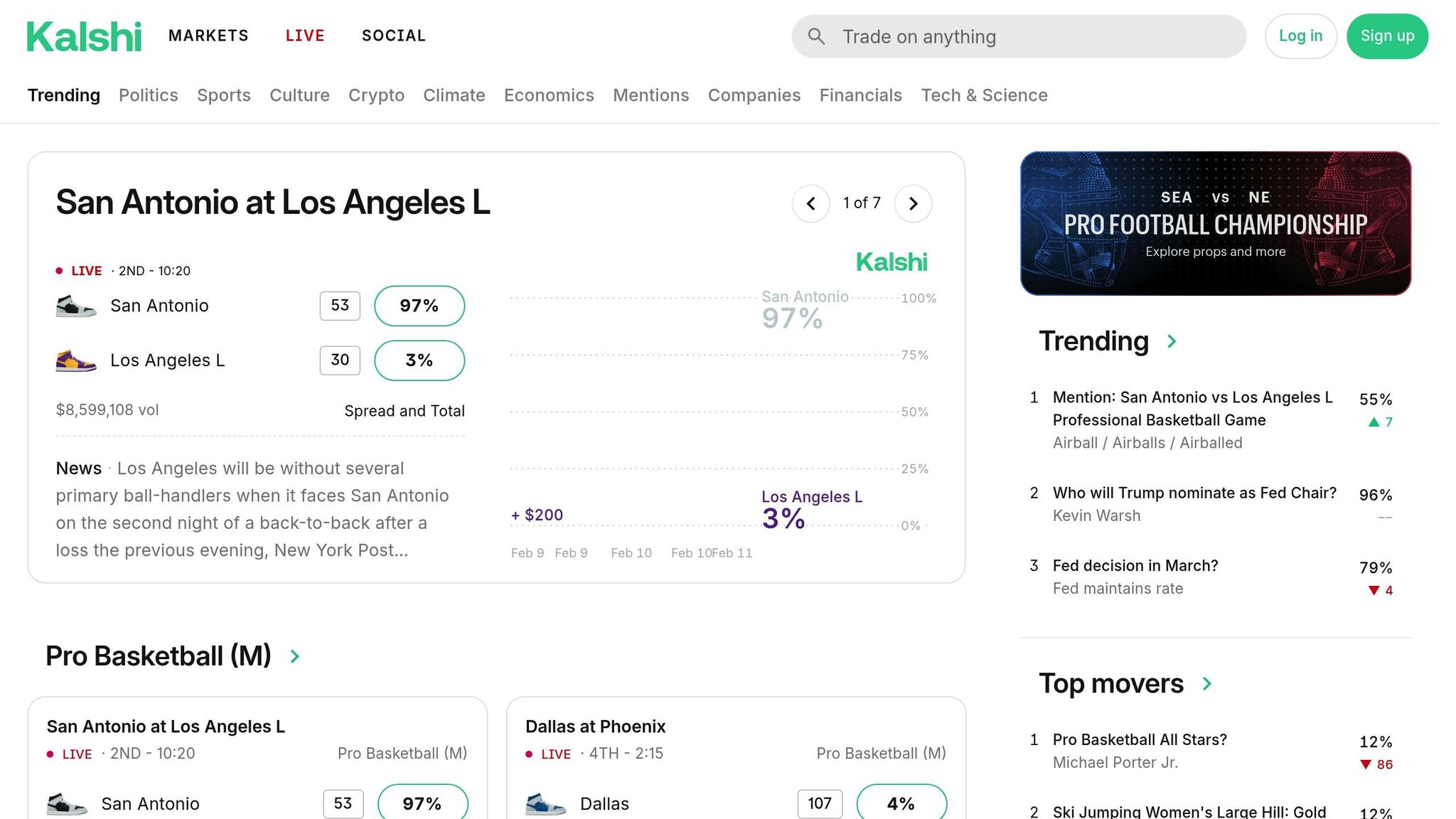

Many platforms today use blockchain technology and smart contracts to streamline transactions, ensuring transparency and minimizing the risk of centralized interference. For example, in February 2026, Kalshi's Super Bowl market for the Seattle–New England matchup saw over $161 million in trading volume, with 70% of trades favoring Seattle. This kind of fluid adjustment highlights the market's ability to reflect real-time sentiment.

Benefits of Prediction Markets

Prediction markets stand out for their transparency and efficiency. Prices are shaped entirely by supply and demand, offering an unfiltered view of market sentiment without the hidden 4% to 10% margins typically found in sportsbook odds. Additionally, trading fees are usually less than 2% of the trade value, making them a cost-effective option.

Accuracy is another key advantage. Since participants risk their own money, they are incentivized to base decisions on reliable information, reducing personal biases. For example, Polymarket demonstrated a 67% accuracy rate in predicting winners during 1,000 NBA games in the 2024–25 season, slightly edging out the 66% accuracy of professional bookmakers. Similarly, a study of 208 NFL games found a near-perfect correlation (0.96) between prediction market prices and actual outcomes.

"Prediction markets are more direct aggregators of participant beliefs and often reflect a broader base of information, particularly when participation is both incentivized and decentralized."

- Koleman Strumpf, Professor, Wake Forest University

These markets also act as a "price discovery" tool, offering insights into shifting probabilities before they’re reflected in traditional sportsbook lines.

Drawbacks of Prediction Markets

Despite their advantages, prediction markets come with challenges. One major issue is volatility. Prices can swing significantly due to small trades, especially in markets with lower liquidity. This makes it tough to execute large trades without causing noticeable price changes, unlike major sportsbooks that can handle high volumes more smoothly.

Another concern is the potential for manipulation. In less active markets, a single trader with enough capital could skew prices, creating probabilities that don’t accurately reflect the broader consensus.

Lastly, prediction markets lack detailed historical and contextual data. Unlike sports APIs that provide in-depth statistics like player performance, injury updates, and team histories, prediction markets rely solely on crowd sentiment. This absence of granular data makes it harder for users to perform deep analysis or backtest strategies.

Sports Data APIs vs. Prediction Markets

Main Comparison Points

Sports data APIs and prediction markets take very different paths when it comes to betting analytics. APIs provide structured, real-time data straight from reliable sources, including stats like historical performance and team metrics, often fine-tuned by professional oddsmakers. On the other hand, prediction markets rely on crowd-sourced probabilities that shift based on the collective actions of traders. These core differences influence how each system operates and how reliable they are for forecasting outcomes.

One key distinction lies in transparency. Odds from APIs often include a built-in margin (vig) ranging from 4% to 10%. For instance, a -120 line at a sportsbook implies a 54.5% probability, but this is adjusted to account for the bookmaker's cut. Prediction markets skip this entirely - if a contract is priced at 60¢, it directly reflects a 60% probability, with no hidden fees.

When it comes to accuracy, the two approaches are surprisingly close. In a May 2025 study of 1,000 NBA games, professional bookmakers (via OddsPortal) correctly predicted winners 66% of the time, while Polymarket, a decentralized prediction market, achieved 67% accuracy. This shows that crowd-sourced wisdom can stand toe-to-toe with professional models.

Operationally, they differ significantly. Prediction markets let users trade positions before an event concludes, allowing them to lock in profits or cut losses as probabilities shift. Traditional sportsbook bets, however, are fixed until the game ends. APIs, meanwhile, provide rich historical data - like player splits, weather impacts, or referee tendencies - that prediction markets don't offer. While prediction markets excel at reflecting real-time sentiment, APIs are the go-to for building detailed predictive models.

Comparison Table

| Aspect | Sports Data APIs | Prediction Markets |

|---|---|---|

| Data Source | Structured, real-time stats from third-party feeds | Crowd-sourced probabilities from user bets |

| Update Speed | Near real-time, depending on provider latency | Immediate updates based on money flow |

| Transparency | Limited insights due to algorithm adjustments and vig | Full visibility of market sentiment |

| Cost | Subscription-based (starting around $29/month) | Low-cost entry with clear transaction fees |

| Reliability | Strong for historical data; variable for live updates | Reliable for real-time sentiment, but volatile in low-liquidity cases |

When to Use Each Approach

The choice between these methods depends on your goals. Sports data APIs are ideal for building models or testing strategies that require detailed historical data. For example, if you want to analyze how teams perform in back-to-back road games or how a pitcher fares against specific batters, APIs offer the depth you need.

Prediction markets, however, shine when you need real-time insights or want to track the flow of "smart money." If a star player is ruled out just before a game, prediction markets adjust instantly - often faster than sportsbooks. Checking these markets close to game time can reveal the latest shifts that may not yet appear in API feeds.

Using both approaches together can be a game-changer. Before placing a bet, compare the implied probability from sportsbook odds with the consensus from a prediction market. For instance, if the sportsbook suggests a 54.5% chance but the market shows 50%, you might be overpaying due to the vig. By leveraging APIs for historical insights and validating your findings with market sentiment, you can craft a more well-rounded betting strategy. This combination highlights the power of integrating diverse data sources for better decision-making.

How WagerProof Combines Both Approaches

WagerProof brings together the strengths of sports data APIs and prediction markets to offer a betting experience that prioritizes clarity and informed decision-making.

WagerProof's Transparency Model

WagerProof provides a clear breakdown of the data and reasoning behind each betting recommendation. By comparing traditional sportsbook odds with prediction market prices, the platform highlights discrepancies that can signal mispriced opportunities. For example, if a sportsbook's line suggests a 54.5% probability (like a -120 line), but the prediction market indicates only 50%, that difference may point to a potential edge. This approach helps bettors spot where bookmaker margins might create openings. Recommendations, curated by real human editors, explain how these market signals align with sportsbook lines. As gambling writer Sofoluwe Mayowa notes:

"Prediction markets are more transparent in terms of predicting the likelihood of an outcome."

By merging these data sources, WagerProof ensures every bet is backed by clear, actionable insights.

WagerProof's Core Features

The platform's standout feature is its automated outlier detection system, which scans for mismatches in prediction market spreads, fade signals, and value bet opportunities. When sportsbooks lag behind the prediction market's high-volume movements, WagerProof quickly flags these discrepancies. Its WagerBot Chat processes millions of data points to uncover subtle patterns. Unlike generic AI tools, WagerBot connects to live professional data feeds, updating every 30–60 seconds. This ensures that insights are always based on the most current market conditions .

Benefits for U.S. Sports Bettors

For U.S. bettors navigating a crowded and often complicated market, WagerProof simplifies the process by offering a comprehensive, all-in-one solution. The platform integrates professional-level data, historical statistics, and prediction market insights into a single, easy-to-use interface. Instead of juggling multiple subscriptions or tools, bettors can access everything they need in one place. WagerProof also standardizes data across hundreds of bookmakers, resolving inconsistencies in player names and formatting that could otherwise complicate manual analysis.

Conclusion

Sports data APIs and prediction markets each bring something valuable to the table. APIs deliver real-time stats, historical trends, and consensus data, while prediction markets offer transparent pricing - a 60¢ share directly translates to a 60% probability, without the hidden 4–10% vig that sportsbooks often include in their odds.

The real advantage lies in combining these tools. For instance, if a sportsbook sets odds at -120 (which implies a 54.5% probability) but prediction markets suggest a 50% probability, that discrepancy could highlight a betting opportunity - or serve as a red flag for an overpriced wager. Cross-referencing prediction market probabilities with sportsbook odds can help bettors pinpoint fair value or uncover inflated premiums. This blend of insights can reshape how bets are evaluated.

WagerProof embodies this approach by merging professional-grade APIs with crowd-sourced market data. Its automated system identifies mismatches between these sources, while human editors provide detailed explanations for each recommendation. This means U.S. bettors no longer need to juggle multiple subscriptions or navigate conflicting data - they get clear, actionable insights in one streamlined platform.

FAQs

How do I remove the vig from sportsbook odds to get true probabilities?

To calculate true probabilities from sportsbook odds and remove the bookmaker's margin (vig), start by converting the odds into implied probabilities. Once you have these, adjust or normalize them so they total 100%. This step eliminates the bookmaker's built-in margin, giving you a clearer, unbiased view of the actual probabilities for more precise analysis.

When are prediction market prices unreliable because of low liquidity?

Prediction markets can lose their reliability when liquidity is low. In such cases, even minor trades can lead to sharp price changes, creating volatility. This instability undermines the accuracy of predictions, making it difficult to rely on the data for making well-informed decisions.

What’s the best way to combine APIs and prediction markets before placing a bet?

The smartest way to bring APIs and prediction markets together is by leveraging unified, real-time data streams. These streams merge prediction market insights with traditional sportsbook odds, making it easier to spot inefficiencies, value bets, and even arbitrage opportunities. By integrating these data sources, you get low-latency updates that allow for quicker responses to market shifts. Platforms such as WagerProof excel at this by offering transparent, professional-grade betting data. They combine prediction markets, statistics, and tools designed to help bettors make sharper, more informed choices.

Related Blog Posts

Ready to bet smarter?

WagerProof uses real data and advanced analytics to help you make informed betting decisions. Get access to professional-grade predictions for NFL, College Football, and more.

Get Started Free